Bonds and Currencies Brace for BoE and Fed Interest Rate Hikes

Interest-Rates / Central Banks Jul 17, 2015 - 02:34 PM GMTBy: Gary_Dorsch

It's approaching that time of year when traders and central bankers alike depart for long holidays. But this summer is shaping up to be anything but quiet for markets, with betting on a "Greek Exit" from the Euro roiling markets, and Red-chip stocks in China nose diving and requiring unprecedented "Plunge Protection Team" intervention in order to halt the onslaught. After a few weeks of turmoil, the Greek debt crisis has been kicked down the road for another few years, with another EU bailout, and after the Shanghai red-chip index, staged a +10% rebound from its panic bottom lows hit on July 7th, traders now regard these sideshows as "fixed" and under the control of their central planners. With these worries can be put on the back burner for now, it's back to business as usual, - that is to say, back to investing in heavily manipulated markets, in which extreme emergency policies, such as NIRP, ZIRP, and QE have distorted the pricing of virtually all assets, and where your local central bank has your back.

It's approaching that time of year when traders and central bankers alike depart for long holidays. But this summer is shaping up to be anything but quiet for markets, with betting on a "Greek Exit" from the Euro roiling markets, and Red-chip stocks in China nose diving and requiring unprecedented "Plunge Protection Team" intervention in order to halt the onslaught. After a few weeks of turmoil, the Greek debt crisis has been kicked down the road for another few years, with another EU bailout, and after the Shanghai red-chip index, staged a +10% rebound from its panic bottom lows hit on July 7th, traders now regard these sideshows as "fixed" and under the control of their central planners. With these worries can be put on the back burner for now, it's back to business as usual, - that is to say, back to investing in heavily manipulated markets, in which extreme emergency policies, such as NIRP, ZIRP, and QE have distorted the pricing of virtually all assets, and where your local central bank has your back.

However, with the Federal Reserve poised to hike short-term interest rates for the first time in nearly a decade, "The actual raising of policy rates could trigger further bouts of volatility, but my best estimate is that the normalization of our policy should prove manageable," said the Fed's "Shadow" chief Stanley on May 26th. Fischer gave no time frame for when the Fed will start its first tightening cycle since 2004-06, but he made it clear that higher rates are coming. Still, he warns, communications can be a "tricky business," and when the Fed does tighten, policymakers are bracing for spillovers to financial markets both at home and abroad. "Some of the world's more vulnerable economies may find the road to normalization somewhat bumpier," he added.

The key question hanging over the markets, in general, is whether the Federal Reserve and its Anglo sidekick, the Bank of England <BoE>, will finally begin to hike their short-term interest rates in the months ahead. On June 28th, the Bank for International Settlements, <BIS>, based in Basel, Switzerland, which is an adviser for global central banks, called on the world's top central banks to start normalizing monetary policy, - either by raising interest rates, or shutting down the printing presses under the guise of "Quantitative Easing," <QE>, and the sooner the better.

"By keeping rates anchored at these historic, ultra-low levels threatens to inflict serious damage on the financial system and exacerbate market volatility, as well as limiting policymakers' response to the next recession when it comes," the BIS warned. "Risk-taking in financial markets has gone on for too long. And the illusion that markets will remain highly liquid has been too pervasive. The likelihood of turbulence will increase further if current extraordinary conditions are spun out. The more one stretches an elastic band, the more violently it snaps back," (like the recent experience in the Chinese stock markets), warned Claudio Borio, head of the BIS's Monetary and Economic Department.

"Cheap money encourages more debt and creates financial booms and busts that leave lasting scars on the economy. They underpin both the potentially harmful high risk-taking in financial markets, while subduing risk-taking in the real economy, where investment is badly needed. And while increases in interest rates could cause stock prices to fall, - the likelihood of turmoil is only increased by waiting," the BIS warned. It advises that monetary policy should be normalized with a firm and steady hand. "Near-zero interest rates could become chronic in the world's major economies unless "a firm hand is used to raise them back to more normal levels." "More weight should now be attached to the risks of normalizing too late, and too gradually," the BIS warned. "Restoring more normal conditions will also be essential for facing the next recession, which will no doubt materialize at some point. Of what use is a gun with no bullets left?" the BIS report said.

