The Greek Stress Test & The Reality Of Incremental Changes

Politics / Eurozone Debt Crisis Jul 02, 2015 - 01:09 PM GMTBy: Dan_Amerman

With the Greek banks closing, capital controls being imposed, and the unwillingness of the European Central Bank to expand its emergency liquidity assistance program - the stability of the global financial system is officially in play. Nothing is set in stone yet, but a looming Greek default and potential economic catastrophe in Greece is setting elements into motion on a global basis that have the ability to impact many things.

With the Greek banks closing, capital controls being imposed, and the unwillingness of the European Central Bank to expand its emergency liquidity assistance program - the stability of the global financial system is officially in play. Nothing is set in stone yet, but a looming Greek default and potential economic catastrophe in Greece is setting elements into motion on a global basis that have the ability to impact many things.

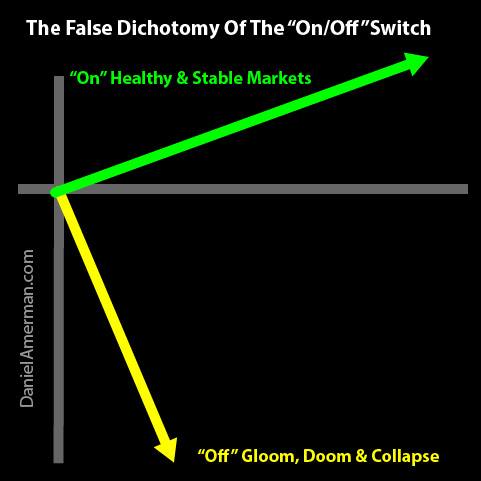

Unfortunately, some of the potentially most important changes will be invisible to the general public, because of the way information is usually presented by the media -which could be likened to an "on/off" switch. That is, either the Greek crisis triggers a collapse of the global financial system, meaning the light switch turns off (which is possible), or order is preserved and the light switch stays on (which is much more likely).

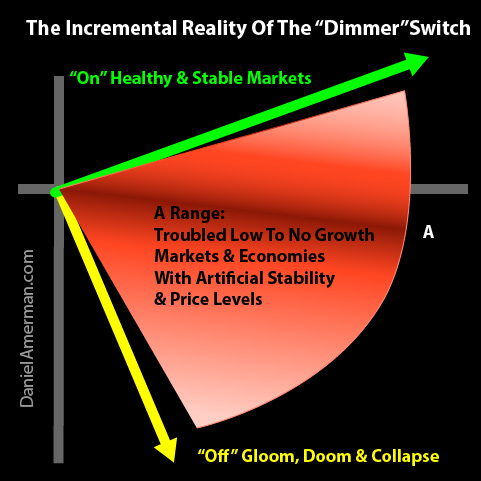

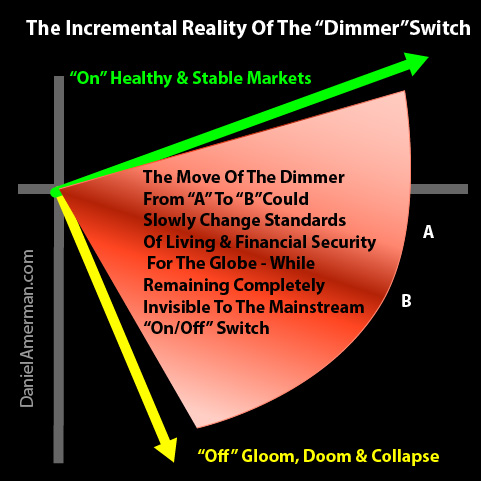

Let me suggest however that when it comes to maintaining our own financial security, a far better framework for making decisions is to reject the overly-simplified on/off switch and to recognize that what we're really looking at here is a "dimmer switch". Where reality isn't the light simply being either "on" or "off", but rather moving around somewhere in the middle. And it's subject to incremental changes as the dimmer slides up or down, with the light levels fluctuating by potentially even small amounts.

Now the most dangerous consequence of accepting the false paradigm of an on/off switch is to wrongly conclude that if the switch doesn't get turned off - if financial catastrophe is avoided with the current crisis in Greece as the current example - then our lives will not be affected on a global basis.

Because the reality is that any movement of the dimmer switch - even with no financial catastrophe - is still enough to potentially change each of our lives for decades to come.

Just a little downward movement on the dimmer switch can decrease the chances of our achieving the future standard of living that we hope for - or even just basic financial security in the years ahead.

The chances that we maintain a job, or that our collective children and grandchildren have not only jobs but the kind of careers they hope for, may move incrementally downwards.

The chances of a future financial crisis where the switch does go all the way down to "off" may increase in terms of probability and move forward in time.

So the price of successfully containing the current crisis may be that while the light switch remains on - the light level moves down at least slightly and perhaps even significantly. And if we are to have effective personal defenses against potentially diminishing light levels, then we have to clearly see and understand this distinction.

The Dimmer Switch In Action

What is an example of a dimmer switch in action? For many people, all we have to do is look around at the world today as well as at most of the last decade.

The light switch nearly clicked "off" in 2008 - but it didn't. So, if we if view this from an "on/off" perspective, then it was victory! The light remained on.

