Stock Market Relief Rally and More

Stock-Markets / Stock Markets 2015 Jul 20, 2015 - 07:17 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market

Intermediate trend - SPX may have started an intermediate correction

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

RELIEF RALLY, AND MORE

Market Overview

It's been a while since the SPX has shown this kind of near-term strength. The combined Greek settlement and two days of positive testimony by Janet Yellen caused the bulls to come out of the woodwork and stage a 75-point rally! And that may not be the end of it! After a minor correction, more uptrend is likely.

The market's refusal to go below 2040 in spite of several attempts to do so showed that there was important support at that level and prepared the daily indicators for a move in the opposite direction. All that was needed was for a catalyst to appear! The price strength is undeniable but there are some lurking negatives which will need to be addressed if we are to continue upward.

The first is that, for this kind of a move, breadth was severely lacking. The first couple of days were adequate, but for the last three days, it averaged -255 on a closing basis while the index tacked on another 28 points. The new highs and new lows also failed to reflect this kind of strength. This discrepancy is a red flag that will have to be remedied quickly if we are to continue to move higher. I must admit that the base that was built ahead of this move has the potential to take SPX much higher, so it will be interesting to see if the technical aspect of the market catches up with the price.

And then, there is the 7-yr cycle! If this continues, it will be evident that larger cycles are overriding it.

Indicators Survey

It will take more than one week of rallying to show strength in the weekly momentum indicators. The MACD turned up, but barely. The RSI, which is more sensitive, moved from about 49 to 58, overcoming a previous short-term high. No argument there!

The daily MACD managed to move from its low of -12 to 2.84. The A/D index is showing negative divergence.

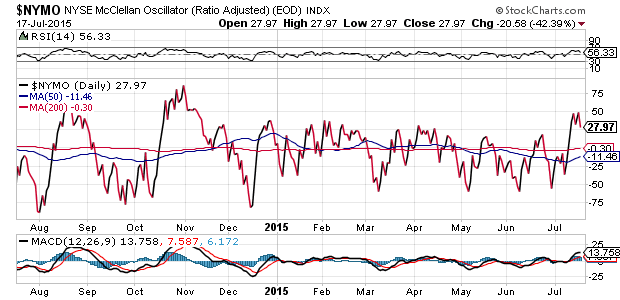

Instead of displaying the NYSI, I am going to post the McClellan Oscillator (courtesy of MarketCharts.com) because it demonstrates clearly the lack of breadth participation in this rally. Both the August and October rallies showed strong breadth associated with the price move. This time, the NYMO just barely managed to clear the former highs associated with the trading range of the past several months. Does this mean that the price will not be able to make a new high? Let's see what happens next!

The 1X P&F filled a phase projection to 2127 on Friday.

The 3X made a base formation which could eventually take this move near 2200. If realized, this uptrend would put an end to the rounding top formation.