However, the BIS has routinely made such dire warnings over the past few years, and the major central banks have routinely ignored them. In fact, the Bank of Japan <BoJ> and the European Central Bank <ECB>, are engaged in a full blown currency war over the fate of the Euro /yen exchange rate. Both central banks are printing about $70-billion worth of Euros and yen, and flooding the markets with ultra-cheap liquidity, that is keeping long-term bond yields artificially low, and stock markets artificially high. Neither the BoJ nor the ECB have any plan to roll back the QE-liquidity injections, anytime soon.

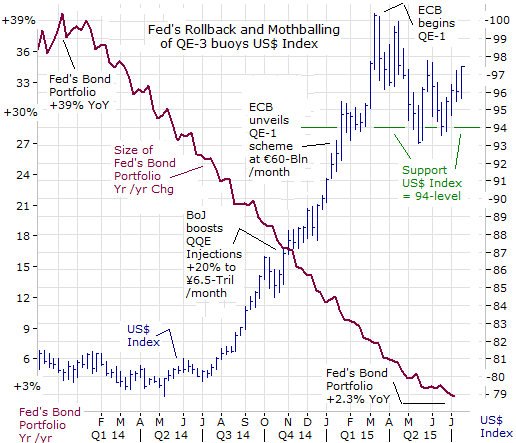

US$ wins the Reverse beauty Contest; Moreover, the monetary policies of the big-4 central banks will soon be moving further out of sync. The Fed began to taper its $80-billion per month QE-3 injections back in January 2014, and finally mothballed it on October 31st, 2014. The Bank of England spent £375 billion on purchasing British Gilts and mothballed its QE-injections in Nov 12. And according to recent leaks to the media, both the BoE and the Fed are preparing to follow the advice of the BIS, and will be the first of the G-7 central banks to hike their short term interest rates, in the months ahead.

On the other hand, the global markets will be swimming in a sea of liquidity, as the Bank of Japan <BoJ> and the European Central Bank <ECB> have both reaffirmed this week, that they will continue injecting a combined $140-billion worth of Euros and yen into the world's money markets in the year ahead. The BoJ is continuing its QQE injections at a rate of ¥6.5-trillion per month, and the ECB is continuing with its first ever QE-1 scheme at a clip of €60-billion per month until the end of Sept '16, despite opposition from Germany's Bundesbank. Together with funneling cheap 4-year, loans to banks, the ECB's Q€-1 scheme will inject more than €1.1-trillion into the money markets. Currency Carry traders' eyes are fixated on ECB chief Mario Draghi and the BoJ chief Haruhiko Kuroda who carry around the big bazooka.

A weaker Euro, and a weaker Japanese yen, is precisely what ECB chief Mario Draghi and BoJ chief Haruhiko Kuroda want. It makes local exports to other currency areas cheaper, thereby increasing the competitiveness of German, French, and Japanese Multi-Nationals. At the same time, it increases the price of imports, thus, reducing the threat of deflation at home. If the Euro and yen hadn't declined so dramatically in the past year, their cost per liter of diesel would be -20% less than it is today.

