China Stock Market Crash / Trading Freeze

Stock-Markets / Stock Markets 2015 Jul 08, 2015 - 02:41 PM GMT China is back in the news as “Greek Hope” for a settlement with the ECB fades the crisis in Europe for the time being. However, the Markets in China are in a panic state and threaten a further breakdown as the Shanghai Index hovers just above 3600.00 after an epic overnight roller coaster ride.

China is back in the news as “Greek Hope” for a settlement with the ECB fades the crisis in Europe for the time being. However, the Markets in China are in a panic state and threaten a further breakdown as the Shanghai Index hovers just above 3600.00 after an epic overnight roller coaster ride.

Bloomberg reports, “Between unprecedented government intervention to prop up the $6.5 trillion equity market and trading suspensions in more than 1,300 companies, analysts can no longer rely on share prices as an indicator of corporate value in the world’s second-largest economy.

The remarkable turn of events comes less than two years after China’s ruling Communist Party vowed to give market forces a bigger role in the economy, part of its largest reform drive since the 1990s. While the stock-market rescue mission is designed to stem a rout that erased $3.2 trillion in three weeks, it may end up making matters worse. Traders rushed to sell whatever they could on Wednesday and foreign investors extended a record three-day exodus as the Shanghai Composite Index sank 5.9 percent.”

Chinese investors find themselves frozen out of 72% of the market.

Bank of America reports, “Regarding the deleveraging process in the market, in our view the government started too late & without adequate preparation for the potential downside. We suspect because it didn’t know the true extent of shadow margin financing activities.”

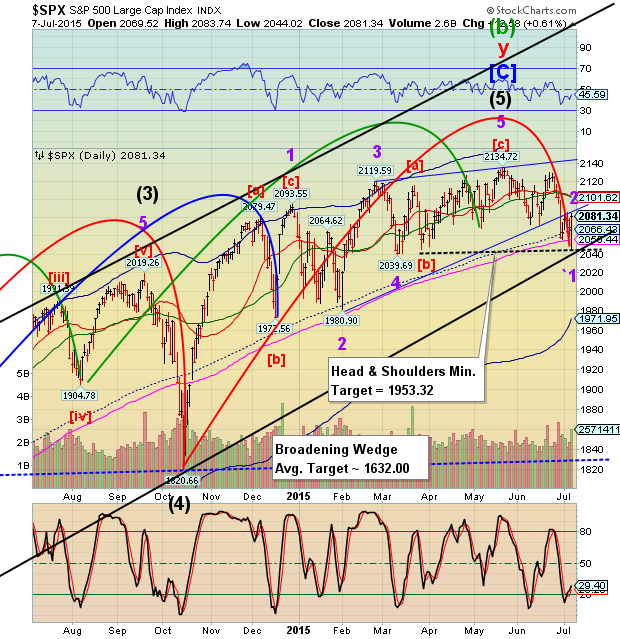

SPX futures fell overnight back to the 200-day Moving Average at 2058.44 before bouncing back to mid-Cycle support/resistance. The SPX Premarket appears to be hovering there at this time. A breakdown beneath 2044.00 may create a panic decline to 1820.00 or possibly deeper.

Greece caved last night, asking for up to 3 years support from the ECB in exchange for sweeping reforms.

The shocker was that Tsipras intended to “lose” the election and is now caught by his own success.

Angela Merkel mocked Greece as the negotiations came up empty. The finance ministry and German lawmakers are pressuring Ms. Merkel to tighten the screws on Greece.

Despite intervention by the U.S. and French leaders, the German answer is still “nein.”

EuroStoxx bounced overnight to 3336.06 but there is no support until it hit Cycle Bottom at 2938.87. The Head & Shoulders neckline is broken, giving this doubly indicated formation a 93% probability of success. In fact, there is an outside chance of this decline reaching the lower trendline of it Orthodox Broadening Top near 2600.00.

So, despite the bounce, the ECB appears to have committed financial hari kiri.

TNX is also bouncing, but not from an important low. It appears that the decline in TNX may last until the end of July.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.