Chart Analysis

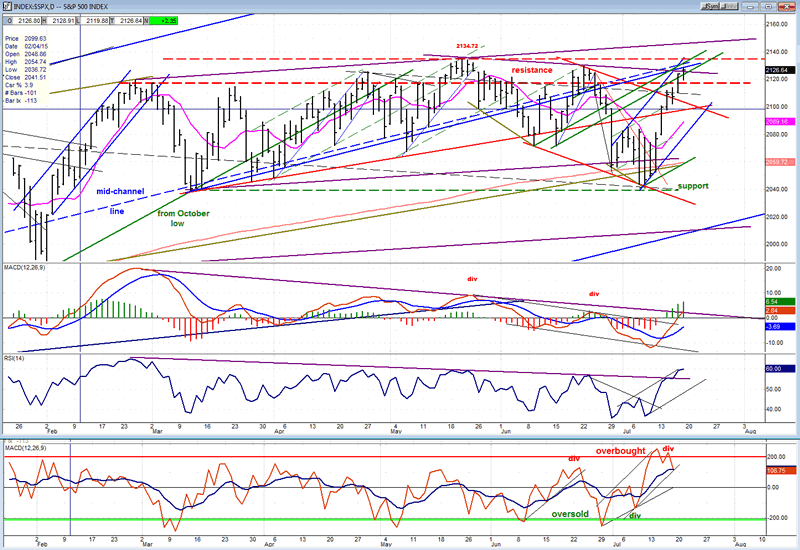

Here is the Daily SPX (courtesy of QCharts.com, as well as others below). Last week's rally took the index completely out of its declining channel, seriously challenging the existing downtrend. However, it did stop at the descending line which connects the two tops. For a technical confirmation that we have started a genuine uptrend, we will not only have to go beyond that trend line, but surpass the 2130 level of the former top. It certainly looks as if we are on our way to doing that, but perhaps not before correcting. At 2127, SPX reached a P&F projection which corresponds to an area of stiff resistance. This should put an end to the move, at least temporarily. I think that the causes of this resistance are clear enough when looking at the chart that they need not be detailed.

The downtrend channel defined by red trend lines is now eliminated, and we have formed a narrower up-channel which will have to be nullified by a penetration of its lower trend line before we can declare this uptrend over. This is not something which is likely to happen over the near term.

Of the three oscillators, the A/D has already turned down and the RSI has flattened, both indicating that we are coming into a minor top. The MACD is still in an uptrend, but the histogram has started to angle over. This showing in the indicators combined with the completion of a P&F phase projection and reaching heavy resistance should put at least a temporary halt to the rally. How we correct will give us a clue about a potential follow through, but since there is little distribution at the current level, we should not expect a deep correction at this stage.

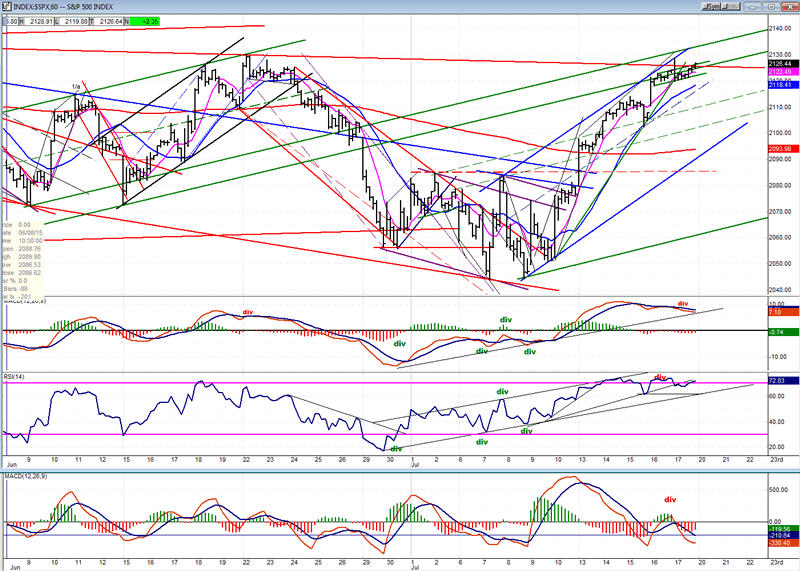

On the Hourly chart, I also show the smaller channel created by the rally, but it is conceivable that, if the move extends, the green trend lines will better define the trend. In that case, there would be an extended uptrend which would be in line with the projection to 2000.

As for now, it appears that we are making a minor top. The momentum indicators have been in an overbought condition with negative divergence for the last couple of days and have been trying to turn down. During that time period, the rally has decelerated and, at Friday's opening, prices spiked in a little buying climax which was immediately sold but has not yet created a reversal, even though the steep minor trend line was violated. This will have to wait until the small bottom green trend line has been broken and the price has fallen through the dashed trend line. Considering the condition of the indicators, this reversal is ready to take place.

For a normal correction to occur, we would have to drop back to the 2099 level. Much more would start to make the staying power of the rally suspicious.