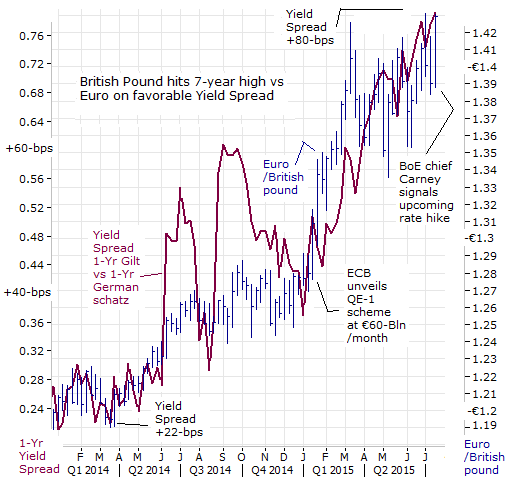

Thus, with full blown QE-schemes underway in the Euro-zone and Japan, and the BoE and the Fed having kicked the QE-addiction, -- the net result was a sharp increase in the value of the US$ index, measured against a basket of six currencies, climbing +20% higher from a year ago, and at one point reaching the psychological 100-level, its highest in 13-years. Behind the rise, the US$ rose from around ¥101.50 to as high as ¥125.50, while the Euro fell from as high as $1.3650 to as low as $1.0400. With the #1 and #2 Fed officials going on record, and hinting they will comply with the wishes of the BIS, with a few baby-step rate hikes in the months ahead, the US$ index is comfortably perched in the zone with support at the 94-level and resistance at the 100-area. Meanwhile, 1- British pound now buys €1.434 - it's highest exchange rate in 7-½ years. That is +24% more than the €1.1350 the pound could fetch this time two years ago. If the ECB ends up maintaining its QE program thru Sept '16's scheduled end, the upside target for the pound could be €1.50.

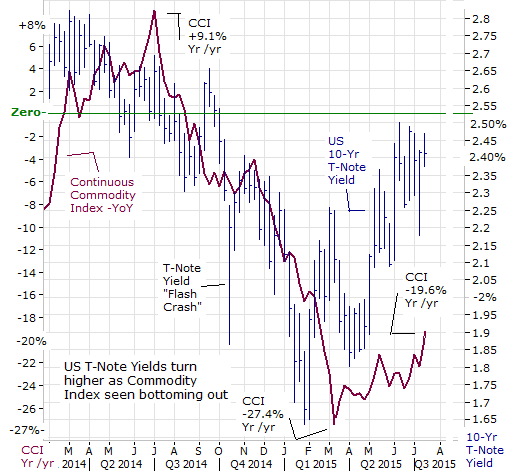

Stronger US$ crushes Commodities; While the US$ was displaying extraordinary strength, and reaching for the 100-level, most of the commodities traded on international exchanges were taking a beating: precious metals, industrial metals, grains, softs, you name it, -were hard hit. In large part, this was a case of a stronger US$ steamrolling the commodity markets. And it was also a matter of oversupply of crude oil due to record US-shale oil production, and a significant slowdown in China's economy. After almost a decade of growing at about +10% / year, the Chinese economy has slowed to +7% per year according to official statistics, and many private economists estimate China's economic growth rate has slowed to +5% to +6% annually, the slowest rate recorded since 1990.

China literally props up demand for most of the raw materials that are shipped across the high seas, but especially iron ore, coking and thermal coal, natural rubber, steel and copper, which defined the boom years that were known as the "commodity super-cycle". Across the board, from industrial metals, natural gas, grains, through to cotton, sugar, and crude oil, prices fell sharply. At its nadir, in March '15 the Continuous Commodity Index, a basket of 17-equally weighted commodities, nearly fell to the 400-level, and was trading -27% lower compared with a year earlier.

At various times during Q'1 of 2015, the price of Gold had fallen to as low as $1,140 /oz, and was trading -15% lower compared with a year earlier, Silver was down -27%, Copper was off -27% and Iron ore plunged to a 5-year low at $47 /ton, and -60% lower than a year earlier. Few were hit as hard as crude oil prices, with North Sea Brent skidding to as low as $46 /barrel, or -56% lower than a year earlier. The pain was felt across other commodity sectors. Coffee fell to as low as $1.28 /pound, or -33% lower, and Sugar got slammed to $12 /pound, or -36% lower than a year earlier. Corn fell to $3.70 /bushel, or -24% lower, and Soybeans fell below $10 /bushel, or -30% lower than a year earlier. But that was only part of the story. Losses were even bigger when including the total decline most of these classes of commodities suffered from their peaks, generally reached in the spring of 2011.

In turn, the 4-year Bear slide across the commodity sector, especially the Crash in Crude Oil, was noticed by traders in the longer-term bond markets. The yield on the US Treasury's benchmark 10-year T-note fell to below 2%, and hit low at 1.65% on the last day of January. Britain's 10-year Gilt yield tumbled to a historic low of 1.50%, and Germany's 10-year Bund yield nearly fell to zero percent, a few months later. By mid-April, a stunning 53% of all G-7 government debt was yielding 1% or less.

