Market Orders - The Most Powerful Total Wealth Tactic of All

InvestorEducation / Learning to Invest Jul 18, 2015 - 03:43 PM GMTBy: ...

MoneyMorning.com

Keith Fitz-Gerald writes: When I started Total Wealth, I made you a promise that we were not only going to cover the events of the day and the opportunities they create, but also the specific tactics you need to maximize profits and build Total Wealth.

Keith Fitz-Gerald writes: When I started Total Wealth, I made you a promise that we were not only going to cover the events of the day and the opportunities they create, but also the specific tactics you need to maximize profits and build Total Wealth.

Today I want to keep that promise with a look at the single most powerful Total Wealth Tactic of all.

It’s simple, easy to use, and takes only an extra second or two to put in place.

Before I tell you what it is, though, I want to tell you why it works…

-

…because the tactic I’m going to share with you today puts YOU in control.

I know that’s hard to imagine given that you’re trading against the likes of Goldman Sachs, JPMorgan, and other firms with billions of dollars, but it’s absolutely true.

Moreover, it doesn’t cost a penny, can save you money, and can dramatically increase your odds of success.

Get this right and you’re immediately in command of your own financial destiny.

Many investors, particularly those who are new to the stock market, are totally unaware that there are different order types. So they simply call up their broker and tell him that they want to buy a given stock, bond, or ETF.

And the problem with that?

Unless you name a specific price, you’re giving your broker permission to fill your order at any price.

The good thing is that you’re guaranteed to get filled as long as there’s trading activity – meaning buyers and sellers making a market.

It’s the price that’s the problem.

Would you go to your favorite store and tell the salesperson that you’ll take those jeans at any price or head for the gas station to fill up for whatever the pump jockey wants to charge you? No way – you don’t want to get ripped off.

But that’s exactly the risk you’re taking in the stock market if you don’t tell your broker what you’re willing to spend. For example, “I want to buy XYZ but pay no more than $50 a share.”

Doing so takes away the advantage afforded to the much bigger traders who hold most investors at the mercy of the markets. It also removes the threat of being played by hedge funds, unscrupulous market makers, and institutional traders who would force you to buy your shares more expensively than you would otherwise.

Let me give you an example.

Carte Blanche for Your Broker Could Cost You More than $3,000 in a Single Trade

As I write this, Netflix Inc. (NasdaqGS:NFLX) is trading at $116.18 per share. The best bid – meaning what somebody will buy it for – is $116.17. The best ask – meaning what somebody will sell it for – is $116.20.

But there are also orders out there for as little as $100 and as much as $130 a share.

If you want to buy 100 shares of Netflix and you don’t specify a price, your broker could execute your trade anywhere in that range. So you could potentially spend as little as $10,000 or as much as $13,000.

The next trade could be anywhere in that range. It could also be dramatically outside that range.

Let’s say there’s a technical glitch – which we’ve seen happen several times in the recent past – and the best ask on the book is $200 a share. If you put in an order to buy at market, your trade will execute at $200 and you will have spent $20,000, which is probably not what you intended.

If you’re a seller, the same risks apply.

If there’s a glitch or you’re trading after hours in thin markets and you simply say sell, you could get the $200 a share or your trade could go right to the $5 a share “lowball” order a guy like me put out there just to go fishing.

Limit orders are almost always the better way to go.

Here’s another example using a more conventional price chart rather than the Level II data I’ve just highlighted.

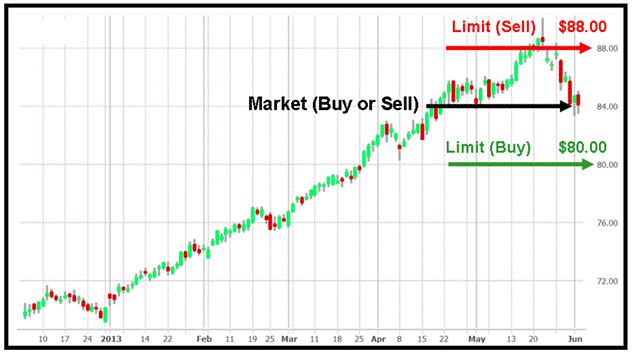

Imagine XYZ trading at $84 a share. Buyers interested in a bargain may stipulate that they’ll pay no more than $80 a share, while sellers interested in maximizing gains may stipulate that they’ll sell for no less than $88 a share.

StreetSmart Edge, Charles Schwab

Effectively, they’re establishing a range. That’s important because you should never want to buy something badly enough or sell in such a knee-jerk reaction that you’re chasing a trade. That’s a losing proposition no matter which way you cut it.

Returning to our example, the better way to buy Netflix would be to tell your broker to “buy Netflix at $116.25 or lower.”

By simply adding price to the order, a few things happen:

- The order is routed to the limit order book, so it’s known and everybody sees it.

- The order is guaranteed to fill at a given price that’s defined in advance so you’ll know exactly what price you’ll get.

The risk is that your order may not be hit in fast-moving markets because the limit no longer applies.

For example, if Netflix jumps 18% like it did following yesterday’s fabulous earnings report, anybody who specified that they want to buy shares at $114 or less will be left out in the wind and their order will not execute unless the stock returns to that price.

Sometimes that happens. Sometimes that doesn’t.

Either way, you simply adjust your order or move on to another stock because the one you want has gotten too expensive.

So here are the Key Takeaways:

- Order are like tools: you want the right one for the job.

- Market orders leave you at the mercy of the markets and larger traders because you have no control over the price you’ll get.

- The simple, easy-to-use way around this is to use a “limit” order that specifies how much or how little you want to pay to the penny… ahead of time. Either you get that price, or the trade doesn’t happen.

Obviously, we’ve just scratched the surface here – there are as many order types as there are ways to serve coffee at Starbucks.

We’ll cover those in due course, along with all sorts of variations including everything from the big three – market, limit, and stops – right up to those that may as well be an alien language – FOKs (fill or kill), IOCs (immediate or cancel), and GTCs (good till cancelled).

In the meantime, I want you to get in the habit of specifying price every time you place an order.

That way you’ll trade on your terms and, in doing so, dramatically increase your profit potential.

Until next time,

Keith

Source :http://totalwealthresearch.com/2015/07/the-most-powerful-total-wealth-tactic-of-all/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.