Stock Market Where are we? And where are we Going?

Stock-Markets / Stock Markets 2015 Jul 03, 2015 - 12:30 PM GMT Announcement: We are running a promotion for 3 days; all packages are reduced 50% for your first month. So if you have ever wanted to try our services out, now is the time to take advantage of a reduced price. The offer ends Sunday July 5th at midnight. Please use this discount code 959815683A to take advantage of the promotion.

Announcement: We are running a promotion for 3 days; all packages are reduced 50% for your first month. So if you have ever wanted to try our services out, now is the time to take advantage of a reduced price. The offer ends Sunday July 5th at midnight. Please use this discount code 959815683A to take advantage of the promotion.

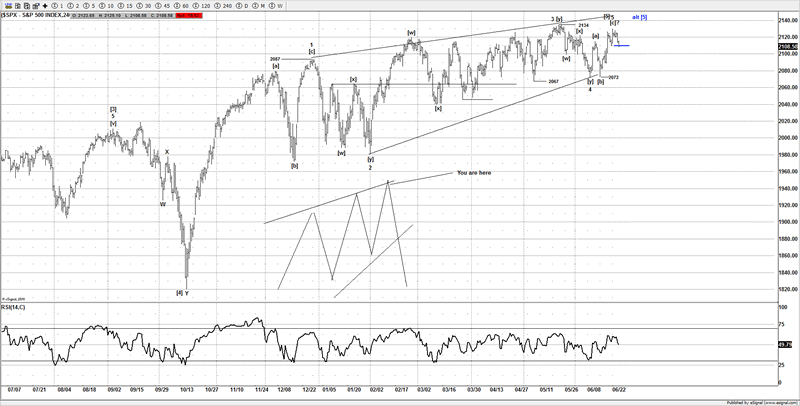

SPX

These are the questions we all want answering. The gap down last week from the Greece announcement that there would be announcement, potentially it could suggest a possible truanted high in place at 2130. Although we have yet to see a 5 wave decline from 2130SPX, so depending on the outcome to the Greece, may or may not push the markets much lower, although I would favor a large gap down should the vote favor leaving the Euro, similar to last weekend.

Where are we?

We went into last week with the idea of a possible high in place as a truncated 5th wave at 2130SPX. Although the surprise announcement after the US markets had closed I think caught many by surprise, hence the large gaps down in many risk markets.

SPX Chart 1

Although the close on Friday left it with the option of seeing a new all time high, should the market decide it's not completed; truncations are very rare, so I was a little concerned that we may be a bit early. But with the gap down on Monday it suggested that we may well have a truncated 5th wave at 2130SPX, the COMPQ and the RUT had made new all time highs as well, so there was every reason to think we need to be looking at a truncated peak.

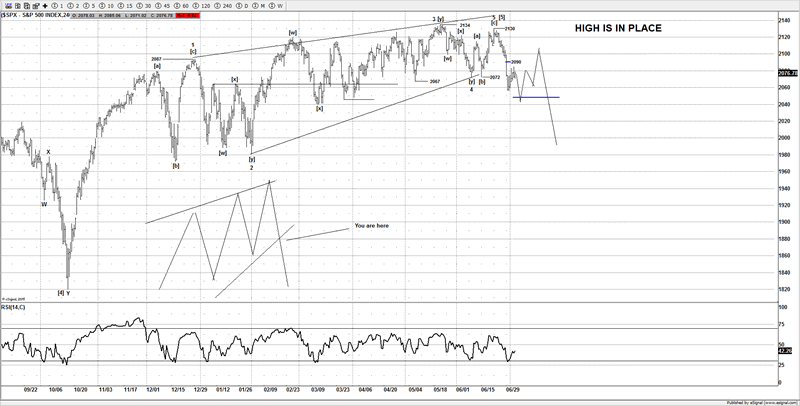

SPX Chart 2

Looking at the internals from 2130SPX it could do with a minor new low to suggest a 5 wave move from 2130 and potentially the first wave of a larger pattern that will see the 1800 area over the coming months.