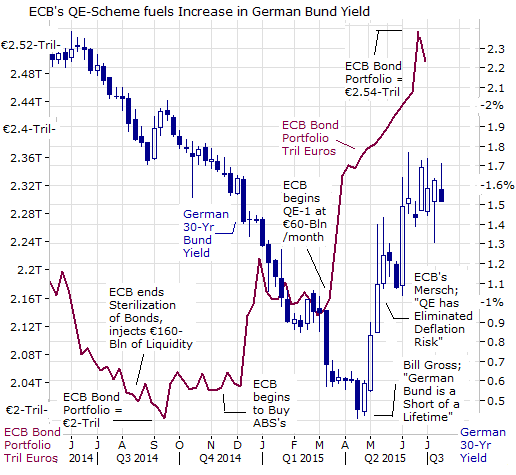

The sharp drop in energy prices depressed the Euro zone's consumer prices to levels last seen during the global financial crisis, with only tiny Malta and Austria escaping deflation. On an annual basis, prices in the 19 countries using the Euro were -0.6% lower than a year earlier, the EU's statistics office Eurostat said. Deflation was deepest in Greece in January, followed by Spain, while almost all Euro-zone countries had negative inflation rates. As such, the ECB began its Q€-1 scheme, and in anticipation of QE-1, many bond traders were front running the ECB, - and had driven a stunning €2.2-trillion of European notes to below zero percent (mostly German and French notes). By early April '15, all of Germany's debt with a maturity of 7.5-years or less, was yielding less than zero percent.

Bursting of Global Bond Bubble, Starts in Germany, On April 29th, "mystery" sellers began dumping the German 10-year Bund futures, and by the end of the day, the value of entire Euro-zone bond market had lost €55-billion ($76 billion) in a single day. It was the beginning of a revolt by bond traders against negative interest rates in Europe. In the eye of the storm, was Bill Gross the bond guru, - he hit a raw nerve that rattled the QE front runners, by going as far as to call the 10-year benchmark German Bund "the short of a lifetime" in a Tweet on April 30th. Double-Line Capital's Jeffrey Gundlach jumped on board, saying he would lever up "100 times" and make a bearish bet against German Bunds. Later that day, Germany experienced a failed auction, it only received €3.65-billion of bids at the five-year note auction, short of its €4-billion sales goal. Adding to the supply pressure, Italy auctioned €8.25-billion of debt, while Portugal sold €2.5-billion of 10-year and 30-year bonds via banks.

As fate would have, the bearish remarks by Mr Gross and Gundlach were just some of the triggers that ignited a mini rout in the German Bund market. A resilient $20 /barrel rebound in crude oil prices was also a key factor that enabled the Bund vigilantes to engineer a sudden and sharp sell-off in top-rated, low-yielding bonds in Frankfurt, and the ripple effects were felt in the bond markets of England, Australia, Canada, Korea, and the US, among other places. At the epicenter of the rapid slide in bond prices was the 10-year German Bund - its yield more than quadrupled to 0.60% in just five days, erasing all the price gains made this year. Investors in longer dated 30-year German Bunds suffered bigger losses of -20% from the bubble peak highs, as its yield ratcheted +100-bps higher to 1.40%, and signaled the passing of the deflation scare. Specific triggers for the downturn in May are hard to identify, but the sudden emergence of "reflation" trades in bonds partly reflected the notion that the ECB's QE-1 scheme was starting to work far more quickly than even optimists dared hope. Not only have Euro inflation rates stopped contracting, but private sector bank lending is expanding again for the first time in years, the Euro's M3 money supply growth has turned positive.

