Stock Market Increased Risk Levels ...

Stock-Markets / Stock Markets 2015 Jul 02, 2015 - 12:56 PM GMTBy: Marty_Chenard

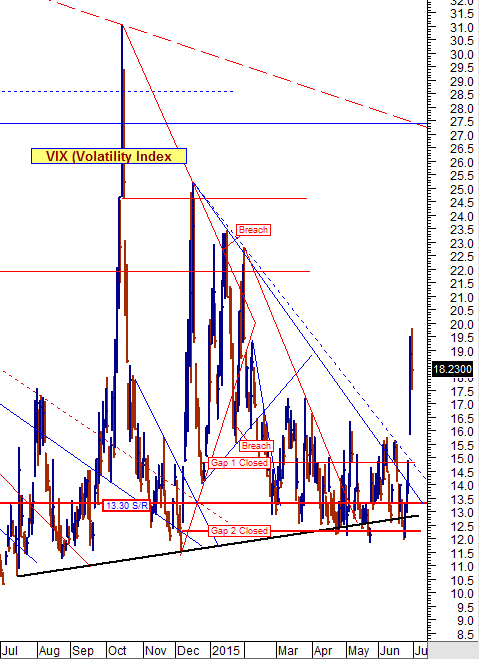

The VIX (see the chart below) is showing increasing stress levels.

Note that the VIX has risen above the blue dotted resistance line level. Since the VIX moves opposite to the stock market, this was a bad event on Monday.

However, the big risk for the VIX would be if it went above the (higher) red dotted resistance line. That level is a resistance line that goes back 3 and 1/2 years and would bring a lot of carnage should the VIX move above that level.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.