Is Bitcoin Price About to Move?

Currencies / Bitcoin Jun 19, 2015 - 04:32 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Yesterday, we wrote about how the recent hype about Bitcoin rallying "because" of Greece might be overstated and that finding a real "reason" behind a given move is extremely hard if not impossible. Today, read yet another piece on how Bitcoin can shift things around for Greece:

As Greece stumbles toward capital controls, bitcoin is once again proving its disruptive power within the global financial system.

Over the past week, both the price and volume of bitcoin has been increasing (it's up 11 percent so far in June) - this is similar to the activity that occurred when Cyprus introduced capital controls in 2013. During the Cyprus crisis, citizens were not only locked out of their bank accounts but many found that some of their money was confiscated when the banks re-opened. This confiscation went by the "friendly" moniker "bail-in." In the Cyprus bail-in, any deposit above 100,000 euros were converted into Bank of Cyprus shares. Given this precedent, it is no surprise that Greeks are seeking a safe haven for their savings.

Yesterday, we wrote:

We've stressed this before, we stress it again: it is never quite certain what the driver is behind a given move in the market. The recent rally might have to do with the Greek crisis, but it might also not have much to do with Greece. The real reason behind the move is that there was increased buying in the market.

We've also recently heard news of Greece leaving the Eurozone and leaning toward Bitcoin. We're extremely skeptical of such statements. Yes, the Greek finance minister has written about the possibility on his blog, but you have to consider two factors. Firstly, it is not sure whether Greece will actually leave the euro. The current bickering over reforms and debt haircuts might only be a strategy of the both sides to gain as much as they can. It certainly would not surprise us if the deal wasn't struck before very late in June, perhaps even close to June 30. Secondly, even if Greece were to leave (which is far from certain), it would likely not adopt Bitcoin. This is simply because the government would most likely want to retain control over the amount of money in the economy. Its inability to do that is one of the reasons it is where it is now. Also, switching back to the drachma would be far easier than to Bitcoin - and any move would have to be relatively quick.

Bitcoin might be becoming a sort of safe haven but we haven't really seen enough evidence to support that so far. It might be that the move up was driven by uncertainty about Greece but it might also be that the two are unrelated. Please, keep that in mind while reading about Bitcoin becoming the new money of Greece - it is highly unlikely.

For now, let's focus on the charts.

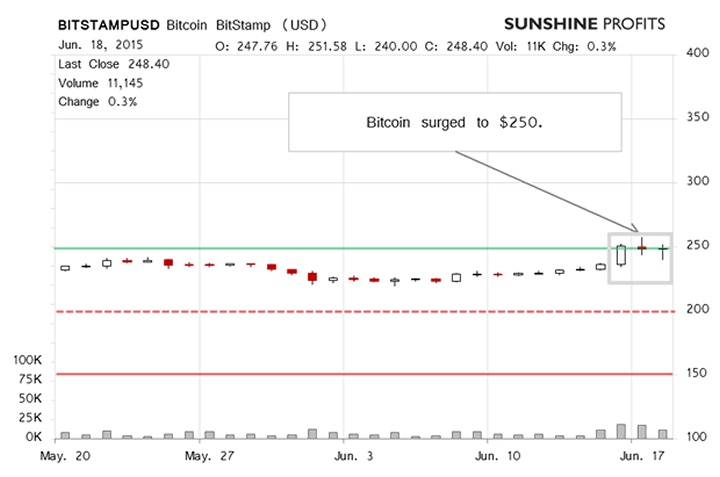

On BitStamp, we saw pretty much action yesterday as far as the price is concerned, the volume was also relatively significant but it was also lower than on the day before. Two days ago, we wrote:

(...) we have seen more of volatile action (...). Bitcoin went down and back up to $250 and over $255 in a volatile fashion. Does this suggest a strong rally at the moment?

We don't think so. The move up has encountered a possible psychological level, it has been relatively steep and the volatility today is both to the upside and to the downside. Combine that with the fact that Bitcoin has stayed at the level of yesterday's close and that it has definitely gone into overbought territory and this might suggest we're at a local top.

The situation still looks like that today. We might have just seen a local top. On the other hand, the action today has been a lot more subdued both in terms of price and volume (this is written before 11:00 a.m. ET). We haven't really seen a more significant move down. This might suggest that there's more sideway trading to come in the next couple of days.

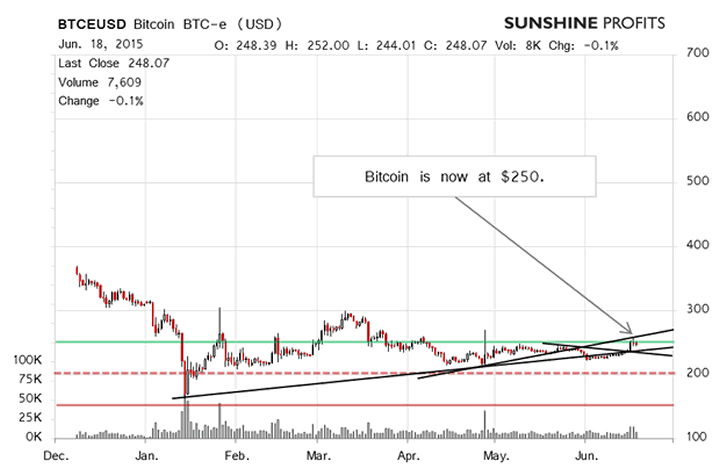

On the long-term BTC-e chart, we see that Bitcoin has stopped at $250 (green line in the chart). Yesterday, we wrote:

Today, we've seen Bitcoin dance around $250 but it hasn't moved either way decisively. There is a bearish tilt as the current situation resembles a local top but the situation isn't bearish enough just now, in our opinion.

This is still the case today. We've seen less action than yesterday and Bitcoin is still below $250. The action has been to the downside but there hasn't been enough action to suggest going short just now. We might see more action in the days to come but the action just now suggests that more sideway trading might be around the corner at the moment. As such, we would still prefer to wait for a confirmation here.

Summing up, we don't support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.