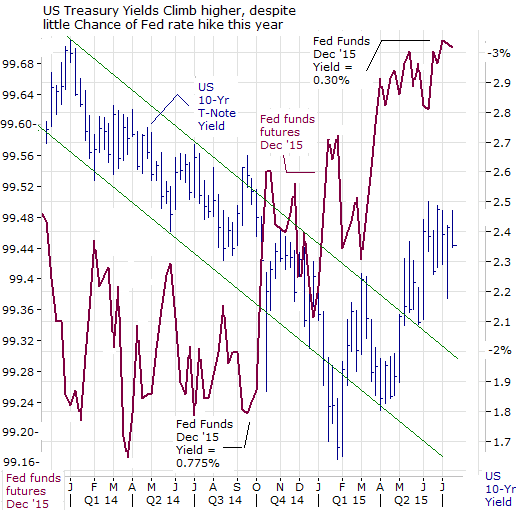

Fed says on Course to hike fed funds rate this year; The markets' attention now turns squarely on the Fed and the Bank of England, the two central banks that are expected to follow the BIS's words of advice, by bumping up short term interest rates in the months ahead. On June 17th, the Fed published its "forward guidance' report, dubbed the "Dots Plot," which suggests the US's fed-funds rate, now at 0.125%, will end up at 0.625% by the end of 2015 and at 3.75% in the "longer run." The Dot Plot graph is essentially a compilation of interest-rate estimates of the Fed's top 17 officials, with each dot representing one forecaster. Fifteen of the 17 predict a rate hike before year-end, but none of the Fed policymakers expect the fed funds rate to hit the 1% mark.

According to a Bloomberg poll of 51-economists, the first Fed rate hike would take place in September. Already, the yield on the US's 10-year T-Note has turned upwards by as much as óbasis points to as high as 2.50%, where it has temporarily met resistance. "The chances are about 50-50 that the US-economy will improve enough for the Fed to raise interest rates in September," said Fed Governor Jerome Powell, on June 23rd, who also expects the Fed to hike rates again in December. And yet according to the betting on the federal funds futures markets in Chicago, traders don't expect to see a Fed rate hike in September, and the earliest date for a rate hike is November or December, and it would be limited to +12.5-basis points to 0.25%. There is a 50% chance of a Ûbps Fed rate hike to 0.375% by year's end, according to futures traders, or a quarter-point less than the "Dots Plot" projection.

Speaking at a meeting of central bankers at England's Oxford University, the Fed's Shadow chief, Stanley Fischer repeated his warning about the Fed's first rate hike in nine years. He did not directly address the timing of historic event, but emphasized that the central bank should stay ahead of the (inflation) curve, since monetary policy only affects the economy with a time lag. "We should not wait until we have reached our objectives to begin adjusting policy. In order to minimize the likelihood of surprises and thus avoid creating unnecessary market and policy volatility, we are striving to communicate our policy strategy clearly and transparently," Fischer said.

On July 15th, Fed chief Janet Yellen reiterated for a third time that economic conditions favor a hike in the federal funds rate later this year, during her semi-annual policy report to Congress, Yellen said signs of economic sluggishness in the first quarter were the result of transitory factors, including unusually severe winter weather and labor disruptions at West Coast ports. However, "if the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds rate target, thereby beginning to normalize the stance of monetary policy," she said. As if to emphasize her warning, Yellen added, "If we wait longer to raise rates, it certainly could mean that when we begin to raise rates we might have to do so more rapidly. So there's an advantage to beginning a little bit earlier so that we might have a more gradual path of rate increases," she explained.

The risk of waiting too long to raise interest rates, in the US-markets, refers to the risk of seeing unsustainable bubbles inflated in the US-equity markets. St Louis Fed chief James Bullard warned "a prolonged accommodative stance is a "recipe for asset- price bubbles and a lot of mischief to happen," he told Bloomberg Radio. "Asset price bubbles have been a devastating feature for the US-economy in the last 15-years." Bullard's "base case" is for a rate increase this year. "We need to get going once we have the opportunity to get going," Bullard said. "The economy is getting back to normal, but policy is still on an emergency setting." The problem is however, the dovish Yellen /Bernanke Fed has lost so much credibility, that nobody believes them, even when they are speaking the truth.

Bank of England chief Signals hike in Base rate; Perhaps the clearest signal that the Fed is not bluffing about raising the federal funds rate later this year, were surprising comments by the Bank of England chief Mark Carney, relayed to the media on July 14th. Carney, said the time table for the BoE's first rate hike is moving closer, even though the latest batch of data showed the UK's inflation rate running at zero percent and the ranks of the jobless had unexpectedly edged up in the three months to May, the first increase in more than two years. Like the Fed, the BoE has pegged its base lending rates at a record low (0.50%) for more than six years, but now, the two central banks seem to be moving in lockstep, and heeding the call of the BIS, to hike their interest rates in the months ahead.

