Growth of Chinese Margin Accounts Drove Bubble – Now Drives the Crash

Stock-Markets / Chinese Stock Market Jul 09, 2015 - 06:32 PM GMTBy: GoldCore

- Restrictions on borrowing to speculate were eased in 2010

- Restrictions on borrowing to speculate were eased in 2010

- Middle class savers gradually saturated the market trading on leverage

- Market crash began as government tried to reign in leverage in overheated markets

- Leverage amplified gains on the up-leg, amplifies losses on down-leg forcing further sell offs

- Policy u-turns could not halt crash

Chinese markets bounced last night following drastic intervention by the state when it banned large players from selling their shares in listed companies – arresting the over 30% decline of the past four weeks.

By definition, a market ceases to be a market if selling is prohibited so it is far from clear at this point if the government can bring stability back into the system.

At the heart of the problem is the use of credit by “investors” to take up larger positions than they might have if they were gambling only with their savings. It was this trading on leverage which ignited the bubble and it is this same dynamic which is now applying downward force.

Until 2010 trading on leverage was tightly regulated in China – only those who could afford to lose could use it. Since that time, however, restrictions have been gradually eased although speculators still have to put up 50% of their own cash.

As momentum grew more middle class speculators entered the market which led to the mania of the past twelve months. In that time the value of shares listed on stock markets more than doubled to $10 trillion. Bloomberg estimate that the surge was financed by $339 billion of new credit.

From the start of this year the government – seeing the emergence of another massive bubble – attempted to rein in margin trading by raising the minimum level of cash required and closing of loopholes that allowed speculation on higher margins. Then on June 12th, when the crash began, the government put a limit on the use of margin trading itself.

When trading on leverage, at the officially sanctioned 2:1 ratio, small time middle class speculators were making double the gains as the market rose encouraging them to take on further debt for speculation and encouraging those on the sidelines to get involved.

However, as the market has plummeted they have made double the losses causing them to liquidate positions, forcing stock prices down and further liquidations.

The Chinese government was forced to change policy again, easing margin requirements, to try to shield investors from margin calls and to kick-start the markets but it appears that many investors had already learned a very painful lesson and as the Chinese securities regulator said a “panic sentiment” had overwhelmed the market.

Speculating with borrowed money played a key role in the 2008 crisis which nearly collapsed the global economy. It would appear that the entire world is hopelessly addicted to debt. The global debt ponzi scheme grows ever more fragile and with the consequences of this crash – the evaporation of trillions of dollars worth of debt on China’s banking system – yet to be seen, we may be entering a new phase of crisis.

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,162.10, EUR 1,053.96 and GBP 755.37 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,154.25, EUR 1,045.61 and GBP 749.46 per ounce.

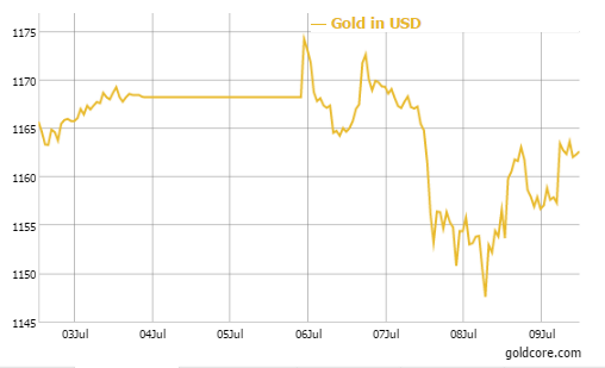

Gold in USD – 5 Day

Gold climbed $3.00 or 0.26 percent yesterday to $1,158.80 an ounce. Silver rose $0.04 or 0.26 percent to $15.14 an ounce.

Gold in Singapore for immediate delivery was up 0.6 percent at $1,164.30 an ounce an ounce near the end of the day, while gold in Switzerland was at $1,163.50 an ounce. U.S. gold futures for August delivery were off 60 cents an ounce at $1,162.90 an ounce.

The yellow metal touched $1,146.75 an ounce earlier earlier this week, only a few dollars from its low for the year, a key support level.

The release of the Fed minutes from the June 16-17 meeting showed that the central bank continues to falter with its plan to raise rates, in the wake of mixed economic data domestically and global market turbulence abroad.

UBS has slashed its price forecasts for both platinum and palladium this year because a decline in investor sentiment and a greater supply of the metals.

In late morning European trading gold is up 0.49 percent at $1,162.35 an ounce. Silver is up 1.59 percent at $15.35 an ounce and platinum is up 0.98 percent at $1,032.00 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.