Discover a New Way of Thinking About Society and the Stock Market

Stock-Markets / Stock Markets 2015 Jun 17, 2015 - 08:32 AM GMTBy: EWI

Editor's note: This video was excerpted from a new multimedia report, "The New Financial Theory that Could Make the Difference in Your Investing Success," from Elliott Wave International, the world's largest financial forecasting firm. Authored by Robert Prechter, the full report demonstrates the failures of the modern investing paradigm and suggests a radically new approach that can make the difference in your investing success. Click here to read and watch the full, four-part multimedia report -- it's free.

Editor's note: This video was excerpted from a new multimedia report, "The New Financial Theory that Could Make the Difference in Your Investing Success," from Elliott Wave International, the world's largest financial forecasting firm. Authored by Robert Prechter, the full report demonstrates the failures of the modern investing paradigm and suggests a radically new approach that can make the difference in your investing success. Click here to read and watch the full, four-part multimedia report -- it's free.

The director of the Socionomics Institute, Mark Almand, came up with an analogy to help explain socionomic causality in people. And I'm so jealous that he came up with this idea, because it's so cool. I just love it. So I'm privileged to be able to embellish on it and present it to you now.

It goes like this: Suppose you got a job -- you're down and out, you finally got offered a job, so you take it -- as a sentinel on an oil rig in the Gulf of Mexico. Your bosses tell you, "Look, we just want you to watch the seas all the time. We don't know what could happen -- maybe some radical greens might come up -- so we just want you to keep an eye on things. Just let us know if there's anything out of the ordinary."

Well, you can't stay awake 24 hours, so you've got another guy who's doing it with you, and you trade shifts. And so you're out there, and you're looking at the ocean, and everything is calm and normal, when all of a sudden, over toward the left side of the horizon, you see this little group of people, apparently standing on top of the water. You watch for your eight-hour shift, then you come back the next day, and you notice they've moved a little bit farther. So you're watching this, and as the days go by, you see this little group of people, and they're not swimming; they're not really walking; they're just standing around on the water. But they're moving around as the days go by.

After a few more days go by, you notice a barge floating out in the sea. So you start talking to your buddy about this.

You say, "Look, I've noticed that these people seem to be floating around; they're moving around the ocean. And I noticed this barge out there. It always seems to be about the same distance from the people, but I can't tell if there's a relationship between these two weird things happening. Tell you what: When I'm on, I'm going to take this big blackboard here, and I'm going to write on it. I'm going to follow the path where the people are going and the barge, and then when I'm sleeping and you're up here, you do the same thing, and we'll sort of graph it and see what we end up with."

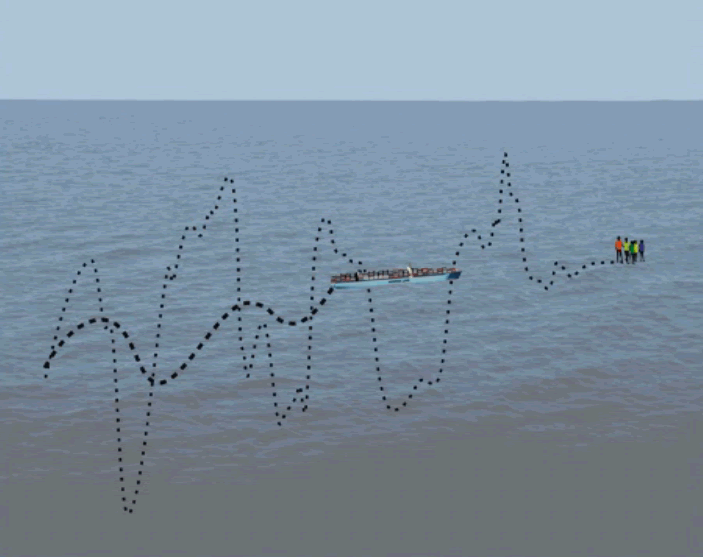

So they agree to do this. Pretty soon, this is the picture that they've drawn.

The dotted line is the path that the people have taken, moving around on the surface of the water. And the dashed line -- the thick dashed line -- is the path that this barge has taken. And sure enough, the people are still there every day, and the barge is still there every day, and they're just doing these seemingly random moves, but the barge is still back there.