Speaking to British lawmakers on July 14th , Carney said households should start to prepare for higher borrowing costs. "The point at which interest rates may begin to rise is moving closer with the performance of the economy," he told parliament's Treasury Committee. Carney's hawkish comments were clearly unexpected and caught the foreign currency market off-guard. Carney pointed to the strength of the recovery - the UK was the fastest growing major economy in the developed world last year - as well as record levels of employment and rising wages. But he said any increases in interest rates are likely to be 'at a gradual pace and to a limited extent' - with rates remaining below the 5% level typically seen in tightening cycles before the financial crisis. 'I do think there are a variety of factors that mean that the new normal, certainly over the next three years, is substantially lower than it was previously,' said Carney.

Brushing off his reputation as a dove, outgoing BoE rate setter, David Miles said the case for hiking interest rates was stronger than at any time since he joined the bank in 2009, raise the possibility that August's meeting could a close vote among the nine BoE rate setters. Fellow BoE member Martin Weale has also suggested he will vote to raise rates soon. Miles said "waiting too long to start a gentle amble to higher interest rates would be a bad mistake," while emphasizing that sharp rises in borrowing costs should be avoided. "Given that many of the after-effects of the mess of 2008 do seem to have faded, I think a first move up in Bank Rate soon is likely to be right. I do not attach great weight to the idea that starting this process will create great risks of dropping back into very weak growth, falling into negative inflation and engendering a splurge in risk-avoiding behavior," he added.

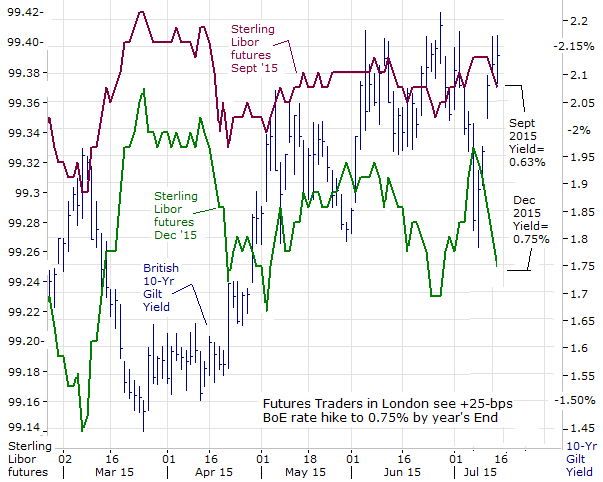

In London, sterling Libor futures traders are taking the hawkish rhetoric in stride, and are rather complacent, by pricing in the likelihood of a mini series of baby step rate hikes later this year. The BoE is likely to hike its base rate +12.5-bps to 0.625% in September and another +12.5-bps increase to 0.75% in December '15. The yield on the 10-year British Gilt has already rebounded into a range between 1.95% and 2.20%, - up ëbps from the level where it traded in early April. And thus, a half- point increase in the BoE's base rate to 1% has already been fully discounted in the Gilt market.

Nowadays, the BoE is putting more weight on workers' earnings, which are central to the BoE's thinking about when to raise interest rates. Total average weekly earnings in the 3-months thru May, including bonuses, rose by +3.2% compared with the same period a year earlier, up from +2.7% in the three months to April. It was the biggest increase in total pay over a three-month period since April 2010, the ONS said. Excluding bonuses, pay rose by +2.8%, the biggest increase in more than six years.

Other reasons that the UK Treasury chief might give the BoE the political "green light" to begin lifting its base lending rate, includes a healthy housing market that is spreading to all areas of the UK. The Council of Mortgage Lenders, which represents major banks and building societies, said gross mortgage lending soared +29% in June compared to May to an estimated £20.5billion - the highest level since July 2008. It was also +15% higher compared to the same time last year. Also, the average UK property value now sits at £274,000, according to the Office for National Statistics, which is £57,000 higher than the peak seen in May 2008 just before the downturn that began during the financial crisis. Nationally, UK homes prices were +5.7% higher in May than a year earlier . Housing prices in Northern Ireland were growing at twice the pace of London over the last year.

