Did Gold Stocks Just Bottom?

Commodities / Gold and Silver Stocks 2015 Jul 23, 2015 - 05:32 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: "Perhaps today was capitulation in the gold market," a CEO of a gold-mining company told me in an e-mail Monday evening...

Dr. Steve Sjuggerud writes: "Perhaps today was capitulation in the gold market," a CEO of a gold-mining company told me in an e-mail Monday evening...

Gold-exploration stocks had just lost 14% of their value in two days – based on the gold-exploration stocks fund, the Global X Gold Explorers Fund (GLDX). This CEO thought it could be the bottom in gold-exploration companies.

"It's hard to believe the current valuation of gold stocks," he said. "I never thought I would ever see our stock back at these levels. I could not resist and purchased some shares today."

He was a bit early in his optimism... As I write, gold-exploration companies are down since he bought earlier in the week.

But I agree that it sure felt like "capitulation" – panicked selling that often creates a bottom...

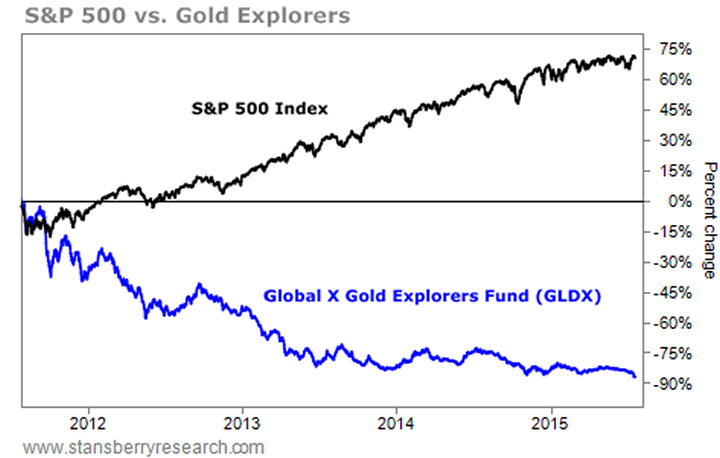

Gold stocks are now down 87% in the past four years (as measured by GLDX). Meanwhile, stocks, in general, are up 72% (as measured by the S&P 500 Index) in the same time frame.

Take a look:

This is what a bottom in an asset often looks and feels like. The problem is, calling a bottom right is tough...

There is a much smarter way to invest in blown-out assets...

Here's what I told my paid subscribers in my True Wealth letter last week – before the big bust in these stocks:

Smaller mining stocks are definitely CHEAP and HATED today. But like gold, we don't have an uptrend yet – so we don't have our green light to buy.

Prices are cheap, but they could continue to get cheaper. We don't want to try to "catch a falling knife."

Don't worry, we won't miss it. There will be plenty of upside potential when we do get in.

It was the right call.

You might get the headlines and the glory for calling the bottom. But in the long run, it's difficult to make money doing that...

Gold-mining stocks are incredibly cheap today. And we will be buyers soon. But we want to wait until after gold stocks hit the bottom before putting money to work. That means we're waiting for now.

Good investing,

Steve

P.S. A great way to learn about the best buys in the resource space right now will be at the Sprott-Stansberry Vancouver Natural Resource Symposium next week. I'm speaking at the event... and I look forward to meeting with other experts from inside the industry.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.