Stock Investors Express Route to Profits in the Healthcare Sector

Stock-Markets / Stock Markets 2015 Jun 30, 2015 - 01:39 PM GMTBy: ...

MoneyMorning.com  Tom Gentile writes: A lot of Baby Boomers are now running smack dab into their retirement.

Tom Gentile writes: A lot of Baby Boomers are now running smack dab into their retirement.

An aging population coupled with the rising cost of healthcare and prescription drugs is a potent brew for profiting in the healthcare sector.

And it's no wonder that this company is in the spotlight with long-term analysts.

Let's find out how to take the "Profit Express" right now…

A Healthcare Sector Giant You Need to Know

Perhaps you have never heard of Express Scripts Holding Co. (Nasdaq: ESRX), but you need to. ESRX is a pharmacy management company in the United States and Canada with over $102.4 billion in revenue. It's a huge player in the healthcare sector and is always in the spotlight with long-term analysts.

But is it ripe for a shorter-term technical trade?

I certainly think so. I love ESRX stock for two reasons.

Let's take them one at a time and use our charts to guide the way.

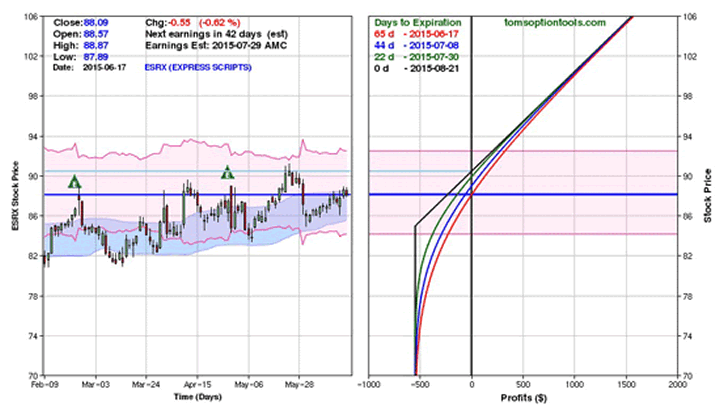

In the chart below, ESRX continues to show the higher-low, higher-high approach to its rising price. The first quarter of 2015 shows stock price lows at $82, and highs at $89.50. Meanwhile, second-quarter lows came in at $83.75, and highs pushed $91.

Recently, ESRX pulled back to $85 before once again heading north to a recent stock price of $88. Just some quick calculations show the stock's lows getting higher by $1.75, while the most recent highs were $1.50. The next swing high should take the stock to $92.50, based on this analysis.

The second thing I love about this stock is that moving averages are moving in the right direction, as you can see in my next chart below.

Now it's one thing to have a moving average below the price of a rising stock like ESRX, but it's something else to have two moving averages help dictate buy and sell points on a stock.

Moving average crossovers do precisely that. They give traders an opportunity to buy rising stocks on pullbacks.

I love the 10- and 30-day moving averages on stocks that have the higher lows and higher highs on their charts. What I concentrate on is when these moving averages cross over each other.

When the 10-day moving average crosses above the 30-day moving average, this is a very bullish signal, especially to a stock like ESRX, which is trending higher. On the contrary, when the 10-day moving average crosses below the 30-day moving average, this would constitute a sell.

As you can see from the chart above, ESRX is now telling us that it's time to go higher…

Here's Our Next Move

As a seasoned trader, I always ask myself this question: What if I am wrong?

As an options trader, I can set myself up so that if that question becomes a statement, I have assumed the least amount of risk.

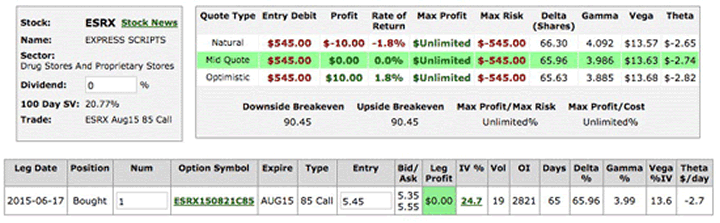

Based on the signals above, here is an example of trading ESRX with much lower cost and risk.

The case study above involves buying the ESRX August 85 call. This means that we have the right to purchase ESRX at $85 per share between now and Aug. 21, 2015. Recent prices show the calls trading at $5.45, or $545 per contract. This is much less than the $8,500 it would take to buy 100 shares of ESRX stock.

And what about risk?

The risk chart below shows that the worst case for the stock is that it takes the express route south. The $5.45 options could go to $0.00, giving the trader a $545 per contract loss on the position.

The good news is that your downside is limited, no matter how much ESRX should drop.

However, if ESRX were to move to $92 a share, what would the $85 calls be worth?

It's anyone's guess, but the minimum value of these options is simple to figure out.

Take the stock price and subtract the strike price to get the real value of the option.

In this case, $92 – $85 = $7. Buying the calls for $5.45 and selling them for $7.00 would hand the trader a profit of $1.55, or a 30% return on the option.

Looking for a 30% return?

Perhaps taking the Express Route will do it!

Keep Your Eyes Peeled:There are now rising indications that the Greek government and its creditors are going to avert a full-blown financial meltdown… And this means there are some positive developments coming for the energy sector. Here's what needs to happen in Greece… and how we'll profit…

Source :http://moneymorning.com/2015/06/29/taking-the-express-route-to-profits-in-the-healthcare-sector/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.