Speaking in London, Mr David Miles reiterated; The cost of raising interest rate sharply is particularly high in the UK, where a large proportion of household debt is in the form of variable interest rate mortgages and where many people would struggle to adjust to sudden and significant rises in monthly payments. Given that, I think a first move up in the Bank Rate soon is right," he concluded. In turn, the British pound soared to a 7-½ year high against the Euro this week, following hawkish comments by Mr Carney and Miles. Having opened the week at €1.395, the pound jumped to €1.43 on July 16th, as the yield on the UK's 1-year T-bill rate rose to óbps above Germany's 1-year schatz yield. That's up from a Ûbps spread seen in March '14, and small shifts in interest rate differentials can have bigger impacts on exchange rates. But with inflation well below the BoE's +2% target - official figures published yesterday showed it fell from +0.1% in May to zero in June - sceptics still doubt the BoE will hike short-term interest rates any time soon.

Fed deputy sees 3.25% to 4% fed funds rate; Should long term Bond investors fear the prospect of a tighter Fed policy in the months or years ahead? "We're going up with the interest rate, then along, then another little jump," warned Fed Vice Chair Stanley Fischer on June 1st. Fischer added that it is "misleading for investors and economists put too much emphasis on when the initial interest rate raise will be; much more prudent would be to consider where the short-term rate will be over the next few years." Fischer predicted the federal funds rate will reach 3.25% - to 4% over the next 3-to-4-years.

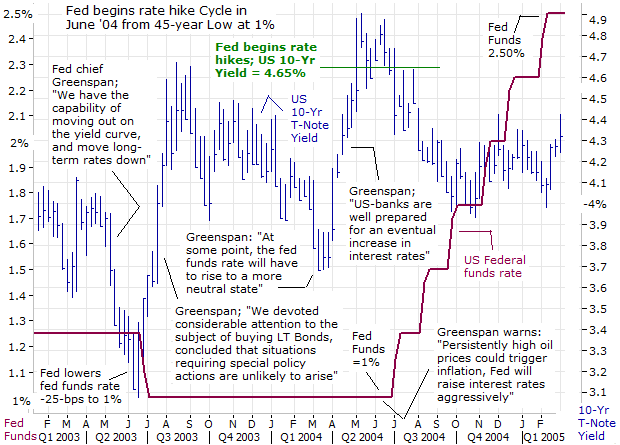

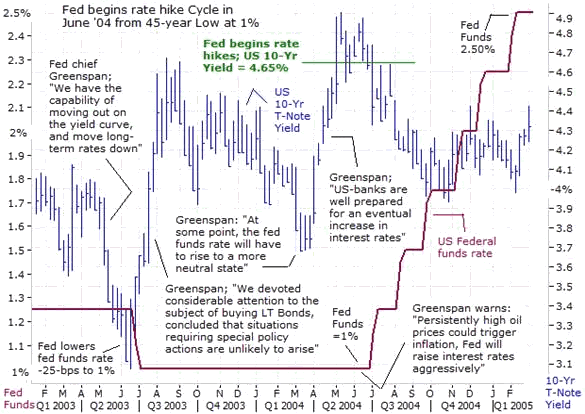

Looking back at history, to the March 2004 thru June 2006 period, - the last time the Fed shifted to a liquidity tightening campaign, and hiked the fed funds rate by a total of +424-bps, - does give some insight into what might happen with 10-year T-Note yields in the year ahead, if the Yellen Fed goes forward with a mini rating hiking campaign. Mr Greenspan was at the helm of the Fed the last time the central bank rolled out a series of rate hikes, starting in June 2004. Under Greenspan, the Fed hiked the fed funds rate at 14 consecutive meetings, by Ûbps each time, from a previous 45-year low of 1% to as high as 4.50%, before the "Maestro" retired in Feb '06. His protégé, Ben "Bubbles" Bernanke sought to brandish his inflation fighting credentials, by extending the Fed's rate hiking spree ïbps to 5.25% in June of 2006, - the last time the Fed ever hiked the fed funds rate.

