China Crash Real Problem is the Housing Market

Housing-Market / China Housing Market Jul 14, 2015 - 03:38 PM GMTBy: Harry_Dent

I always say bubbles burst much faster than they grow. And after exploding up 159% in one year, Chinese stocks crashed 35% in three weeks.

I always say bubbles burst much faster than they grow. And after exploding up 159% in one year, Chinese stocks crashed 35% in three weeks.

This all happened while the Chinese economy and exports continued to fall. And two thirds of these new trading accounts belong to investors who don’t have so much as a high school degree. How crazy is that?

As Rodney wrote earlier this week, the Chinese government is taking every desperate measure to stop the slide:

Artificial buying to prop up the market…

Banning pension funds from selling stocks…

Threatening to jail investors for shorting stocks…

Allowing 1350 out of 2900 major firms to halt trading in their stocks indefinitely, and stopping trades on another 750 that fell 10% or more…

It’s madness!

This second and FINAL bubble in Chinese stocks occurred precisely because real estate stopped going up. Over the last year it actually declined.

[wdca_ad id]

So after decades of speculation, the gains stopped coming in, and rich and poor investors alike switched to stocks.

But the funny thing about the Chinese is – they don’t put most of their money in stocks. Only about 7% of urban investors own stocks and half of those accounts are under $15,000. In fact, it’s estimated that the Chinese only put 15% of their assets there, and that may be on the high side.

What is so unusual about the Chinese is that they save just over half their income! And the top 10% save over two-thirds!

And where do those savings go? Mostly into real estate!

China’s home ownership rate is 90%. It’s just 64% in the U.S. even though we’re much wealthier and credit-worthy.

That’s because home ownership is a staple of their culture. A Chinese man has no chance of getting a date or getting laid unless he owns a home – no matter how small.

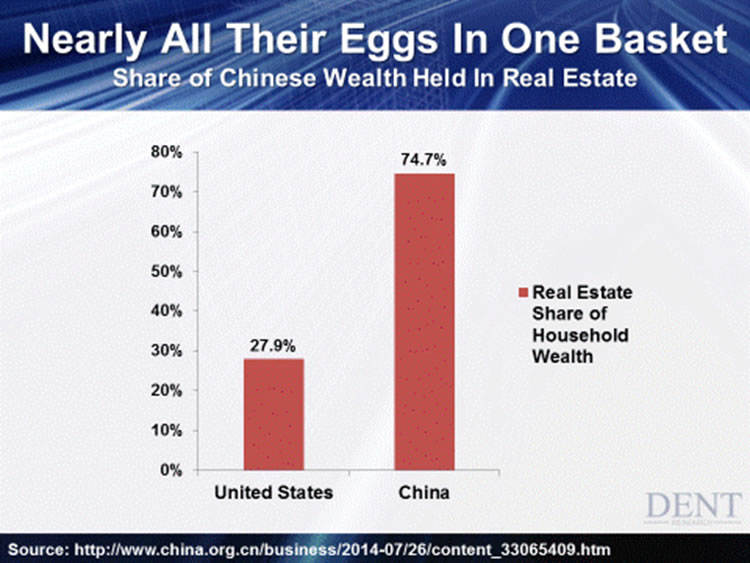

Just look at this simple chart:

Chinese households have 74.7% of their assets in real estate vs. 27.9% in the U.S. – which helps explain why theirs is one of the greatest real estate bubbles in modern history!

But the key here is – when that bubble bursts, it will cause an unimaginable implosion of Chinese wealth. In one fell swoop, three-quarters of their assets will get crushed!

And just how big of a bubble is it? In Shanghai, real estate is up 6.6 times since 2000. That’s

560%.

I’ve been going on and on about the massive overbuilding of basically everything in China for years now. I’ve never once flinched from my prediction that this enormous bubble will burst. And I’ve kept saying there will be a very hard landing no matter how much the government tries to fight it.

Central banks had been setting this global bubble up from 1995 to 2007. China’s government – even more so!

By my estimates, they’ve built up their infrastructure, real estate, and industrial capacity 12 to 15 years ahead of demand. And that’s if urbanization continues at such astounding rates. Good luck on that in a slowing world economy!

In a massive overhaul of their economy, they did this to provide jobs for half a billion people who moved from rural plains to urban cities over the past three decades. It was so rushed that 220 million migrated in just the past 12 years and aren’t even legal citizens in the cities they live in!

Now, China’s ambition has cost them. A sharp 35% correction in their stock market tells me that this second and final bubble has already peaked and is definitely bursting.

As for us, remember that China led the global collapse in 2008. The last bubble saw a six times gain in just two years and a 72% crash in just one.

And while stocks are bouncing in China right now, I see almost no chance of them making a new high back above 5,178 on the Shanghai Composite.

If I’m being realistic, they’ll probably bounce to 4,300 over the coming weeks, but then start crashing again by September at latest. After that, I expect they’ll fall sharply for a year or so.

If they crash down to 2,000 and as low as 1,000 which I suspect they will, then the economy and real estate will come next. And like I’ve said, that will destroy massive amounts of wealth and take years to shake down.

Then beyond China, it’ll send shockwaves through real estate worldwide.

After all, who are the leading buyers in cities like Sydney, Singapore, L.A., San Francisco, New York, Vancouver, and London? The Chinese! Just in 2014, they accounted for 24% of the total real estate purchases in the U.S. at some $22 billion!

You don’t have to be Einstein to understand what happens when foreign buyers with that kind of horsepower come to a halt.

But there is another layer to this – the country’s affluent have been fleeing their country in droves by moving “temporarily” to major English-speaking cities, in part to get their kids a top-notch education.

Except what they’re really doing is laundering their money out of the country by buying the most expensive real estate they can afford, usually for cash!

China’s government will only put up with this for so long – especially when their economy starts to putter out. They’ll have to stop this exodus sometime in the next year or so, and when they do, it will cause the global real estate bubble to implode. I cover this much more in depth in the July issue of The Leading Edge.

Just like I don’t want you to get caught off guard by a global selloff in stocks, I want you to be aware when real estate and world economies follow.

We’ll cover more in depth strategies to weather the economic storm ahead at this year’s Irrational Economics Summit in Vancouver – which bubble or not is one of my favorite cities. This “meeting of the minds” grows more and more dire as we get closer to the next global crash, so I hope to see you there.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.