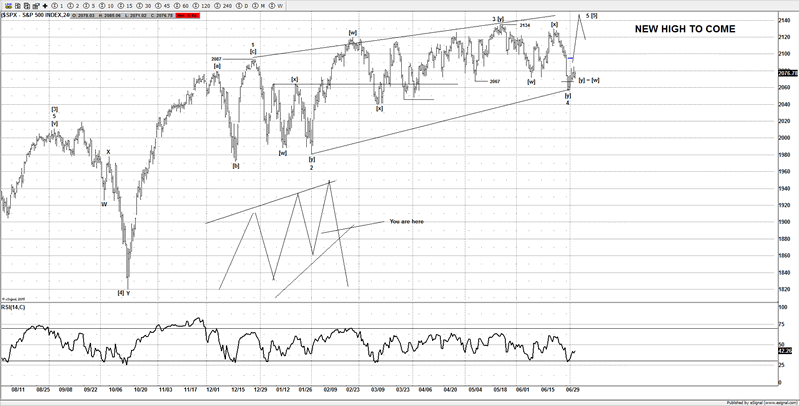

SPX Chart 3

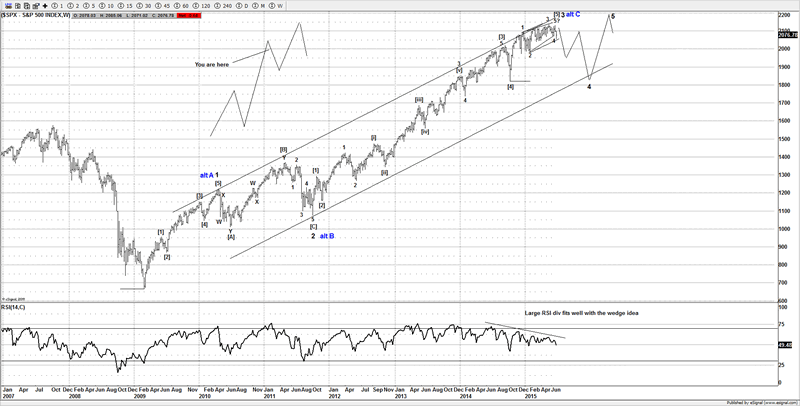

SPX Chart 4

The pattern that appears to be tracing out is what Elliotticians call an ending diagonal, this is a terminal pattern that is usually seen in a 5th wave position of an impulse wave, so we are counting this as the end the trend that started from the Oct 2011 lows. So once wave 3 or wave C is finished, we should at least expect to see 1800, that being the point of origin to the suspected ending diagonal and a natural wave 4 target.

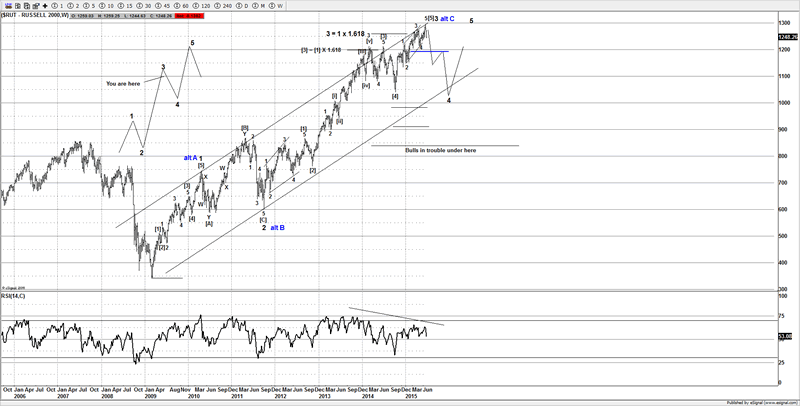

RUT (Russell 2000)

Russell 2000 Chart

When you look around at some of the other US stock markets I see a similar picture and that a potential ending pattern could well have ended. The RUT needed a minor new high to complete a possible ending diagonal, we got that new high and it's subsequently reversed, although at this stage it's a tentative idea but I think it has strong grounds to suggest wave 3 or wave C is now complete and we can see a larger decline towards 1000.

