Long Term Interest Rates Are On The Up…What’s Next?

Interest-Rates / US Interest Rates Jun 23, 2015 - 04:12 PM GMTBy: Harry_Dent

The Fed has delayed a rate hike yet again. It seems convinced the economy isn’t ready to survive on higher short-term rates. So we continue to see zero rates to stimulate more economic activity. But today the market is proving just how limited the Fed’s influence really is!

The Fed has delayed a rate hike yet again. It seems convinced the economy isn’t ready to survive on higher short-term rates. So we continue to see zero rates to stimulate more economic activity. But today the market is proving just how limited the Fed’s influence really is!

I’ve been warning for years now that there is a limit to how much you can stimulate the economy with free money and zero interest rate policies before the financial drugs no longer work. Eventually, the system breaks down from excessive debt and overexpansion.

There are two signs that this is finally happening. No. 1 is the beginning of debt defaults again, starting with Greece. No. 2 is that, despite continued zero short-term rate policies and endless QE around the world… long-term interest rates are finally rising.

These policies will fail. When it happens, it will result in debt deleveraging and deflation as we have written about extensively.

We saw this start to occur in late 2008… which is precisely why governments around the world stepped in with unprecedented zero interest rate and endless QE policies. They believed they could simply print enough money to offset the economic decline and debt deleveraging — using inflation to fight deflation.

We’ve seen 10-year Treasury yields go up from late January’s low of 1.65% to 2.47% last Wednesday. And they look likely to continue to rise, just as I’ve forecasted. This is not good for stock market valuations or real estate or the economy or the “frackers” that are due to bust ahead from falling oil prices. I believe we could see U.S. 10-year rates rise to as high as 3.3% or a bit higher in the months ahead.

But this rise in rates is worldwide… and it accelerated recently in Europe.

The greatest impact of the impending Greek debt default is not the “Grexit” threat hanging over the euro zone. It is that long-term sovereign interest rates have been rising across the board since April because of it.

Greek 10-year rates were first to rise and have jumped from 5.57% to 13.04% in the last several months. They reached 37.1% in 2012 when the last euro crisis hit… so how high will they go next time?

German bond yields went to an astoundingly low yield of 0.08% and have recently bounced to as high as 0.99%. Other bonds in the euro zone went up similarly as did Japanese bond yields. That’s a big move in a short period of time for Europe’s “healthiest” economy. And it very likely marks an important turning point in rates.

The way Greece’s potential debt defaults are spilling over to Portugal, Spain and Italy is the first cause of rising rates, and these defaults back-up on leading countries like Germany. As risk-free sovereign rates rise, corporate — and especially high yield or junk bond rates — rise more.

The second driver may be what I call “late-stage inflation.”

Inflation has almost always risen into the early stages of a recession — and we are either already in a recession or very close to it, as I discussed in the June Boom & Bust issue. Inflation pressures will likely rise a bit more as job growth remains strong (which I explained Tuesday won’t last forever). It’s a paradox. But that’s how we continue to get rising long-term interest rates at first, despite a slowing economy.

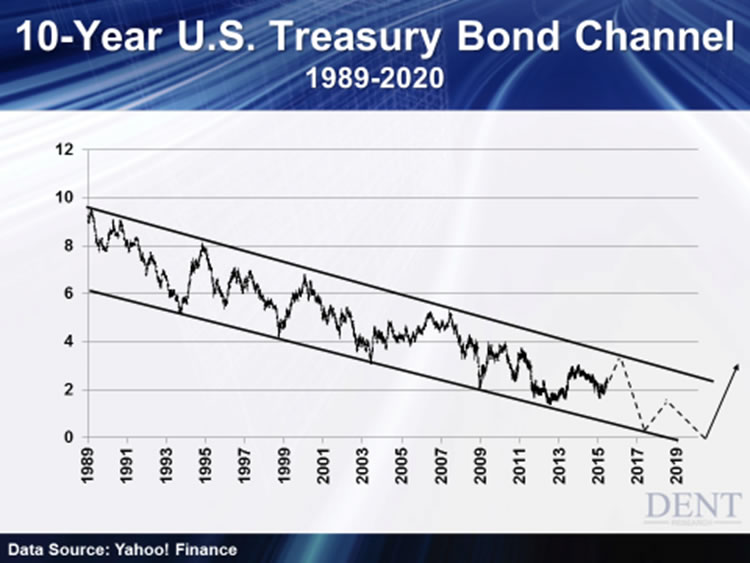

Besides all that, I know long-term rates are very likely to continue rising due to one of my best long-term indicators: the Treasury Bond Channel. When we get to the bottom of this channel, rates tend to rise. When they hit the top, they bounce back down. See for yourself...

The last bottom occurred in mid-2012 when 10-year Treasury rates hit 1.39%. The first rise was to 3.04% leading up into late 2013, then back down to 1.65% late this January. Then, as high as 2.47% last week.

I have been predicting they will rise to 3.3% to 3.4% by late 2015 or so. That will be another trigger for a deeper economic crisis and stock crash ahead. Such a move would simply be about the same spike I just mentioned between mid-2012 and late 2013. That would translate currently to a move from 1.65% to around 3.3%.

So this is not a wild forecast. It’s actually a very likely one.

If we do see such a rise it will be the time to load up on 30-year Treasury bonds to get the greatest yields (4%-plus) and capital gains from the deflationary crisis to follow.

That crisis could bring 10-year yields down towards 0% — the lowest in history. This won’t be as much from potential new and accelerated QE policies like we saw from 2008 through 2014. If QE happens again, it will be less potent. Voters may even resist it after the last QE policy failed so miserably. Rather, it will be more from negative average inflation rates of 2%-plus for the next several years.

So avoid the 10-year. We recommend 30-year Treasuries because they’ll have almost 1% higher yields than the 10-year and greater appreciation when deflation finally sets in and interest rates fall even further.

This play will be especially good for investors nearing or in retirement looking for solid yields and income. Forget buying high dividend stocks with 2% yields! They’ll get crucified in the years ahead and your dividends — if they don’t get cut — will look like nothing compared to your investment losses.

Just remember: Long term Treasury and high quality corporate bonds roughly doubled including interest in the 1930s. They were the only major asset class to go up in the last deflationary and winter season. It will happen again.

Be on alert for higher yields on the 30-year Treasury!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.