Stock Market Uptrend/downtrend Inflection Point

Stock-Markets / Stock Markets 2015 Jun 27, 2015 - 01:53 PM GMTBy: Tony_Caldaro

The market started the week at SPX 2110. A gap up opening took the SPX to 2130 on Monday, the high for the week. Then the market pulled back every day, including Friday, to end the week at SPX 2102. For the week the SPX/DOW were -0.4%, the NDX/NAZ were -0.7%, and the DJ World index was +0.1%. Economics reports for the week were mostly positive. On the uptick: existing/new home sales, personal income/spending, FHFA prices, the PCE, consumer sentiment, the WLEI, and Q1 GDP improved. On the downtick: durable goods, plus weekly jobless claims rose. Next week’s reports will be highlighted by Payrolls, the Chicago PMI and ISM manufacturing. Best to your week!

The market started the week at SPX 2110. A gap up opening took the SPX to 2130 on Monday, the high for the week. Then the market pulled back every day, including Friday, to end the week at SPX 2102. For the week the SPX/DOW were -0.4%, the NDX/NAZ were -0.7%, and the DJ World index was +0.1%. Economics reports for the week were mostly positive. On the uptick: existing/new home sales, personal income/spending, FHFA prices, the PCE, consumer sentiment, the WLEI, and Q1 GDP improved. On the downtick: durable goods, plus weekly jobless claims rose. Next week’s reports will be highlighted by Payrolls, the Chicago PMI and ISM manufacturing. Best to your week!

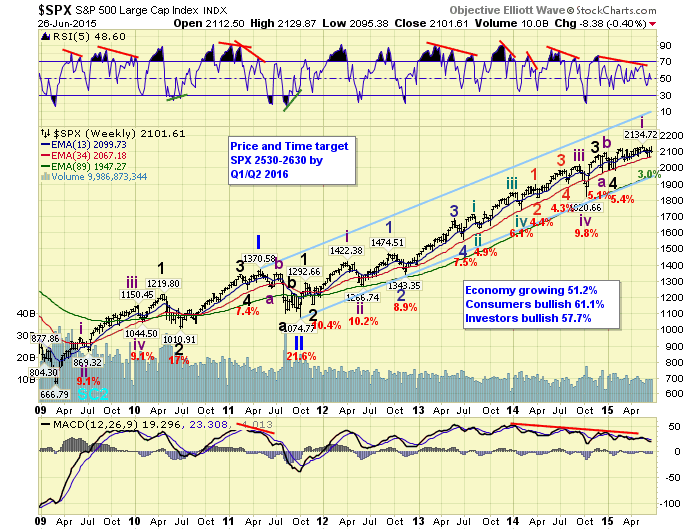

LONG TERM: bull market

Despite Monday’s rally to within five points of the all time high, and nearly the first six months of 2015 in the books, the market is barely up 2% for the year. In fact, since the year started, the market has been down as much as 78 points, and up as much as 76 points. Not a whole lot going on so far this year.

In the meantime we continue to label this bull market as Cycle wave [1] of a new multi-decade Super cycle bull market. Cycle wave bull markets unfold in five primary waves. Primary waves I and II completed in the year 2011, and Primary wave III has been underway since then. When it does conclude, the market should experience its largest correction since 2011 for Primary IV. Then when that concludes Primary wave V should carry the market to all time new highs. Currently we are expecting the bull market to end in the year 2017. Expecting the targets posted on the weekly chart to be reached by 2016.