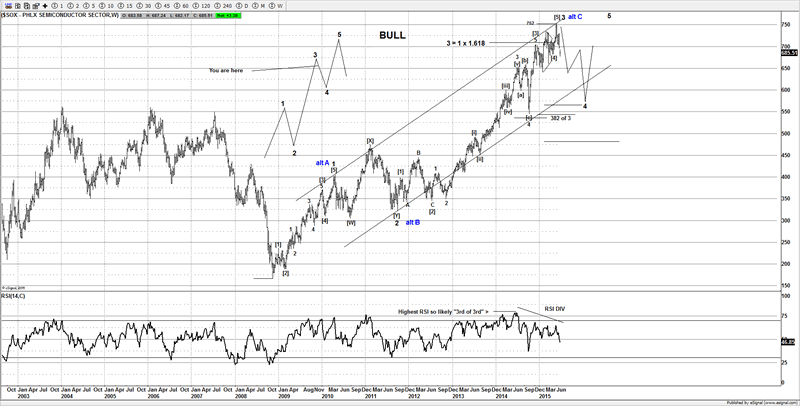

SOX

SOX Chart

This is another market that I have written about, but the strong downside again is supportive of a potential peak in place for wave 3 or wave C, so I would expect to see a large move lower to target the 550 area for wave 4.

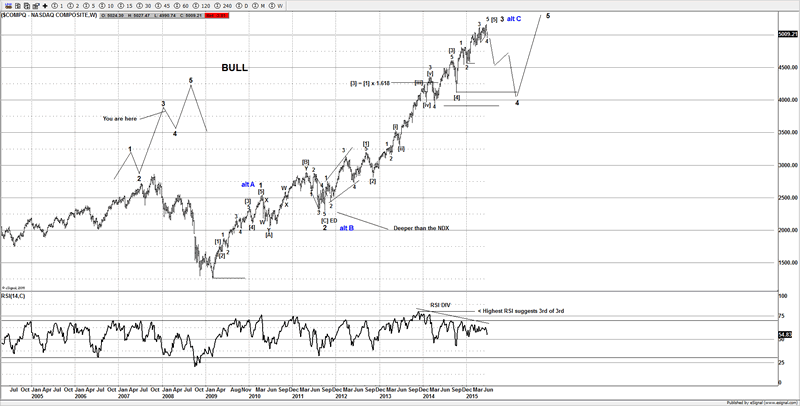

COMPQ

NASDAQ Chart

I recently posted an article suggesting that there was enough gyrations in place to suggest some caution, with the strong decline this past week it again is supportive of a possible peak now in place for wave 3 of wave C, although like the NDX it ideally could do with a bit more downsize to possibly complete a 5 wave decline from the new all time highs, that would further help the bearish case.