Dow Jones Composite Index

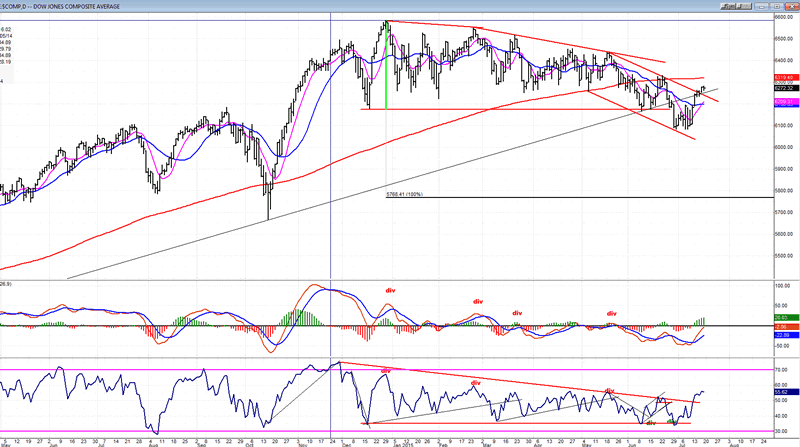

When the rally started, the Dow Jones Composite Index was in a more pronounced decline than the SPX and, although it too broke out of its downtrend channel, it was only by a slight margin. If the SPX makes a new high, it will have a hard time following suit. So, which is telling the truth about the overall market trend, SPX or Composite? This kind of divergence between various indexes has been the nemesis of analysts. Last week, Google went from 532 to 674, most of that distance achieved on Friday on better than expected earnings! How do you account for that behavior in a market that has been essentially static for several months. Is this the starting gun which suggests that the market is off to the races?

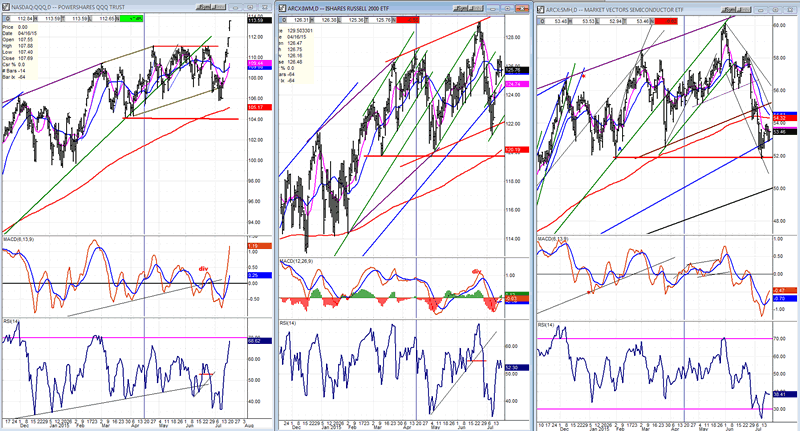

SMH - IWM - QQQ

The various trends that exist in the market are portrayed perfectly in the following three charts. The QQQ (NDX) exploded on Google's advance. IWM rallied with the rest of the market, but did not do anything sensational. The sharpest contrast in behavior occurred in the SMH which just yawned and went back to sleep. What are we to make of that? All three are recognized market leaders! This is why we need to give the market a chance to settle down and display some unification among its various components, either up or down ... or sideways, which has been its preference for the past five months.

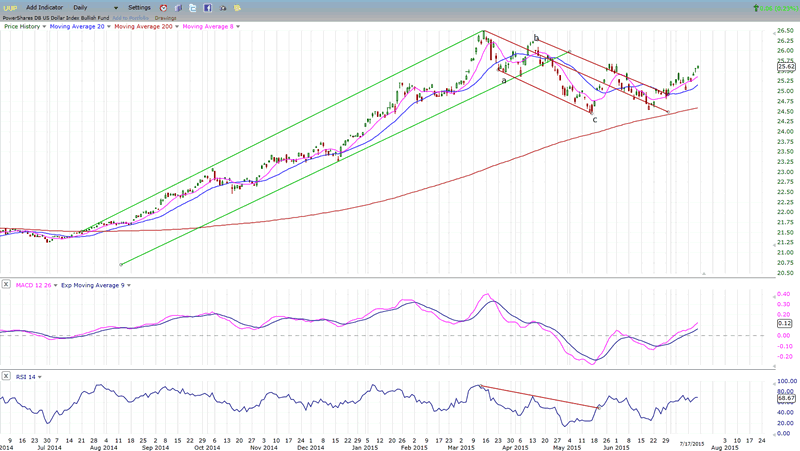

UUP (dollar ETF)

UUP finally looks as if it is ready to move higher. There is one problem! GLD (below) has arrived in the time frame designated for its 25-wk cycle low. This often corresponds in a high for UUP! Let's see what happens next week!

