How Does Greece Influence Bitcoin?

Currencies / Bitcoin Jun 30, 2015 - 05:55 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Yesterday, we wrote how Bitcoin doesn’t necessarily have to be linked to the Greek situation. Yes, the recent turmoil has coincided with capital controls in Greece but this might not be a stable situation contrary to what one might think only looking at the price action. Today, on the Fortune website we read:

There are a few ways to tell whether the rising interest in bitcoin is coming from Greece. One is to look at the volume of bitcoin transactions in different currencies. Are more bitcoins suddenly being bought in euros? The web site Bitcoin Charts says no: over the last 30 days, purchases in euros make up 6% of bitcoin transaction volume, consistent with what it has been for months. (Similarly, 6% of the $2.1 million in bitcoin held by the storage platform Bitreserve is in euros.) A more anecdotal method would be to check Google Trends. Have more people been searching about bitcoin in Greece than before? Google says no: Greece has a search volume index of 36 for “bitcoin,” which does not land it in even the top 15 regions, and no searches from or relating to Greece are rising or trending. Then there’s the question of volatility: is the price surging unevenly enough to create sudden volatility? According to a tracker Dourado created, no: bitcoin’s volatility has in fact gone down steadily since January.

“I think we are seeing a boomlet in global demand as a hedge against any kind of uncertainty, not just [the uncertainty] in Greece,” said Dourado. “I think the value of the concept is being affirmed. I would also note that it doesn’t take a huge increase in interest to move the bitcoin price, so I would be careful about overselling the increase in price over the last couple weeks—it’s still a pretty modest increase.”

So, the increase in Greek demand is not something that can be used to comprehensively explain any possible more significant rally. It is also less than clear that the current rally is “caused” by the Greek demand the Greek trouble. If anything, we would suspect that psychological effects here are possibly more important than the actual demand coming from Greece. It might be that Bitcoin is now perceived as an alternative to currencies. It might also be that the constant talk of how Bitcoin might help Greece has actually contributed to this perception. The cause-effect relationship here is not at all clear.

The recent situation in which Bitcoin has gone up might also present an opportunity. Namely, if the Greek situation is resolved in the eleventh hour, as we expect it to be, any possible short term sentiment propping up Bitcoin currently might dissolve and Bitcoin might be open to more declines.

For now, let’s focus on the charts.

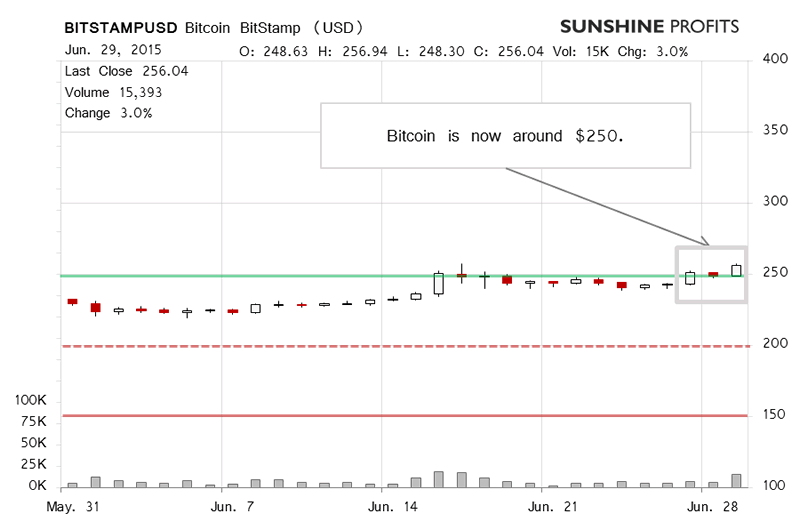

On BitStamp, we saw a day of appreciation yesterday. This appreciation was on increased and relatively significant volume. The main question remains: “Was it due to Greece?” There’s no good answer to that. One way or another, Bitcoin closed above $250 (green line in the chart), a clear bullish sign. Today, the action has been very similar to what we saw yesterday (this is written around 9:30 a.m. ET), again a bullish sign. But the situation might be less bullish than it looks at the first sight. Yesterday, we wrote:

The next week and particularly the next Sunday and Monday after the Greek referendum might shed more light on the coincidence of the Bitcoin rally and the Greek crisis. In our opinion, however, even if there is a link between Greece and Bitcoin, it might be a lot weaker than one could suspect. Also, politicians are known for their brinkmanship. We expect some sort of a new-old deal being struck after the next weekend.

This is still the case. If a deal is actually reached any time in the near future, we might see the sentiment for Bitcoin turn around.

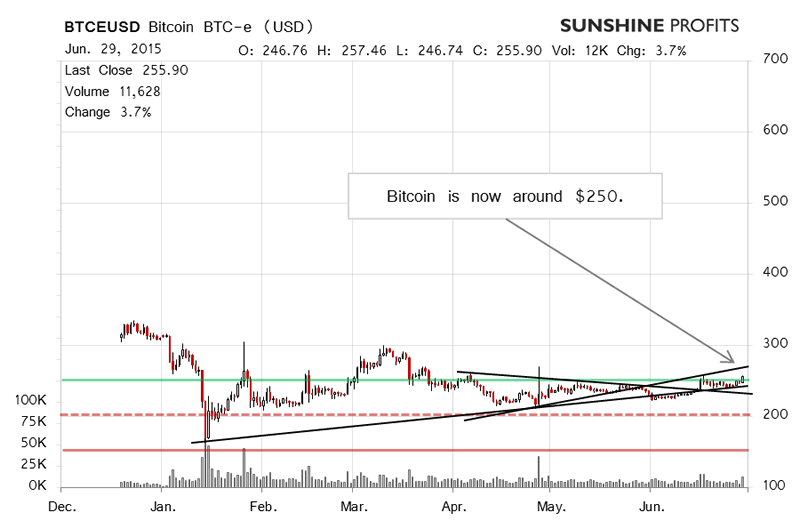

On the long-term BTC-e chart, we see that Bitcoin finally reached the $250 level (green line in the chart) again yesterday and came relatively close to the possible rising trend line. Yesterday, we wrote about the move above $250:

We saw a move which could be construed as a confirmation but it might be associated with the uncertainty about Greece. Since our take is that the perception of uncertainty might become more favorable within the next two weeks, and since Bitcoin hasn’t really shot up just yet, it seems that the recent action to the upside might not be as bullish as currently believed. Consequently, we still prefer to wait on the sidelines for more confirmations coming in.

The long-term chart is now definitely more bullish than before but one also has to consider that Bitcoin is hitting overbought territory. The currency might still go up, but given the possibility that the current uncertainty about Greece influences the price, it would seem that once a deal is agreed, Bitcoin could return to its trend, which is to the downside.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.