Stock Market No Fireworks Yet, But We May Have Seen the Top

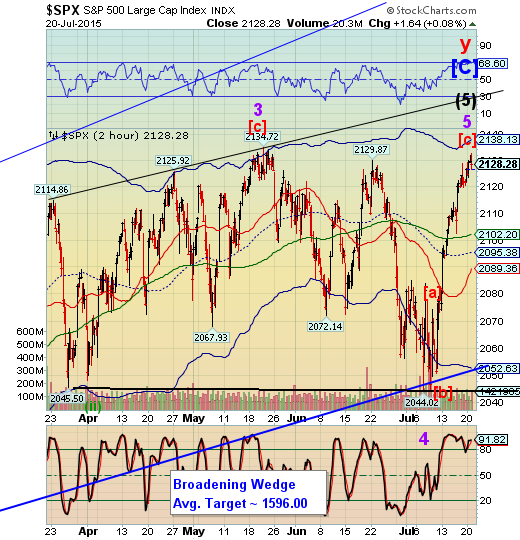

Stock-Markets / Stock Markets 2015 Jul 21, 2015 - 12:03 PM GMT I was amazed this afternoon to see the top come in 61 days from the high on May 21, very close to 3:30 pm on both days. Due to the July 4 holiday, this turned out to be precisely 43 market days, to the hour, from top to top.

I was amazed this afternoon to see the top come in 61 days from the high on May 21, very close to 3:30 pm on both days. Due to the July 4 holiday, this turned out to be precisely 43 market days, to the hour, from top to top.

This is no guarantee of a top, but as I mentioned earlier, today was indicated by the Cycles Model as an important Cycle high. In fact, my earlier prognostications suggested that today might be a lower high in SPX, which it was. But I am marking it as a slightly truncated Wave 5 of (5) high, since it is only 190 ticks lower than the previous high.

VIX closed higher, at 12.25, but no buy signal, yet. It may come rather suddenly if the SPX futures continue to drift lower overnight.

VIX made a new low today, but it may qualify as a new Master Cycle low. If correct, this suggests the VIX may be making new highs through November!

The Hi-Lo Index closed lower today. At this juncture, I would call it a confirmed sell signal on the Hi-Lo.

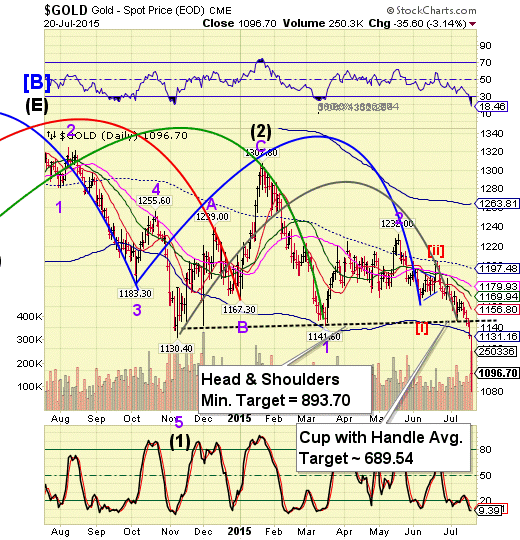

Gold burst through the combination Head & Shoulders/Cup with Handle trendline at 1145.00. This should have been no surprise as I had been warning about this. The Cycles Model now suggests a continuation of the decline through the first week of August.

To bolster this view, ZeroHedge reports, “Minutes after the cash equity close, gold prices tumbled, having leaked lower all afternoon, breaking back below $1100. Overnight flash crash lows were $1080.”

I have a seriously overscheduled week, so my commentaries, including the Mid-Week Report, may not be available. I simply hope to catch events as they are happening and report back in brief emails.

Regards,Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.