Investor Tactics to Profit from the Greek Debt Crisis

Stock-Markets / Eurozone Debt Crisis Jun 20, 2015 - 12:01 PM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes: There's a lot being written about the Greek debt crisis right now. It's scary, it's problematic, and, for the most part, almost totally unusable for the average investor.

Keith Fitz-Gerald writes: There's a lot being written about the Greek debt crisis right now. It's scary, it's problematic, and, for the most part, almost totally unusable for the average investor.

That's completely unacceptable as far as I'm concerned.

So I thought we'd take a good hard look at what you actually need to know, then move on to three tactics that can help you capitalize on the situation. And I don't just mean by single digits, either.

The last time we saw this crisis-driven setup, savvy investors who followed along had the opportunity to take home returns of at least 245% by jumping a stock that would thrive under the circumstances.

Here's what you really need to know.

Greek Debt Crisis Headlines Add to Horror AND Set Up Your Opportunity

There's no doubt the headlines are scary. I took a quick spin across the Internet a few moments ago and this is just a fraction of what popped up:

Europe Is Urged to Prepare for Greek Default as Stances Harden on Debt Deal – The New York Times

Greece on "Brink of Disaster" as Talks Fail Yet Again - CNBC.com

Greece Crisis: PM Blasts "Criminal IMF" in Defiant Speech – The Guardian

Blah, blah, blah.

Keep in mind that the mainstream media's real job is to sell sensationalism and that the Internet simply exacerbates the situation by creating a digital feeding frenzy of sorts.

A little perspective goes a long way, especially now.

Consider: Apple's valuation of $735 billion is more than triple Greece's entire annual GDP of approximately $240 billion. Exxon brings in 10 times more cash in revenue than the Greek economy creates in a year. Letting Greece go would be for the EU what letting the Florida Keys go bankrupt would be for America's $17 trillion economy – an unpleasant hit for anybody who lives there, but by no means a game changer in the long term.

Second, the ECB has been preparing for exactly this contingency for months, despite the fact that politicians have been jawboning about solutions and agreements incessantly. Chances are they've done their homework at this point.

The European Stability Mechanism intended to backstop a Greek default is in place. Whether Greece leaves or gets kicked out really doesn't matter at this point. The country lied about its finances to get in, terribly mismanaged things along the way, and, in reality, has done very little to pay back what it owes. Speaking very plainly, it's not like there's a cash spigot that's suddenly going to get turned off.

And, third, Greece is still going to be part of the EU even if it leaves the euro. That means the nation will be eligible for "balance of payment" assistance from Brussels just like Latvia and Hungary, for example.

Locally, here's what will happen on the ground, though.

Greece will experience a wave of bankruptcies with everything from state-owned utilities to local businesses going feet up. Ludovic Subran, chief economist for the credit insurer Euler Hermes, predicts a 50% rise in insolvencies this year alone and another 30% next year. I think that's conservative.

There's going to be a run on Greek banks, hard limits to currency transactions, and plenty of supplier problems that will jam emergency services and basic shopping networks. The black market will thrive.

Globally, there's going to be some volatility as the ripples spread through the interconnected banking community. It's naïve to think otherwise. At issue will be hundreds of billions of euros worth of debt and whether it's bad or not.

Then, fairly quickly, things will get back to brass tacks. And that brings me to the real opportunity here and why you want to pay attention.

What Europe's leaders really fear and don't want to discuss publicly is that Greece bails and – gasp – actually makes a go of things by returning to prosperity.

You're not hearing anything about this at the moment, but this possibility is exactly why you want to be on your toes. If Greece (and the Greek market) returns to normal absent all the financial baggage that comes with the euro and jointly encumbered debt it represents, other countries are going to follow.

The incentive is clearly there.

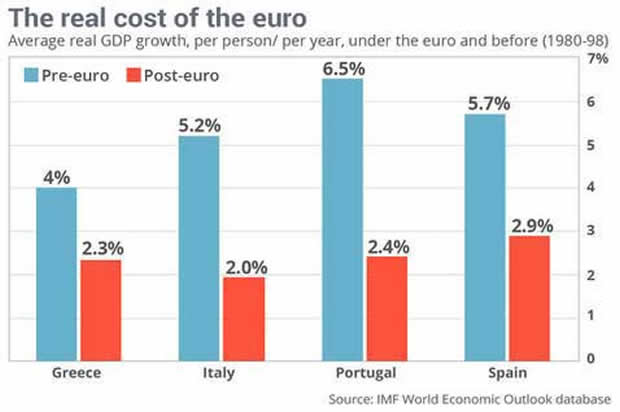

Take a look at this chart of pre and post-euro GDP growth per capita and you'll see what I am talking about.

Figure 1 – MarketWatch, IMF

According to the IMF, pre-euro growth for the countries most at risk of default – Greece, Italy, Portugal, and Spain – was nearly double or in some cases more than double prior to joining the euro. It's also proof positive that the euro is a load of you-know-what rather than the stabilizing influence it was envisioned to be.

This is about as inconvenient a truth as I've ever seen and, specifically, it's your opportunity.

Here are the tactics you'll need to capitalize on chaos when the time comes:

- Inverse funds – global traders don't understand what I've just laid out for you and, even if they did, chances are they don't care. What matters most to them in the short term is who's going to pay for all that bad debt. So, odds are good that there will be a knee-jerk sell off that's felt around the world. An inverse fund like the RYURX or SH will help shore up your portfolio while they get their ya-yas out.

That's because those funds appreciate as the broader markets fall. The last time Greece went to the edge in the early summer of 2010, the S&P 500 lost 11% while investors holding these two alternatives enjoyed some much-deserved stability and gains of 15.4% and 15.57% respectively.

More sophisticated investors can use put options to accomplish the same thing.

- Lowball orders – we've talked extensively about these and the importance of wading into the fray even as everybody else is headed out the door as fast as they can. There are plenty of companies with solid business models and lots of growth that are going to be put on sale… and rebound quickly. That's what you want to be buying if you get the chance.

One of my favorites, Altria Group Inc. (NYSE: MO), lost 6.7% the last time around, versus the S&P 500 which tanked to the tune of 14.95% in the early summer months. But then, it came screaming out of the hole, and readers who followed along with my February 2010 Money Map Report recommendation to buy it had the opportunity to capture returns of 245%.

Altria's still a great bet, but I've got my eye on the Williams Companies Inc. (NYSE: WMB). Energy is totally undervalued right now and priced artificially. Any short-term Greek vacation will pay off big when traders realize that global growth is going to continue anyway. It's already returned 15.27% since I first brought it to your attention on Jan. 7, 2015.

- And, finally, capture profits using trailing stops. If you've been along for the ride from the very beginning, as I hope you have, chances are good that you're sitting on some outsized gains. I know we usually talk about trailing stops as a protective mechanism, but in this case I want you to think about them as a means of freeing up fresh capital that you can immediately put to work in the pursuit of even bigger gains.

So there you have it and now you know – what's really going to happen and what to do about it.

Now, all this talk about Greece makes me hungry for some of my favorite food – moussaka, fassolatha, and custard phyllo pie.

"γειά" (for health – if I remember my Greek correctly.)

Source :http://moneymorning.com/2015/06/18/the-tactics-youll-need-to-profit-from-the-greek-debt-crisis/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.