US Banking Stocks Downward Spiral to Zero

Companies / Credit Crisis 2008 Jun 20, 2008 - 11:15 AM GMTBy: Mike_Shedlock

On Wednesday, BankUnited Financial Corporation Announced Public Offering of Stock .

On Wednesday, BankUnited Financial Corporation Announced Public Offering of Stock .

BankUnited Financial Corporation (BKUNA) today announced the launch of a public offering of its Class A common stock, with gross proceeds of $400 million. The offering is expected to be pursuant to customary underwriting terms for a firm commitment offering of this type.

BankUnited expects to use the net proceeds from this offering for general corporate purposes, including contributing capital to its bank subsidiary. This offering was not greeted with open arms to say the least. Bank United was crushed 33% ahead of the news (who knew?) and another 19% the following day. Its stock now sits at $1.90.

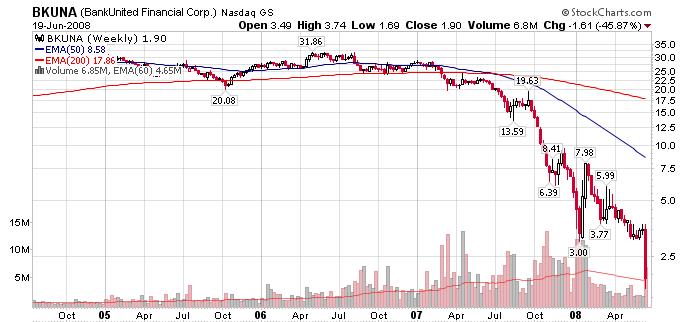

Bank United Weekly Chart

Why Now?

Why didn't Bank United raise capital at $31, $20, $14, or even $8?

It's market cap today is $68 million. Now it wants to raise $400 million which is 588% of what the market says it's worth. If that dilution comes on top of the declines we have already seen, its share price will be something like 32 cents.

Problem Financials

- Bank United (BKUNA) $1.90

- Chorus Bank (CORS) $4.74

- Washington Mutual (WM) $6.35

- Indymac (IMB) $1.26

- Ambac (ABK) $2.03

- Keycorp (KEY) $11.35

- MBIA (MBI) $6.45

- Fifth Third (FITB) $9.75

Opportunities Missed

Every one of those companies had enormous opportunities to shed assets or raise capital. Now, BKUNA is doing so at $1.90 and Fifth Third at $9.75 (see Fifth Third Clobbered In Capital Raising Plan ). Ambac is in denial about the need to raise capital. So is Indymac.

None of these companies could see what was happening even though it was perfectly obvious to many of us.

So why now for Bank United? This is a guess on my part, but I suspect the Fed told Bank United to raise capital or be taken over. I also think this is part of the reason Paulson is desperately pleading for more Fed power. See my comments on this horrendous idea in Screams For More Fed Authority Get Louder .

Will $400 million be enough for Bank United?

To answer, let's take a look at the balance sheet from the latest 10Q .

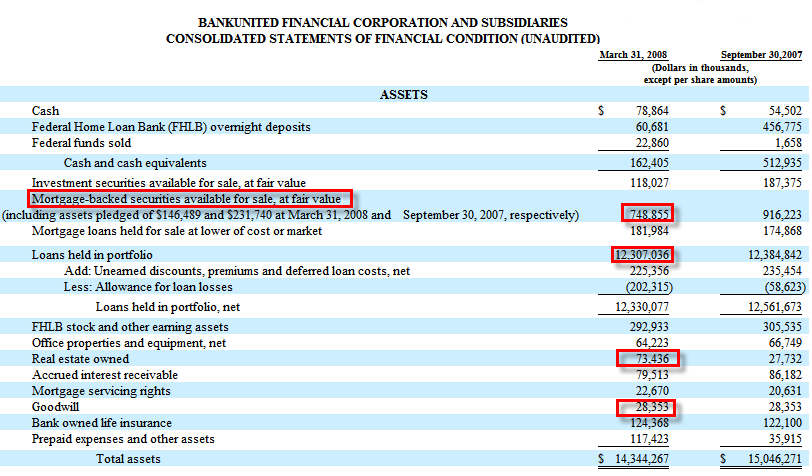

Bank United Assets

Hmm. What have we here?

I see $748 million in mortgage backed securities at "fair value". Anyone want to hazard a guess as to how "fair" that value is?

What about a total loan portfolio of $12.3 billion? Isn't that a little excessive for a bank with a market cap of $68 million.

I also see $73.4 million in REOs - real estate owned. Anyone want to guess the fair value of that?Finally, I see Goodwill of $28.3 million that is most likely worthless.

But wait... There's more. Let's look at the liability side.

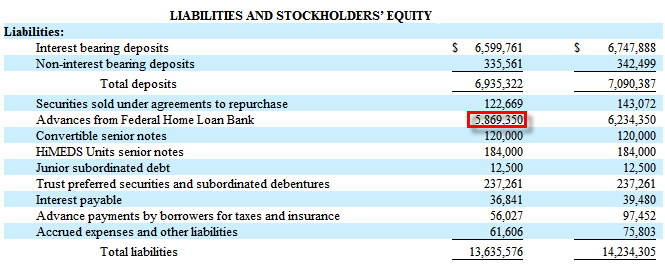

Bank United Liabilities

That's interesting isn't it? Bank United, a bank worth $68 million, is in hoc to the Federal Home Loan Bank for $5.86 billion.

Federal Home Loan Bank System

Inquiring minds just might be interested in the FHLBank System .

Mission:

"The mission of the Federal Home Loan Banks is to provide cost-effective funding to members for use in housing, community, and economic development; to provide regional affordable housing programs, which create housing opportunities for low and moderate-income families; to support housing finance through advances and mortgage programs; and to serve as a reliable source of liquidity for its membership."

Advances:

"FHLBank Advances. Advance lending is the FHLBanks' main business line. It currently represents about two-thirds of all the FHLBanks assets. These loans, known as advances, are well-collateralized loans used by members to support mortgage lending, community investment and other credit needs of their customers.”

FHLBank consolidated obligations are sold to institutional investors through the Office of Finance. The Office of Finance, which handles FHLBank transactions, is able to sell the debt at rates just slightly higher than Treasury bonds because FHLBank products are rated Aaa/AAA by Moody's and Standards and Poor's.

The FHLBanks frequently borrow short, primarily in the form of discount notes, while our membership tends to lend long, primarily to fund 15 to 30-year mortgages. At first blush, this may appear to be a term mismatch, but it's not. In fact, the FHLBank System intermediates on behalf of its members to reduce term mismatch risk and provide liquidity.

FHLBanks don't fund individual mortgages. They fund mortgage pools. Since these pools are constantly changing, they have no maturity. Consequently, the many term rates FHLBanks issue reflect their member needs, including the advances they use to minimize their own interest rate risk.

The FHLBanks are not the only prominent financial institution that operates this way. The U.S. Treasury does it, too.

Financial Highlights:

(As of December 31, 2006)

* $1.02 Trillion in assets

* $ 641 Billion in advances

* $ 98 Billion in mortgage loans

* 4.41% Capital to Asset Ratio

This Ponzi scheme cannot possibly be solvent. The only question is when it blows sky high.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.