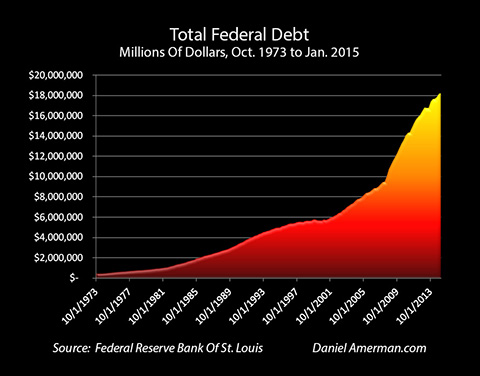

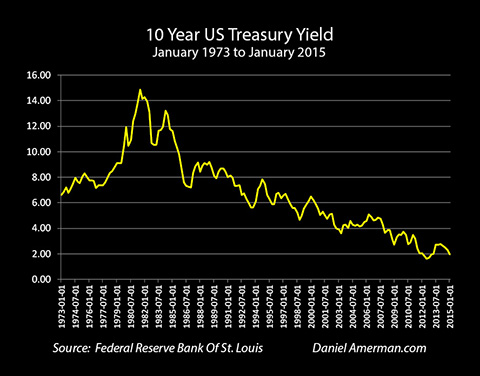

But while the light did stay on, the level of light dimmed greatly. It was after all very expensive to save the economy from total collapse, and the national debt exploded in the United States and other nations.

Through the creation of massive sums of money which were used to force interest rates to record lows, markets were put on life support - and stability maintained.

At the same time, however, retirement accounts were devastated, and standards of living in retirement have plummeted for those who rely upon interest payments to pay for their lifestyle. Even as unemployment rates soared (as measured by workforce participation rates) and remain at near historic highs even today. Even as the middle class shrank in size, and median incomes fell in inflation-adjusted terms.

So while the light has remained "on" throughout, the price of containment has been a pulling down on the dimmer switch to the extent that it's transformed markets, jobs, income and standards of living for many millions of people around the globe.

Yet, the common narrative is to disassociate the light switch from the level of light. We are increasingly told that essentially, happy days are almost here again. The central bankers are the heroes who saved us all. The markets are roaring and wealth is being created at a fantastic rate (asset bubble issues aside). Never mind the national debt, or the legions of the long-term unemployed, and don't worry that interest rates that have been deliberately and openly forced below the rate of inflation - you can invest with confidence.

And for those who question that narrative? As explored here, the simplified dichotomy of the "on/off" switch means there is only one place for them to go, and that is the gloom and doom camp of eternal pessimists. A marginalized and delusional group who has been continuously proven wrong - because the light never did turn off.

Or so the narrative is commonly presented, as people are effectively given the choice between the easy path of fitting in with the comfortable mainstream, like supposedly everyone around them, or the lonely path of the somewhat disreputable fringes thereof.

There is good reason for why false dichotomies are used in what could be called "perception management", which is that in practice - they can be highly, highly effective. Again, all we have to do is look around us to see this.

Greece & The On/Off Switch

We do have an artificial and therefore inherently unstable financial system right now, as recently explored in this article. The atmospheric energy is there, and Greece appears to be heading down a path that is quite capable of setting a major crisis off. But will such a larger crisis actually develop?

The immediate questions are contagion and liquidity. In the coming days and weeks, does the time come when investors in a given market - which could include the bond or stock markets in the United States - decide to head for the exits in sufficient numbers that a liquidity crunch develops?

And if it does - will the current defenses be sufficient to handle a developing stampede for the exits? In seeking an answer, let's quickly consider some of those defenses.

A return to or increase in quantitative easing is the likely first level, with ever more money being created for the purpose of market stabilization.

If liquidity issues develop, then the central banks may create the money to loan to banks and other financial institutions so that they don't have to sell their securities, much as what happened in 2008.

The Europeans may resort to their Outright Monetary Transaction program, which would effectively make them the market when it comes to European government bonds.

As recently suggested by the IMF and explored here, central banks around the world could even become market makers on a global scale, creating however much money is needed to buy every stock and bond for sale.

So if we return to our latest global stress test in process - which may or may not become a full-fledged crisis or global instability event, then if we view it from the false dichotomy of the on/off switch, the most likely result (although far from guaranteed) is that the light remains resolutely on.

As negative events unfold, if they do unfold, the central banks of the world will use unconventional monetary policies to contain the damage.

And the way it is likely to be ultimately presented is that the crisis is over, the system held, let's all move along - there is nothing to see here.

Greece & The Dimmer Switch

On the other hand, when we allow for the dimmer switch of incremental adjustments that often impact reality - understanding that total state changes are rare but incremental changes occur all the time - then we see a completely different picture.

The very act of increasing the degree of central banking interventions in a number of different ways impacts reality. It does indeed affect investment returns. It makes it more likely that fixed income investors will receive lower investment returns for years to come and even decades to come, as one of a number of incremental factors over that time period.

Part II

Part II of this article discusses how the movement from Point A to Point B on the graphic can change every aspect of investments, the economy, and the redistribution of wealth - even while remaining completely invisible within the false dichotomy of the mainstream "on/off" switch.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2015 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.