SPX Stock Market Retracement May be Over

Stock-Markets / Stock Markets 2015 Jul 01, 2015 - 05:40 PM GMT The SPX retracement was stopped at its Ending Diagonal trendline at 2082.00, having briefly challenged it at 2082.78. It is now beneath the neckline of the Head & shoulders formation at 2075.00. Head & shoulders patterns allow throwbacks for a brief period, as long as the index does not close above them. This one apparently qualifies.

The SPX retracement was stopped at its Ending Diagonal trendline at 2082.00, having briefly challenged it at 2082.78. It is now beneath the neckline of the Head & shoulders formation at 2075.00. Head & shoulders patterns allow throwbacks for a brief period, as long as the index does not close above them. This one apparently qualifies.

What may have caused the reversal? ZeroHedge reports, “Contrary to suggestions that Greek PM Alexis Tsipras was set to cancel this weekend's euro referendum as part of a negotiated deal with creditors, at least one report claims Syriza isn't set to back down and will go ahead with the popular vote.”

VIX thankfully reversed above the Head & Shoulders neckline. It is now possible to call this a Minute Wave [ii]. Wave [iii] appears to be on its way.

The Hi-Lo index briefly went positive, but remained on its sell signal nonetheless.

The TNX retracement stalled at 24.44 and appears to have reversed course. This is also consistent with the expectation for much lower yields in the TNX.

Crude futures dropped this morning to 57.74, confirming that WTIC may be being sucked into the deflationary vortex of lower prices. The Cycles Model suggests the decline may resume through late July before the next appreciable bounce.

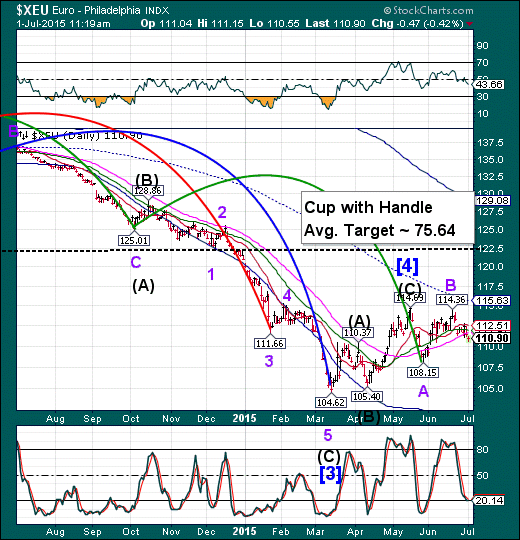

Finally, the Euro has fallen beneath all of its Model Supports on its way to parity and then some.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.