Key Steps to Your First Options Trades

Stock-Markets / Options & Warrants Jun 15, 2015 - 01:05 PM GMTBy: ...

MoneyMorning.com  Tom Gentile writes: During the past month we've welcomed in thousands of new subscribers over at Power Profit Trades.

Tom Gentile writes: During the past month we've welcomed in thousands of new subscribers over at Power Profit Trades.

Many of you have started out with "paper trading" on my picks and are excited at the prospect of pocketing the gains in real time.

Taking advantage of what veterans like me didn't have when we started trading is a great idea! I know it's not like real trading, but one of the things using a "virtual" account will do is help you get familiar with order placement through the platform you intend on using BEFORE you use real money.

For those of you already on "live" platforms, congratulations! You're already enjoying gains.

Beginners are also working through the "how to get started" phase of investing. However, the most common question I get is "how do I open an account?"

For those of you not yet receiving Power Profit Trades, or for anyone who hasn't traded yet because of concerns over opening a live account, let me take the fear out of what is an easy process.

Just follow my lead…

Since moving to New York City back in the early 1990s, I've witnessed incredible changes in brokerage firms and the financial services industry.

Back then, it took weeks to get an account opened, most trades were done over the phone, and commissions were unbelievably high.

In the last 20 years, however, due to competition and technology, all three of these things have drastically improved for the retail trader. Competition has driven commission prices down to levels that are barely factored into risk and reward these days, and technology has allowed us to get instant quotes and fills in the blink of an eye.

For the new options trader, it all starts with opening your first options account. The good news is that opening up an options account online is quick and easy.

But before you get to that step, there are a few things you need to understand first.

Before You Begin

Most traders seeking to trade options already have a stock brokerage account. Before you place a call to your broker or go online to start the process of opening an options account, make sure you want to trade options through your brokerage firm.

There are stock firms that offer options trading, and then there are options firms that offer stock trading. I like the latter, because an options firm knows what a client needs and hasn't just programmed together an options platform on the side of their equity trading.

Option firms build their platforms from the ground up, in many cases offering easier and more streamlined platforms in which to trade. Commissions are generally lower as well, as they are looking for active traders.

Platforms Matter

If you are a new options trader or a position trader, meaning you hold trades for periods of longer than 30 days, then it might make sense to use a web-based platform rather than a streaming one.

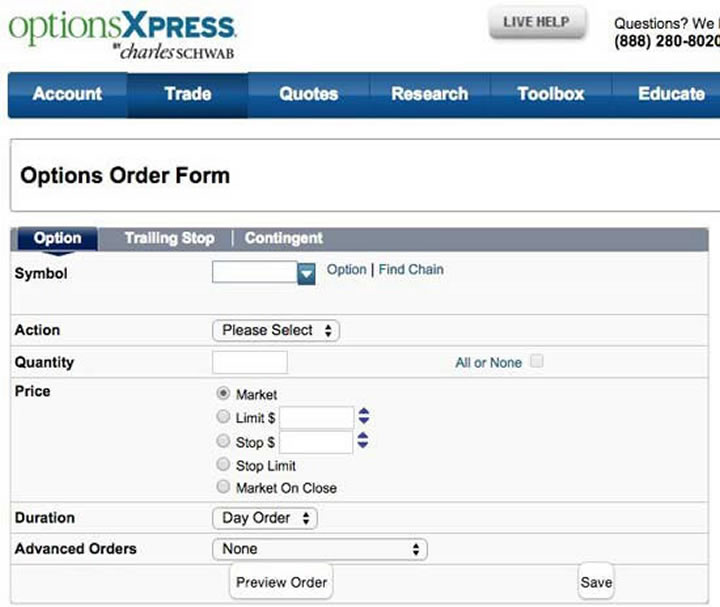

Web-based platforms such as that used by OptionsXpress, below, is great for someone getting started. It's easy to master, from simple option purchases even up to three- and four-legged spreads, and the platform is set up nicely in a step-by-step format when it comes to placing an order. The drawback on platforms such as this one, though, is that they are more of a snapshot of the market, rather than constantly streaming.

The chart below comes from ThinkorSwim, TD Ameritrade's active platform. Now, this one has all the bells and whistles and can chart and analyze stocks on the fly in real time. It also allows you to set up real-time scans and indicators, with alerts to let you know if a bullish or bearish trade signal is present.

All this excitement does have its drawbacks. Entering orders on a real-time platform can sometimes be a bit daunting with everything that's happening on the screen.

Which is right for you?

Whether you decide to go easy (web-based) or go crazy (computer-based) is all up to your experience level and how smoothly you flow through computer screens. If you are a computer novice, a web-based platform should suffice. If you were the pinball wizard of your day, then perhaps an active trader platform is for you. If you are not sure, you could start with a web-based platform and graduate to an active trader platform when ready.

Getting Past the Questions

Opening an options account feels a bit like an inquisition, involving many questions that seem to say the same thing… liability and risk. The way these are answered will determine if (A) you get authorization to trade options, and (B) what level of options trading authority you qualify for.

Each broker's trading authorization form may vary, but they typically have these types of questions:

Investment Objectives – This will range from "income" on the low side to "speculation" on the risky side. I suggest that if you want to trade options as well as qualify for something other than covered call authorization, then "speculation" is what you want to apply for.

Options Strategies – Basically this involves what type of strategies you are familiar with. The more that you understand, the higher trading level you will qualify for. Keep reading my material to learn about the majority of these strategies.

Trading Strategies - There are several here, and the biggest takeaway at this point is that the more strategies you select, the higher your chances of getting a high trading authorization. Wouldn't you want the ability to trade these when you are ready?

Trading Experience - Again, like trading strategies, the higher a number here, the better. If you don't have a lot of experience, think about the future of what you believe you will be trading, and factor that in.

Personal Finances - These are straightforward and consist of your "liquid" net worth, total net worth, annual income, source of income, etc. Be honest here, as this type of information is easily attainable and the firm could come back to you with questions if things don't match up.

Congratulations!

The goal is to get that correspondence back saying you have option trading authority. Most option firms require a minimum deposit of $2,000 to 3,000, and to get started it generally takes only the time required to get your money cleared through the broker.

Relish in the moment. You are about to embark on a journey that brings many people to envy those who get it right. I promise to help get you, and keep you, on that path. Good trading!

To get Tom Gentile's high-profit options trading tactics and strategies twice weekly in Power Profit Trades, click here. It's free for Money Morning Members, and you'll get his latest investor briefing on banking a quick 100% gain on one of the world's most valuable companies. You don't get quick gains like that from blue chips without making this trade…

Source :http://moneymorning.com/2015/06/15/the-key-steps-to-your-first-options-trades/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.