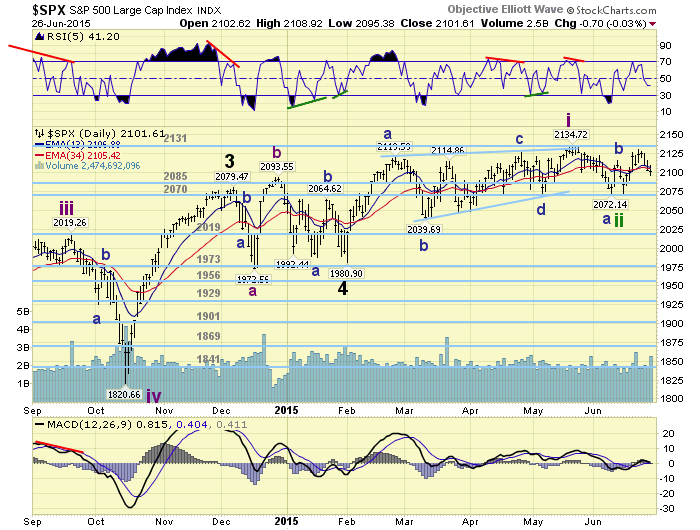

MEDIUM TERM: potential uptrend looks sloppy

After a leading diagonal uptrend high in mid-May at SPX 2135 the market declined in a series of three wave structures until it doubled bottom at 2072. Then the market rallied in what looks like a five wave structure into its recent high at SPX 2130. During this last rally the Nasdaq exceeded its all time high for the first time in 15 years. Since the SPX hit the recent high it has pulled back about 61.8% of the entire 2072-2130 rally. On the surface this all looks good for the beginning of a new uptrend. However, there are a few minor problems.

Our quantified approach to the shorter term charts are displaying mixed signals. The 5min and 10min charts are clearly displaying five waves up, then a 61.8% retracement. The 60min chart is only displaying three waves up, and then the recent pullback. Had the second pullback dropped a couple of points lower. Then all time frames would have been in sync, and we would feel a lot more confident that a new uptrend is underway. It has been this kind of market all year. Nevertheless, the five wave advance on the shorter timeframes is the first five wave advance since the early February uptrend.

The next thing that should occur, if a new uptrend is truly underway, is OEW confirmation of the uptrend. When this occurs we can make some projections as to how high the market could rise, before the next correction. So the market either breaks out to new highs, or resumes the downtrend with SPX 2040 and the 2019 pivot as support. Until the market drops below SPX 2089 we continue to lean toward a new uptrend. Medium term support is at the 2085 and 2070 pivots, with resistance at the 2131 and 2198 pivots.

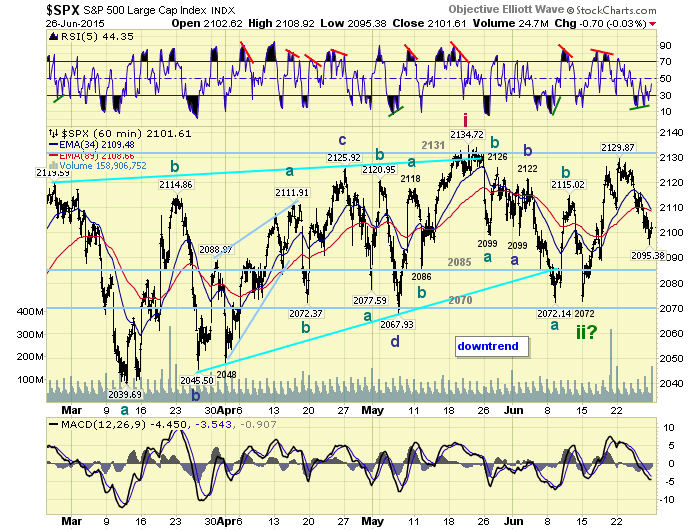

SHORT TERM

As noted above the recent Monday-Monday SPX 2072-2130 rally was the first five wave structure since the early-February low at 1981. The advance was defined as follows: 2104-2089-2127-2109-2130. Had the second pullback dropped to about 2107 we could have quantified a five wave advance on all shorter timeframes. After the SPX 2130 high, the market pulled back to 2095 on Friday. After this near perfect 61.8% retracement (2094), the market had its first notable rally since the pullback began. The first few days of next week should determine what is next: new highs or SPX 2040.

Short term support is at SPX 2095 and the 2085 pivot, with resistance at SPX 2109 and the 2131 pivot. Short term momentum ended the week with a positive divergence.

FOREIGN MARKETS

The Asian market were quite mixed on the week for a net loss of 0.3%.

The European markets were all higher for a big net gain of 5.1%.

The Commodity equity group was also mixed for a new loss of 0.3%.

The DJ World index is trying to uptrend and gained 0.1%.

COMMODITIES

Bonds remain in a downtrend losing 1.4% on the week.

Crude remains in an uptrend but lost 0.1% on the week.

Gold is still in a downtrend and lost 2.2% on the week.

The USD is trying to uptrend and gained 1.4% on the week.

NEXT WEEK

Monday: Pending home sales at 10am. Tuesday: Case-Shiller, Consumer confidence and the Chicago PMI. Wednesday: the ADP, ISM manufacturing, Construction spending, Auto sales. Thursday: Payrolls (est. +240k), weekly Jobless claims, and Factory orders. Friday: a national holiday. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.