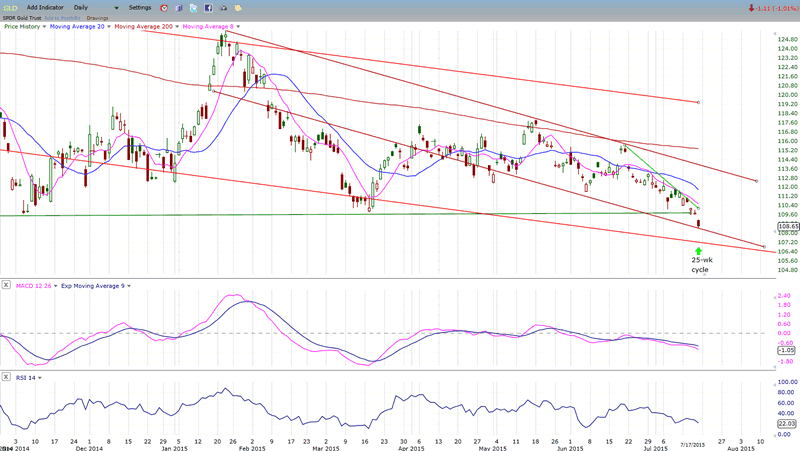

GLD (Gold trust)

All three of these indexes (UUP, GLD and USO) are doing precisely what had been predicted. As mentioned above (and in previous letters) GLD is now either at, or within a day of its cycle low. It has a near-term projection of 107/108. On Friday, it made a low of 108.40, refused to go lower, and closed at 108.66. It would not bother me in the least if it reversed from here. The projection has essentially been met, and it has already exhibited a behavior characteristic of a low prior to a reversal by producing some exhaustion gaps. GLD normally does not create a base. It just reverses when ready.

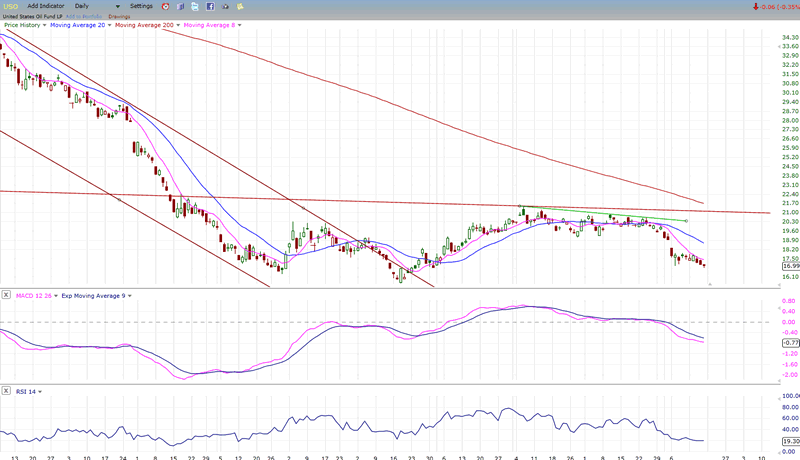

USO (US Oil Fund)

USO has also responded to the recent strength in the dollar, but it has fallen well short of its target of 13. Perhaps this is something reserved for later, or it could result in a projection failure.

Summary

With the Greek situation resolved (at least temporarily), and bullish statements about the economy by Janet Yellen, the market staged a powerful relief rally last week. There are a few contradictions which will have to be resolved if it is to move much higher, although the P&F chart appears to be suggesting this possibility. The next two weeks should tell us if this is a fake out, or the real McCoy!

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.