Grexit?, BIS Warning, Chinese Market Crash & Systemic Risk Shake the Global Economy

Stock-Markets / Eurozone Debt Crisis Jun 29, 2015 - 05:25 PM GMTBy: GoldCore

- Persistent low rates leave central banks with no ammunition to fight next crisis

- Persistent low rates leave central banks with no ammunition to fight next crisis

- BIS says short-sighted central banks and governments contributed to current weaknesses

- Lack of policy options have forced some central banks to stretch “boundaries of the unthinkable”

- Bust in developed economies the main risk facing global economy

- Greece prepares to default

- China markets routed overnight

- Gold will be last man standing when currencies collapse

Greece embarked on capital controls as talks over the weekend between Tsipras’ leftist government and foreign lenders fell apart.

All banks and the Greek stock exchange are closed today. Greek citizens cued in long lines at ATMs or cash machines over the weekend and a run on the banks left most ATMs empty. There is a €60 limit on withdrawals from cash machines under strict capital controls. The ATMs will reopen tomorrow. Citizens are also lining up for petrol and food.

Central banks have run out of options to deal with the next global financial crisis the Bank of International Settlements (BIS) has warned so in its annual report. Failure to make difficult policy decisions and raise rates throughout the “recovery” have left central banks with no stimulus options with which to juice the economy when the next downturn arrives.

The BIS, which is central bank of the central banks based in Basel, Switzerland, points to the short-sighted policies of governments and national central banks over the past few years who preferred to try keep their economies afloat using excessive debt rather than take unpopular steps to reform their economies.

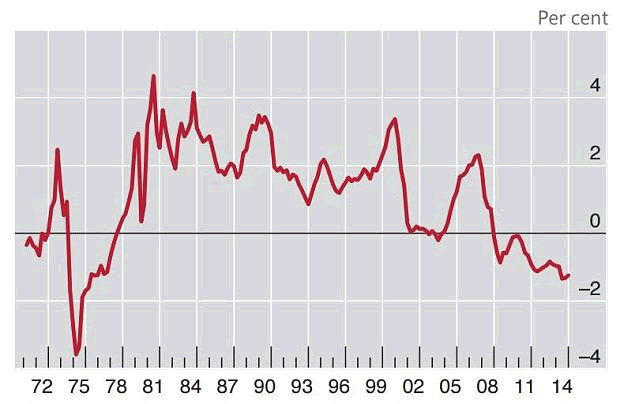

Dangerously low interest rates for too long by Central Banks

The Telegraph puts it thus:

“The BIS claimed that central banks have backed themselves into a corner after repeatedly cutting interest rates to shore up their economies. These low interest rates have in turn fuelled economic booms, encouraging excessive risk taking. Booms have then turned to busts, which policymakers have responded to with even lower rates.”

“Rather than just reflecting the current weakness, they may in part have contributed to it by fuelling costly financial booms and busts and delaying adjustment. The result is too much debt, too little growth and too low interest rates…In short, low rates beget lower rates,” according to Claudio Borio, who heads the monetary and economic department at the BIS.

The BIS is critical of the low interest rate environment and is, apparently, appalled by the actions of some central banks – namely, those of Switzerland, Sweden and Denmark – who have introduced negative interest rates which it describes as “stretching the boundaries of the unthinkable”.

The organisation rejects the argument that the current status quo of very low rates is some kind of “equilibrium”. Jaime Caruana, General manager of the BIS says:

“True, there may be secular forces that put downward pressure on equilibrium interest rates … [but] we argue that the current configuration of very low rates is neither inevitable, nor does it represent a new equilibrium”.

Low rates are gradually whittling away the balance sheet of banks as low rates are a disincentive to savers, particularly when the cost of many necessities is rising.

The greatest threat facing the global economy today is another bust in developed economies according to the bank. Persistent low rates may “inflict serious damage on the financial system”.

Economies driven by excessive debt, rather than productivity, has caused labour to migrate into less productive sectors of the economy which would not have survived the bust had authorities not intervened. Productivity in the west is therefore weaker than it should be in a recovery.

The report cites Greece as an example of this type of mismanagement where a “toxic mix” of “private and public debt being used as a solution to economic problems, rather than making the proper commitment ‘to badly needed’ structural reforms” as the Telegraph puts it.

The release of the report coincides with Greece preparing to default and a major stock market correction in China. Indeed the crisis to which the BIS says the central banks have no solutions may already be upon us.

An acknowledged default of Greece will trigger credit default swaps in the opaque derivatives market. If a major bank – such as Deutsche Bank, with its enormous derivatives exposure that dwarfs the GDP of Germany – were caught on the wrong side of a trade, we would be immediately in the midst of a truly unprecedented global crisis.

At the same time China is experiencing major difficulties as its stock markets have doubled in the past year and now has shed over 21% of its value in recent days.

It seems certain that a new crisis is imminent. When the public finally lose faith in central banks and the money they print, currencies will rapidly devalue. Holding an allocation of physical gold outside the financial system will prove to be valuable insurance.

Please Review: Gold Is a Safe Haven Asset

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,176.50 , EUR 1,060.82 and GBP 749.10 per ounce.

Friday’s AM LBMA Gold Price was USD 1,174.40, EUR 1 ,048.38 and GBP 745.89 per ounce.

Gold rose $1.00 or 0.09% percent Friday to $1,174.10 an ounce. Silver slipped $0.07 or 0.44 percent to $15.80 an ounce. Gold and silver both fell last week at 2.22% and 1.92 percent respectively.

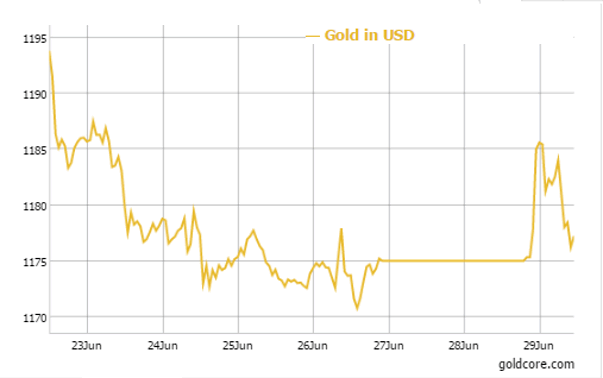

Gold in U.S. Dollars – 5 Day

Gold in Singapore for immediate delivery climbed 0.7 percent to $1,183.18 an ounce near the end of the day.

The yellow metal rose today as investors piled into safe haven assets as the Greek debt crisis took a turn for the worse over the weekend and a Grexit appear imminent.

U.S. gold futures also climbed 1 percent to a session high of $1,187 before capping gains. Silver rose nearly 1 percent along with gold.

Riskier assets fell such as U.S. equity futures, Asian stock markets and the euro fell as investors made a beeline into safe-haven assets like gold and silver.

Friday’s U.S.CFTC data showed speculators upped bullish bets in COMEX gold futures and options and switched to a net short position in silver for the week ending June 23.

In Asia, the People’s Bank of China slashed its one-year lending rate by 25 basis points to 4.85 percent, and lowered the amount of reserves certain banks are required to hold by 50 basis points. This has been its fourth cusince November. The central bank also decreased its one-year deposit rate rate by 25 basis points to 2.0 percent.

In late morning European trading gold is up 0.09% or $1,176.38 an ounce. Silver is up 0.05 percent at $15.80 an ounce, while platinum is off 0.94 percent at $1,067.88 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.