Consumers Not Following Orders

Economics / US Economy Jun 15, 2015 - 05:29 AM GMTBy: James_Quinn

Last week the government reported personal income and spending for April. After months of blaming non-existent consumer spending on cold weather, shockingly occurring during the Winter, the captured mainstream media pundits, Ivy League educated Wall Street economist lackeys, and Keynesian loving money printers at the Fed have run out of propaganda to explain why Americans are not spending money they don’t have. The corporate mainstream media is now visibly angry with the American people for not doing what the Ivy League propagated Keynesian academic models say they should be doing.

Last week the government reported personal income and spending for April. After months of blaming non-existent consumer spending on cold weather, shockingly occurring during the Winter, the captured mainstream media pundits, Ivy League educated Wall Street economist lackeys, and Keynesian loving money printers at the Fed have run out of propaganda to explain why Americans are not spending money they don’t have. The corporate mainstream media is now visibly angry with the American people for not doing what the Ivy League propagated Keynesian academic models say they should be doing.

The ultimate mouthpiece for the banking cabal, Jon Hilsenrath, who does the bidding of the Federal Reserve at the Rupert Murdoch owned Wall Street Journal, wrote an arrogant, condescending, putrid diatribe, directed at the middle class victims of Wall Street banker criminality and Federal Reserve acquiescence to the vested corporate interests that run this country. Here are the more disgusting portions of his denunciation of the formerly middle class working people of America.

We know you experienced a terrible shock when Lehman Brothers collapsed in 2008 and your employer responded by firing you.

We also know you shouldn’t have taken out that large second mortgage during the housing boom to fix up your kitchen with granite counter-tops.

You should feel lucky you’re not a Greek consumer.

Fed officials want to start raising the cost of your borrowing because they worry they’ve been giving you a free ride for too long with zero interest rates.

We listen to Fed officials all of the time here at The Wall Street Journal, and they just can’t figure you out.

Please let us know the problem.

The Wall Street Journal was swamped with thousands of angry responses from irate real people living in the real world, not the elite, QE enriched, oligarchs living in Manhattan penthouses, mansions on the Hamptons, or luxury condos in Washington, D.C. Hilsenrath presumes to know how the average American has been impacted by the criminal actions of sycophantic Ivy League educated central bankers and their avaricious Wall Street owners.

He thinks millions of Americans losing their jobs and their homes due to the largest control fraud in financial history is fodder for a tongue in cheek harangue, blaming the victims for the crime. Hilsenrath reveals he is nothing but a Fed flunky who is fed whatever message they want the plebs to hear. His job is to obscure, obfuscate, spread disinformation, and launch Fed trial balloons to see whether the ignorant masses are still asleep. The Fed and their owners can’t understand why their propaganda hasn’t convinced the peasantry to follow orders.

A system built upon an exponential increase in debt, cannot be sustained if the masses stop buying Range Rovers, McMansions, stainless steel appliances, 72 inch HDTVs, iGadgets, bling, and boob jobs on credit. His letter to America reeks of desperation. The Fed and their minions have used every play in their Keynesian monetary playbook, and are losing the game in a blowout. With a deflationary depression beginning to accelerate, they have no game.

Despairing mothers, unemployed fathers, impoverished grandmothers, and indebted young people are supposed to feel lucky because they aren’t starving to death like the wretched Greeks. We do have one thing in common with the Greeks. We’ve both been screwed over by bankers and corrupt politicians. Did you know you’ve been given a free ride by your friends at the Federal Reserve? Did you know that zero interest rates and $3.5 trillion of Quantitative Easing (aka money printing) were implemented to benefit you? According to Hilsenrath, the Fed lending money at 0.25% to their Wall Street bank owners, who then allow you to borrow from them at 15% on your credit card, represents a free ride for you. Are the subprime auto loan borrowers, who account for 30% of all auto sales, paying 13% interest getting a free ride?

Hilsenrath is purposefully lying. Bernanke and Yellen have been saying they want to start raising interest rates for the last four years. Remember the 6.5% unemployment rate bogey set by Bernanke in January 2013? Unemployment dropped below 6.5% in early 2014 on its way to 5.5% today. Did they raise rates? In 2013 we had two consecutive quarters of 4% GDP growth, with no Fed rate increase. In 2014 we had two consecutive quarters of 4.8% GDP growth, with no Fed rate increase. We have added ten million jobs and the stock market has tripled since 2009, with no Fed rate increase.

We are supposedly in the sixth year of an economic recovery and the Fed is still keeping the discount rate at a Lehman “world is ending” emergency level of .25%. Six years after the last recession the discount rate was 5.25%. The last time the unemployment rate was this low the discount rate was 4%. The only ones getting a free ride from the Fed’s zero interest rate policy and QE to infinity have been Wall Street banks, the .1% who live off the carcasses of the dying middle class, zombie corporations who should have gone bankrupt, and politicians who keep running up the national debt with no consequences – YET. The Federal Reserve is a blood sucking leech on the ass of America. Their cure has been far worse than the original illness – Wall Street criminality. In fact, their cure has been to reward the Wall Street criminals while spreading cancer to the working class and euthanizing senior citizens.