However, the story actually begins in May 2003, when Mr Greenspan, nicknamed the "Maestro" roiled the US T-Note market when he hinted that the Fed might move to lower the fed funds rate towards zero percentand could start to buy long-term bonds, to fight off the possibility of the US-economy from falling into the "Deflation Trap." Thus, Greenspan did threaten to unleash "Quantitative Easing <QE> during his tenure. The threat of QE did lower the yield on the US's 10-year T-note from around 4% in April '03 to as low as 3.10% in June '03. "Should it turn out that - for reasons that we don't expect, but that we certainly are concerned may happen, - the pressures on the short-term markets drive the federal-funds rate down close to zero, that does not mean that the Fed is out of business on the issue of further easing," Greenspan warned on May 21st, 2003. "Even though short-term rates are at 1.25%, longer-term rates are significantly above that. We do have the capability - should that be necessary - of moving out on the yield curve, essentially moving long-term rates down."

The Fed would accomplish that by buying Treasury securities with longer maturities and setting a cap on their yields (ie; QE). However, two months later, on July 15th, 2003, in testimony to a Congressional panel , Greenspan whipsawed T-bond traders by doing a 180-degree reversal, saying the Fed wouldn't have to resort to QE. "The Fed stands prepared to maintain a highly accommodative stance of policy for as long as needed to promote satisfactory economic performance, and has substantial room to keep lowering overnight rates. However, Fed members have concluded it is most unlikely the Fed would need to take unconventional steps such as buying Treasuries to lower market rates," Greenspan said. Instantly following his comments, the benchmark 3.375% Treasury note maturing in May 2013 plunged 2-points lower, pushing the yield up Ûbasis points <bps> to 3.95%. Bond yields continued to surge higher and by the middle of August 2003, the 10-year T-Note yield hit a high of 4.65%, and far above the cycle low of 3.10%, hit just two months earlier - on June 5th, 2003.

In May 2004, one month before the Fed actually began its rate hiking campaign, the yield on the 10-year Treasury note had already surged to as high as 4.95%, was light years ahead of the central bank. The message coming from the Fed was the same script that we hear today; "keeping interest rates too low for so long could cause problems. Some members are concerned that keeping monetary policy stimulative for so long might be encouraging increased leverage (ie; borrowing), and excessive risk-taking, (ie; bidding up stock prices). Such developments could heighten the potential for the emergence of financial and economic instability (ie; bubbles) when policy tightening is necessary in the future."

When the Greenspan Fed finally initiated its first baby step rate hike to 1.25% in June of 2004, the 10-year T-Note yield was trading around 4.65%. Yet what was most confusing and surprising to Fed officials, at the time, the yield on the 10-year T-note continued to slide -65-bps lower towards 4%, even as the Fed continued raising the fed funds rate higher to 1.75%, by Sept 2004. In fact, after 15 straight Fed rate hikes to 4.75%, the 10-year T-note yield was still hovering around 4.65%, where it was when the Fed started the tightening campaign. Greenspan called this situation a "conundrum," since the 10-year yield was little changed at 4.65%, even though the Fed had lifted the fed funds rate +350-bps higher. The key lesson is; most of the increase in long-term bond yields, in anticipation of a tightening cycle, has already materialized, before the Fed even takes its first baby-step rate hike.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Global Money Trends filters important news and information into (1) bullet-point, easy to understand reports, (2) featuring “Inter-Market Technical Analysis,” with lots of charts displaying the dynamic inter-relationships between foreign currencies, commodities, interest rates, and the stock markets from a dozen key countries around the world, (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, posted Monday and Wednesday evenings, with the latest news and analysis on global markets. To order a subscription to Global Money Trends, click on the hyperlink below,

http://www.sirchartsalot.com/newsletters.php

or call 561-391- 8008, to order, Sunday thru Thursday, 9-am to 9-pm EST, and on Friday 9-am to 5-pm.

This article may be re-printed on other internet sites for public viewing, with links to:

http://www.sirchartsalot.com/newsletters.php

Copyright © 2005-2015 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.