“Oxi!” - Greeks Defy Eu As Varoufakis Resigns To Ease Tensions With “Partners”

Stock-Markets / Eurozone Debt Crisis Jul 06, 2015 - 03:29 PM GMTBy: GoldCore

- Brave Greeks vote overwhelmingly against austerity

- Brave Greeks vote overwhelmingly against austerity

- Varoufakis resigns to clear air for next phase of negotiations

- We think a Greek debt deal is highly likely over the next few days

- EU elites had hoped “yes” vote would force the replacement of Syriza with unelected technocratic experts

- Syriza may nationalize banks to protect depositors from “bail-ins”

- UK slashes Deposit Insurance from £85,000 to £75,000

- Europe and the world now in uncharted waters, gold will protect

The Greek people have voted overwhelmingly against using austerity as a tool to somehow normalise their economy in a world where normality no longer applies, on any level, to economic policy.

Yanis Varoufakis, the Greek Finance Minister, has announced his shock resignation this morning. This, despite the vote of confidence that yesterday’s result is for Syriza’s policies.

It is believed that his absence from the next phase of negotiations will clear the air with Greece’s “partners”. He had managed to antagonise most of his European counterparts by speaking bluntly about the problems facing Greece – both internally and externally.

The “no” vote carried despite blanket coverage in the private media that such an outcome would be disastrous for Greece – which it may yet be.

However, the alternative would be to allow the EU continue to kick the can down the road until conditions for ordinary Greeks become so intolerable that they would be faced with the same option some time in the not too distant future.

Christine Lagarde has gone on record to say that Greece’s debts are unpayable. For Syriza – and the Greek people apparently – there is absolutely no advantage to be gained in taking on more austerity without some of their debt being written off. It offers no long-term solutions to their suffering.

It is highly unlikely that the EU elites are unaware of this. It would appear that the wave of scare-mongering prior to the referendum was designed to force the resignation of Tsipras and Varoufakis.

This would likely be followed by the imposition of an unelected technocratic government as was proposed by unelected European Parliament president Martin Schultz last week. In an interview with German business daily Handelsblatt he said that following a “yes” vote Syriza would be forced to resign and the period between then and the election of a new government would “be bridged with a technocratic government, so that we can continue to negotiate”. The notion that an EU imposed technocratic government would then “negotiate” with the EU is, of course, laughable.

In the Telegraph today, Ambrose Evans Pritchard reports that the Greek Finance Ministry may nationalise the banks in an attempt to protect the public from bank bail-ins – and it is worth noting rumours that Greeks deposits are only covered up to a value of €8,000 – and to prevent the ECB from shutting down any banks.

Factions within Syriza advocate taking the “provocative step in extremis of creating euros”, writes AEP, should the ECB fail in its duty to keep greek banks capitalised.

The resignation of Varoufakis is somewhat disappointing. He has been the one element in the mix that has saved observers watching the drawn-out Greek tragedy dying of utter boredom.

Like or loath him, his refusal to conform to business-as-usual and “the (unelected) experts know best” politics of the EU has drawn attention to the increasingly authoritarian nature of the EU institutions.

The people of Greece have rejected further impositions on them. They reject further hardship when there is no reason to believe that such hardship will lead to a brighter future. In effect, they are asserting their liberty in the face of slavery.

How the institutions choose to respond will be telling. Do they respect democracy or do they choose authoritarianism for what they decide is the greater good? We are now truly in uncharted waters.

Physical gold will serve as protection in the coming weeks and months as the consequences of the referendum unfold.

We think a Greek deal is highly likely over the next few days and here is why. Varoufakis’ exit implies that negotiations are already under-way. The removal of a perceived lighting rod and divisive figure from the table will allow creditor countries to ease the passage of a deal which may likely have substantial haircuts. Varoufakis’ role in this debacle has been very effective. Creditors know that a Greek exit will create a dangerous precedent that will linger in Europe for years and stifle attempts for closer fiscal and political union.

