Three Total Wealth Stock Investor Tactics You’ll Need Because Greece Isn’t Over

Stock-Markets / Stock Markets 2015 Jul 02, 2015 - 03:17 PM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes: Greece actually missed its payment last night, exactly as we thought it would. And in doing so, it became the first Eurozone country to ever default on its debt. Some say that the country is in “arrears,” but that’s splitting hairs.

Keith Fitz-Gerald writes: Greece actually missed its payment last night, exactly as we thought it would. And in doing so, it became the first Eurozone country to ever default on its debt. Some say that the country is in “arrears,” but that’s splitting hairs.

At this point, “everybody” wants quick resolution.

Things are so bad that nearly 14,000 people have contributed to a crowdfunding page started by a 29 year old Londoner, Thom Feeney, on Indiegogo.com. As of yesterday, donations totaled $245,000.

There’s a joke making the rounds on trading floors that Apple is going to buy Greece using some of the $230 billion in cash it’s got socked away… and that the Cupertino giant will have change left over.

If you’re so inclined, you can make a €3 donation and get a postcard from none other than Greek Prime Minister Alexis Tsipris himself. So far 2,652 people have done so, according to CNBC.

One person even proposed giving away a private Greek island if a wealthy benefactor wanted to pony up the entire €1.6 billion… but subsequently had to withdraw the offer because the Greek government didn’t sanction the deal.

All joshing aside, though, the Greek Crisis isn’t over. Not by a long shot.

And that means you need these three Total Wealth Tactics to ensure your money doesn’t get “Greece-wacked.”

Here’s what you need to know to keep your money safe.

Would Markets Panic if Dunkin’ Donuts Went Out of Business?

There’s no question that headlines are scary. With every new bit of posturing, there’s a corresponding gasp from the global trading community that sends major indices reeling.

Now that Greece actually missed its payment, things are going to get rougher. Pension rationing has started, capital controls are beginning, and the banking system is running out of cash. Greek bank deposits have tanked by €44 billion since November. Defiance is turning to desperation.

These are the kinds of things that happen when you run out of money. Contrary to what people believe and Alexis Tsipras is discovering, the Greek situation has nothing to do with politics and everything to do with basic math. If you spend more than you take in, eventually the math catches up with you.

Closer to home it’s hard to watch because fears are that it will happen here. That may ultimately be true.

Still, it’s worth noting that this isn’t the first capital crisis, nor will it be the last. We’ve lived through worse.

Here’s just a short list dating back 26 years that includes events that many people have forgotten about in the heat of the moment:

- 1989 – the U.S. Savings and Loan Crisis

- 1990 – the Japanese asset bubble collapsed

- 1991 – the Scandinavian banking crisis

- 1992 – speculative currency attacks on the European Exchange Rate mechanism that predates the euro

- 1997 – the Asian banking crisis and devaluations

- 1998 – the Russian financial crisis

- 2001 – the Turkish economic crisis

- 2001 – the Dot.bomb crisis

- 2002 – the Argentinian debt crisis

- 2008-2009 – the Global Financial Crisis

- 2014 – the Russian financial crisis

As bad as Greece seems, you owe it to yourself to put this crisis in perspective.

Global investors hold roughly $300 billion in Greek debt. For an economy like Greece’s, that’s comparable to the entire state debt of Illinois being held by a state with a GDP the size of Connecticut.

According to Bloomberg, U.S. equity investments in Greece totaled around $5.7 billion as of June 21. That amount is roughly equivalent to the entire market cap of Dunkin’ Brands Group Inc., of Dunkin’ Donuts fame.

My point is that Greece isn’t too big to fail.

The country has been functionally bankrupt for years – and the global community knows it. Investments and EU policy have been planned accordingly.

It’s not like this is a surprise to anybody. The country has long been a bug in search of a windshield, to speak very bluntly about the situation.

If anything, I’m surprised that things haven’t disintegrated sooner.

I’m reminded of the ignored warnings of the late economist Milton Friedman. Most famous for being a pioneer of free-market principles, he also made important contributions to monetary policy – perhaps no more so than in 1997, when he predicted the euro would be a disaster.

Watching it in formation, I agreed at the time and still agree today. The euro is political fantasy absent a single central bank.

The relationship between Greece and Europe seems a lot like a polyamorous marriage in which all parties agree to the idea of a union but remain able to take on as much debt as they want, completely ignoring the “pre-nup.”

Nothing will change unless European leaders – all of them – acknowledge the fundamental weaknesses that come from the complete absence of a central authority capable of stopping profligate spending.

Given that “they” don’t want to do that anytime soon, Greece will be back like a bad soap opera, and so will the market volatility that goes with each new episode.

