SPX Sinking Premarket

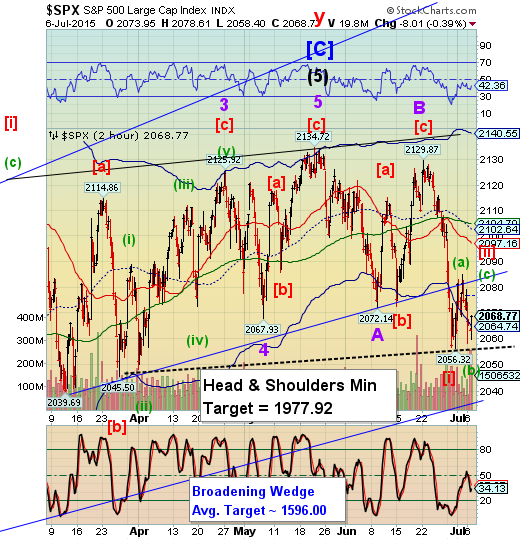

Stock-Markets / Stock Markets 2015 Jul 07, 2015 - 02:50 PM GMT The retracement appears to be playing out in the futures. The Wave (a) high was 2078.94 on July 2 while the overnight futures appear to have topped out in a 9-wave (c) at 2077.94. It is still unclear whether it will continue to rally after the open, but the futures favor a failurs.

The retracement appears to be playing out in the futures. The Wave (a) high was 2078.94 on July 2 while the overnight futures appear to have topped out in a 9-wave (c) at 2077.94. It is still unclear whether it will continue to rally after the open, but the futures favor a failurs.

The Premarket is still positive, up .75 while the futures are down -7.80 as I write. The Cycles Model suggests we may still rally today. The Cycles Trading Channels suggest a possible top near 2082.65, which is very close to the Ending Diagonal trendline.

The market is being a tease, but a rally to complete Wave (c) should not affect our sell signal.

VIX futures are range-bound with nothing new to report here.

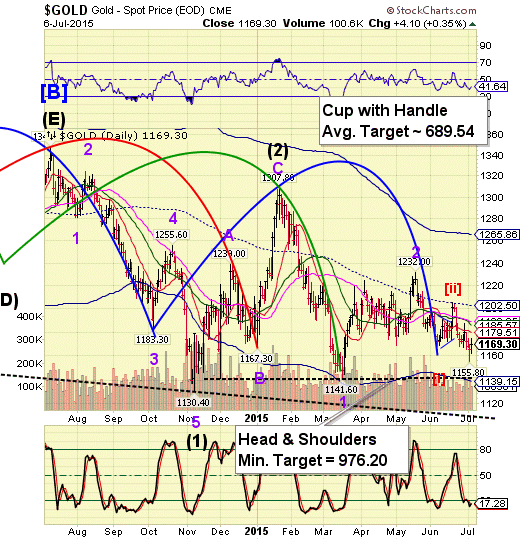

Gold appears to have broken down beneath its prior low, hitting a new low of 1154.10. ZeroHedge reports, “FX markets are roiling today, US and German bonds are surging (yields are tumbling), and European stock and bond markets are ugly again. Between all of this we are seeing 'jerky' moves in many disparate instruments as it appears margin calls are mounting and forced unwinds accelerate across markets, the latest of which is gold (and silver) which just saw someone decide to dump almost $1 billion notional instantly into the open market.”

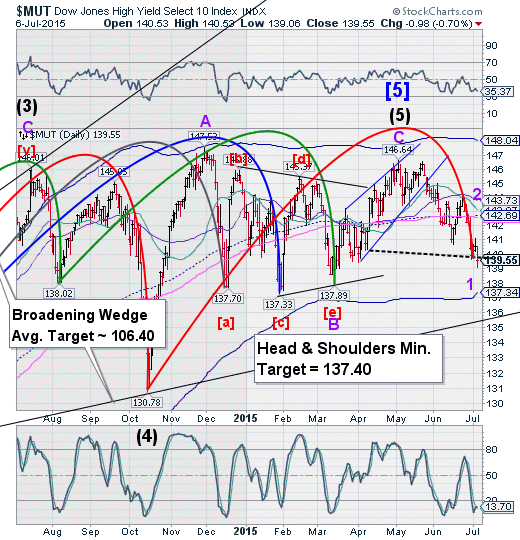

Yesterday I reported the MUT broke below its Head & Shoulders neckline. As all things are connected, this one has to do with the falling price (again) of oil. WTIC has dropped to a new Cycle low of 52.10 this morning.

ZeroHedge comments, “Overnight hope has faded and WTI crude prices have retumbled as Iran deal expectations rebuild and China economic collapse fears grow. The last few days have seen crude break crucial support levels and tumble to 3 month lows, down over 12% - the biggest losing streak since November. Credit risk for HY energy names is resurgent, crushing the mal-investment dream in a double-whammy for the industry as cost of capital rises and incomes shrink.”

This may prove to be an exciting day, indeed.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.