Like a game of chess Tsipras may have just sacrificed a knight in order to achieve a greater strategic aim – the marketing of a compromise deal to highly sceptical northern European countries. Were Greece to be expelled, and our television screens filled with Greek humanitarian causes, the likelihood of any Euro nation passing additional powers to an increasingly European feckless elite has become essentially zero.

This modern Greek tragedy may have spelled the end of the European project. It is probably just a matter of time before it unwinds. It has blown apart any vestiges of cohesion and foresight and planning on the part Brussels.

The entirely predictable Greek debt bomb was created many years ago. Bureaucrats knew Greece was cooking the books, utilising Wall Street banks to concoct complex debt instruments to manufacture fiscal and structural targets. Throughout that time they did nothing. It is sad, as the European project was a very noble effort and it united Europe’s tribes like nothing ever has.

In other news, the UK’s Financial Services Compensation Scheme (FSCS) has directed banks that the new deposit guarantee level will fall from £85,000 to £75,000. They effected this new level on the on the same day they announced it! They also instructed the banks to have staff trained up on the new level on that same day. Needless to say banks are furious.

The very odd reason given is the British Pounds exchange rate change over the last 5 years. The equivalent European target level for bank deposit insurance of Euro €100,000 used to be £85,000, now only buys you £75,000. The timing of the announcement is either a stroke of genius, (waiting for bad news (Greece) in order to deliver your own bad news), or a case of staggering stupidity; undermine the confidence in your own banking system just as a European neighbours system is in the process of collapse.

The fact that they changed it so quickly without anyone being aware that it was happening is more than concerning. Suppose a crisis envelopes Britain’s banks, will the FSCS arbitrarily drop the rate again, to say £50,000. The mere risk of this utterly undermines the effectiveness of the guarantee and renders it pretty much useless.

If they were smart they would have sought to increase the guarantee to the largest in Europe and attracted monies to Britain’s bank. If you have excess money sitting in a bank in amounts greater than £50,000 you should seek to move it to safer banks in safer jurisdictions and invest a modest sum in gold for safe keeping a safe jurisdiction.

Must Read Guide: 7 Key Gold Must Haves for Storing Gold Bullion

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,164.25, EUR 1,053.43 and GBP 748.43 per ounce.

Friday’s AM LBMA Gold Price was USD 1,168.25, EUR 1,051.10 and GBP 747.44 per ounce.

Friday’s PM LBMA Gold Price was USD 1,167.95, EUR 1,052.21 and GBP 748.21 per ounce.

The U.S. Market’s were closed on Friday for a national holiday.

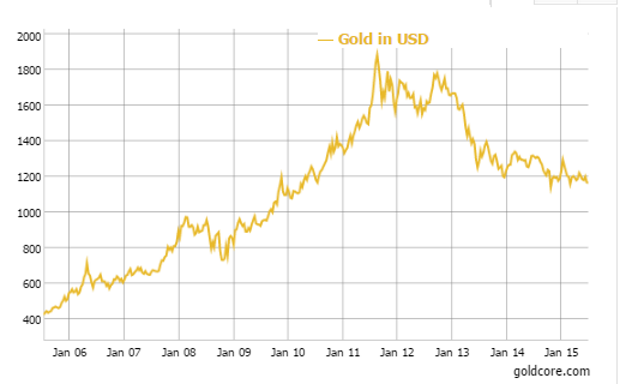

Gold in U.S. Dollars – 10 Year

Gold in Singapore for immediate delivery was flat at $1,167.50 an ounce near the end of the day. The yellow metal rallied to hit a one-week high of $1,174.70 during Asian trading hours, but failed to hold onto gains, as the dollar rose against the euro.

Gold dipped on Monday against the dollar strength as Greek voters rejected the bail-out package, likely sending Greece out of the euro.

Greek prime minister Alexis Tsipras said during a TV address on Sunday that the country would go back to the negotiating table “as of tomorrow” and that his party’s primary priority was to reinstate the financial stability of the country.”

In late morning European trading gold is down in U.S. dollars 0.27 percent at $1,165.09 an ounce. Silver is off 0.64 percent at $15.58 an ounce and platinum is also down 1.85 percent at $1,060.00 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.