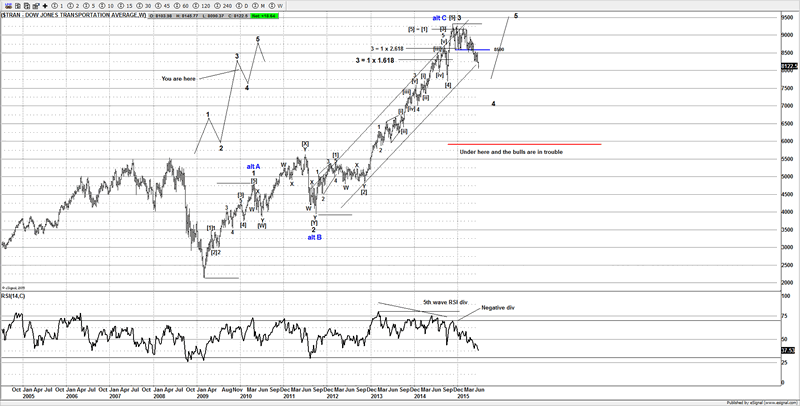

TRANSPORTS

Transports Chart

The Dow Transports appear to have already decided that a high was in place for wave 3 or wave C and well ahead of some of the other markets. Staying below 8590 keeps us looking lower as the trend is clearly down. I am targeting the 7000 area for wave 4. If a peak is in place for some of the markets above then we should see the other markets play catch up soon.

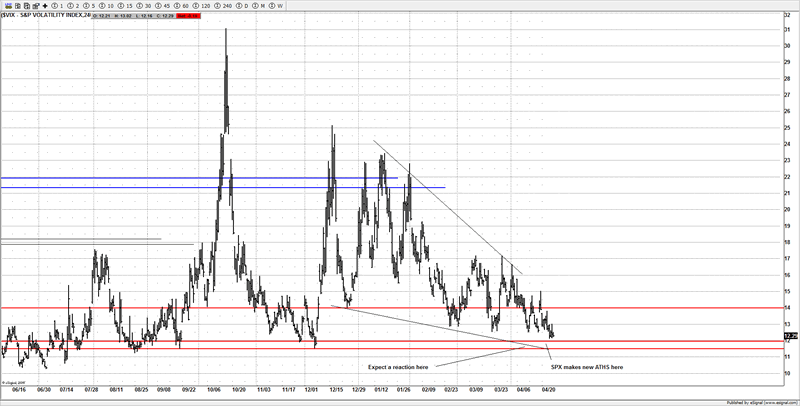

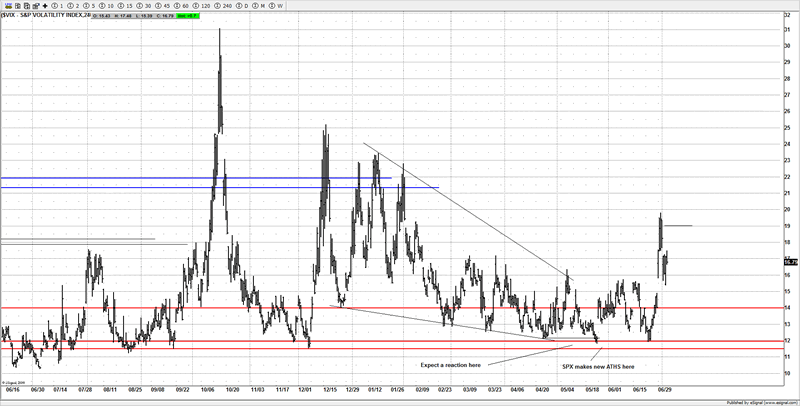

VIX

Once of the reason that could be suggesting a possible peak on the US markets is the idea that the VIX could have put in a low, I have showed this chart a few times in articles, but the strong break out is exactly what we were expecting. So again supportive of a possible peak on the US markets.

Before

VIX Before Chart

After

VIX After Chart

The 12 area is like a granite floor, should the VIX break 12. I would think is an issue for the bears on stocks.

Conclusion

Whilst some of the other lesser known markets could have started the much awaited correction/pullback. There is still a possibility that we see new all time highs in markets such as the SPX and DOW (not shown), although we will have to adjust the short term ideas based on the reaction next week. Overall I still do feel there is a large amount of risk for those still insisting to buy the dip, I have been pretty much bullish for most of the year from Jan 2015, but it's now that I have turned my attentions to looking for a large decline now as I think the reward now warrants the effort.

Finally I want to wish all my American members and readers a happy 4th Jul.

Until next time,

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2015 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

WavePatternTraders Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.