Gold Stock Carnage Continues Unabated

Commodities / Gold and Silver Stocks 2015 Jul 24, 2015 - 02:12 PM GMTBy: Dan_Norcini

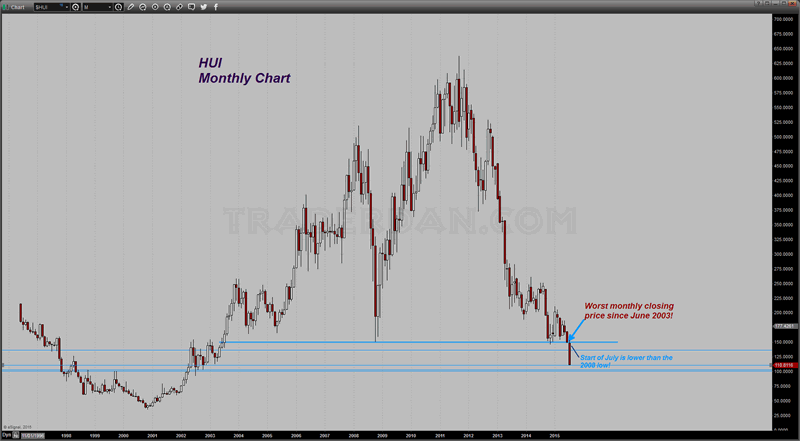

There is still no sign of any serious buying occurring in the gold mining sector. The HUI continues to plummet lower and has fallen to levels last seen in October and November of 2002! This is simply astonishing for its ferocity.

There is still no sign of any serious buying occurring in the gold mining sector. The HUI continues to plummet lower and has fallen to levels last seen in October and November of 2002! This is simply astonishing for its ferocity.

HUI Monthly Chart

In trying to ascertain where support might emerge I have had to use the 1999 highs which also happen to correspond closely to the August 2002 and October 2002 lows. That level comes in near 103 and extends to 100.

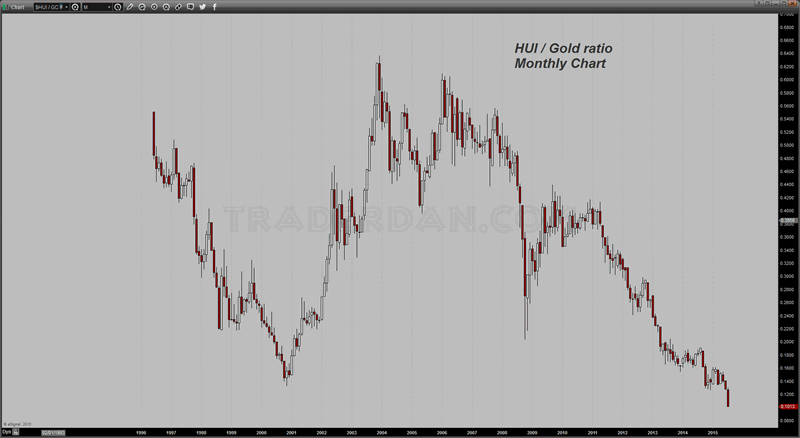

I find it hard to believe that I am even writing about levels of this magnitude (or LESSertude - if there is such a word). What makes matters even more difficult when attempting to ascertain at what price gold might finally level out, is the fact that the HUI / Gold ratio is at HISTORIC LOWS. In other words, either the gold stocks need to rally to bring this ratio back somewhat to a norm or the price of gold needs to fall farther.

HUI/Gold Ratio Monthly Chart

I suspect we are finally going to see even some of the die hard gold bugs throwing in the towel at this point. After watching one's life savings evaporate, savings that so many have worked so long and so hard to secure for themselves, the emotional toll is too much for many people to stand.

Please understand that while we traders and chart watchers can see these lines on the price chart and try to approach these markets somewhat objectively, every line lower means more heartache, pain, despair and grief for the thousands of poor souls who have been utterly ruined by the shameless, conscienceless gold hucksters and their perma bullish stance on gold, no matter what the charts were warning them.

We are talking about wrecked lives, perhaps wrecked families and maybe even worse. There were college educations for their children, retirement dreams, health needs, etc, that were all tied up in these investments in this miserable mining sector. That is what so deeply affects me knowing that every bit of it was preventable had the victims of these flim-flam con men simply learned to ignore these quacks and "expert market analysts", phony predictors, etc. and learned to think for themselves based on what the action in the price chart was telling them.

I just hope that enough of these poor folks have some money left over so that they are not completely ruined and thus subject to despair and even the temptation of giving up on life. Please, if any of you who have been so affected in such a matter, do not yield to that temptation. Life will go on; more challenging, but if you have your health, and your family that loves you around you, you are still a blessed man or woman.

My prayers go up for your well-being and safety.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.