You start thinking, "What could explain what's going on here?"

Your friend says, "Well, I've been thinking about it, and I've got a theory." He tells you his theory, and you kind of look at him oddly, and say, "Well, that's kind of a weird idea you have." And here's the theory that he gives you: The barge has its own engine and goes where it wants. The people are psychic, and they are anticipating where that barge is going to go. They don't do it perfectly, so they kind of wander around in front of it. But as the barge follows, it proves that they have foreknowledge of where that barge is going. And that's my theory."

You say, "Well, I've been thinking about it, too. I have an explanation for this, because I really don't believe people can walk on the water, and you're kind of accepting that as magic. I don't think people are psychic, either. You're kind of accepting these ideas, but I think, somehow, we have to deal with reality here. So I have a different idea.

"I'm a socionomist, and here's the way I see it: There must be a hidden variable, something we can't see that's making this pattern happen. I'm postulating there's a submarine under the people. They're not walking. They're not swimming. They're just standing around. And there's probably some sort of towing device, a chain or something, between the submarine and the barge. And this kind of explains it: Wherever this submarine wanders, that chain pulls the barge, but it doesn't follow immediately. It's not on the exact same path, because this is a long distance, so it's kind of roughly following in the same path."

He tells you, "You're crazy!" I don't see any submarine. And you say, "Well, no, we can't see it. But this would explain it without the magic, without the psychic stuff and the walking on water; you know, everything is taken into account."

"I just can't see it," he says.

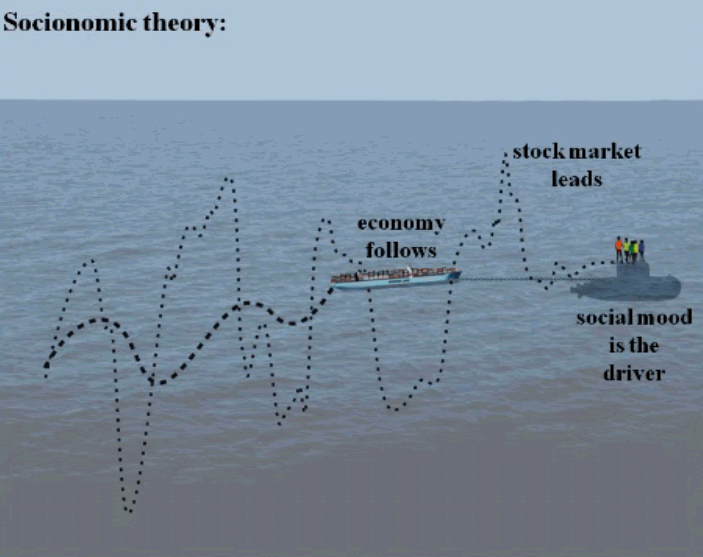

Well, why am I showing you this analogy? Because this is exactly what we get in terms of the way economists explain what the stock market is doing. They say the economy is the driver, and the stock market follows in advance. How does it do that? Investors are psychic. Seriously. They say investors are looking into the future, three to six months, and they're buying or selling their stocks in accordance with what they will do. The economy is running on its own. It's got its own engine, and these people are just somehow psychic. They know what the economy is going to do three to six months in advance. And that's the accepted explanation for why the stock market is a leading indicator.

On the other hand, socionomic theory says social mood is the driver. The stock market leads, because its follows directly from social mood. And the economy follows at a distance, because it takes times to make economic decisions. There's no magic, no psychic. One thing follows another. It is direct causality. I kind of like that, because I think it puts things into perspective.

Most of the economists are saying, "You guys are on the fringe." Well, I think when you look at this kind of explanation, maybe it's they who are on the fringe.

Editor's note: This video was excerpted from a new multimedia report, "The New Financial Theory that Could Make the Difference in Your Investing Success," from Elliott Wave International, the world's largest financial forecasting firm. Authored by Robert Prechter, the full report demonstrates the failures of the modern investing paradigm and suggests a radically new approach that can make the difference in your investing success. Click here to read and watch the full, four-part multimedia report -- it's free.

This article was syndicated by Elliott Wave International and was originally published under the headline (Video) Socionomics Explained: The Hidden Engine Behind Society and its Markets, and the Science that Helps You Navigate Both Safely. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.