Government Dysfunction Can Be Great for Gimlet-Eyed Investors

It’s easy to believe that this kind of government madness is bad for your money and even worse for your psyche. In reality, though, government indecision, posturing, and rhetoric can be great for your money.

Take Obamacare, for example.

Doomsayers were out in force claiming that the health care act would destroy the $3 trillion U.S. healthcare industry.

What’s actually happened, though, is that the formerly staid and boring industry is now acting more like the growth stocks of yore. The S&P 500 Health Care Index is up more than 160% over the past five years, far outstripping the 102% gains the S&P 500 posted in the same time frame.

I recommended Becton, Dickinson and Co. (NYSE:BDX) as a way to play this because it’s backed by the Unstoppable Trend we call Demographics. The stock has returned 100.43% since I recommended it to Money Map Report subscribers who followed along, versus the S&P 500’s 54% over the same time frame.

Or, how about the defense industry?

It was left for dead back in August 2011 when Washington had to put emergency sequestration measures in place to compensate for its own “Greek-style” budget battle.

I recommended Raytheon Co. (NYSE:RTN) as a means of getting around this knowing that it was backed by another of our Unstoppable Trends – War, Terrorism & Ugliness. Readers who followed along as directed have enjoyed total returns of 126% since, versus only 84% in the S&P 500 over the same time frame.

My point is that every crisis produces its own set of opportunities, especially when they’re backed by the Unstoppable Trends.

Greece is no different in that sense if you have the right approach, understand the Unstoppable Trends, and keep the correct tactics top drawer.

Three Total Wealth Tactics to Preserve and Protect Your Profits As the Greek Saga Evolves

As you and I have discussed so many times… from chaos comes opportunity.

Here are three ways to make the most of it and potentially laugh all the way to the bank, too. Just make sure it’s not a Greek bank… at least for now, anyway.

Total Wealth Grexit Tactic No. 1: Look for Openings in Must-Have Companies

Every new bit of posturing and counter posturing is going to produce market angst accompanied by panicked selling by the weak money.

That means some great companies are going to be on “sale” as part of a short-term move that has nothing to do with longer-term potential and upside.

So get your buy list ready.

The best companies will be those like Becton, Dickinson and Co., Apple Inc. (NasdaqGS:AAPL), and Raytheon Co. (NYSE:RTN) – all of which are tapped into Unstoppable Trends and trillions of dollars in spending down the line.

Total Wealth Grexit Tactic No. 2: Don’t Tighten Trailing Stops

I know this is counter intuitive, but the last thing you want to do is tighten trailing stops on a day when the markets are already pitching a fit. That’s because professional traders will “run the stops,” meaning they will hunt down the weak money players and force you out of the game very deliberately.

That way they can turn stocks on a dime while being perfectly positioned for an upside run. They know that you’ll chase ’em, which only adds to their returns.

To be clear, I am not saying that you abandon your stops. Just don’t tighten them based on emotion or some sort of knee-jerk reaction when volatility rises.

Total Wealth Tactic No. 3: Remember that a Correction Is No Excuse to Time the Markets

Millions of investors try to time the markets when things get tough and, in the process, doom themselves to poor returns.

How poor?

Try this on for size: DALBAR research suggests that 81% of Buy/Sell decisions based on market timing are wrong. That means, to be perfectly blunt, you’d have better luck flipping a coin.

Instead, capitalize on big down days and market chaos by using the opportunity to dollar cost average into positions you want.

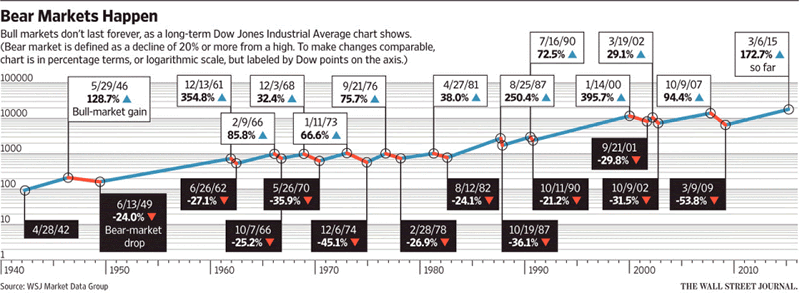

If you’re not familiar with the term, what I mean is that you’re going to set aside a fixed amount of capital every month and invest it at regularly timed intervals regardless of market conditions. Doing so not only helps you avoid things like Greece, but also harness the overwhelming upward bias that markets have shown for more than a century:

Get these right, and Greece chaos will seem like nothing more than a minor speed bump.

Until next time,

Keith Fitz-Gerald

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.