Hisenrath and his puppet masters at the Fed can’t figure you out. For decades you have followed their orders and bought Chinese produced shit with one of your 13 credit cards. The Bernays’ propaganda playbook has produced wins for the ruling class since the early 1980’s. Their record is 864 – 0 versus the working class. Our entire warped economic system since the 1980’s has been dependent upon an exponential increase in debt peddled by Wall Street to citizens, government and corporations to give the appearance of a growing, healthy economy.

An economy built upon the consumption of iGadgets, Cheetos, meat lovers stuffed crust pizza, and slave labor produced Chinese baubles, along with the production of enough arms to blow up the world ten times over, and the doling out of trillions to the non-productive class, is doomed to fail. Maybe I can explain the situation in such a way that even an Ivy League educated central banker or a Wall Street Journal faux journalist will understand.

Maybe Jon and his Fed cronies could be enlightened by a look at the American consumer before the bubble boys (Greenspan, Bernanke) and gals (Yellen) at the Fed, along with the corporate fascist takeover of our political system, and the propaganda spewing corporate media monopolies, combined to deform our financial and economic system for their sole enrichment. The lack of spending by consumers might just be due to some of the following factors:

- Back in 1980 income meant money earned through working, investing, and saving. The amount of personal income made up of wages totaled 60% in 1980. Today it totals 51%. Interest earned on savings accounted for 14% in 1980. Today it accounts for 8%, as the Fed has punished seniors and savers with negative real interest rates. Since 2009 the Fed has robbed over $1 trillion in interest income from seniors and savers with their zero interest rate policy and handed it to the Wall Street banking cabal. Bernanke didn’t just throw seniors under the bus, he ran them over, backed up over them, and ran them over again.

- In a shocking development, government welfare transfers accounted for 11% of total personal income in 1980 and have risen to 17% today. Only the government could classify money which has been absconded at gunpoint from working Americans in the form of taxes and redistributed back to other Americans as welfare payments, as personal income. If you take money from your left pocket and put it in your right pocket, is that income? The replacement of wages and interest by welfare redistribution payments has not benefited society whatsoever.

- In 1980 consumer credit outstanding as a percentage of personal income totaled 15%. Today it totals 22%, an all-time high. It is higher than the bubble peak in 2007-2008. Real per capita disposable income has only risen by 88% over the last 35 years. Meanwhile, real per capita consumer debt has risen by 288%. Wages and earnings from saving have been replaced by debt. The propagandists for consumerism have convinced the ignorant masses to spend money they don’t have, while pretending to be wealthier and successful. Consumer debt currently stands at a towering all-time high of $3.4 trillion, almost ten times the $350 billion level in 1980. Hilsenrath and the Fed are upset with you because credit card debt still lingers $122 billion, or 12% below 2008 levels. It has forced them to dole out $900 billion of government controlled subprime debt to University of Phoenix wannabes and any deadbeat that can scratch an X on an auto loan application. The U.S. economic system is like a Great White Shark that must keep swimming or it will die. The Federal Reserve run U.S. economic system must keep generating debt or it will die. They are growing desperate and you are not following orders.

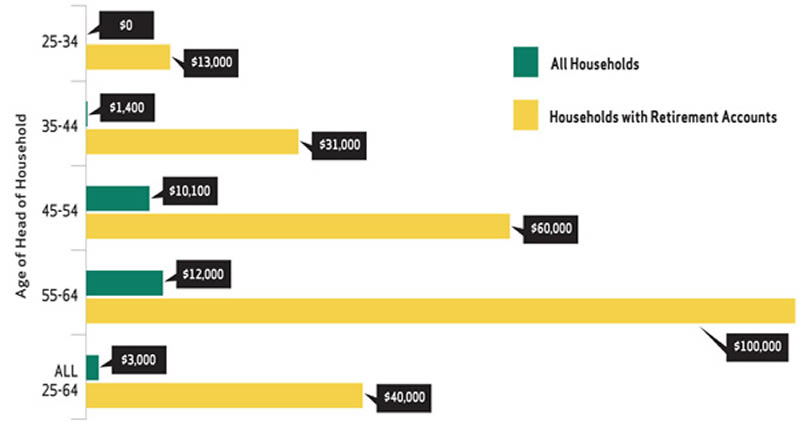

- Before the grand debt delusion overtook the populace, they were saving 11% of their disposable personal income. In 1980, Depression era adults still believed in saving for large purchases such as a house, car, appliance or home improvement. The young adult Boomers didn’t have the same experiential deterrent. They were convinced by the Wall Street debt peddlers, Madison Avenue maggots, and corrupt politicians that saving was for suckers. Live for today, for tomorrow may never come. Well tomorrow did come. Boomers are entering their retirement years with $12,000 in retirement savings, while still in debt up to their eyeballs. There have been 10,000 Boomers turning 65 every day since 2010. This will continue unabated through 2029. This demographic certainty was already depressing consumer spending, as this age demographic spends far less than 25 to 54 year olds. Factor in the pitiful amount of savings and you have an ongoing spending implosion.

- The propaganda machine was so well oiled, the savings rate actually reached 1.9% in 2005, as the masses all believed they would live luxurious retirements off their home equity windfall. How’d that delusion work out? The current level of 5.6% is seen as troublesome by the powers that be. They cannot accept the crazy concept of saving and investment when their entire warped paradigm is built upon borrowing and consumption. Banks don’t make money when you save and they despise when you use cash. They can’t sustain their opulent lifestyles without their 3% VIG on every electronic transaction, 15% compounded interest on the $5,000 average credit card balance, billions in late fees for being one day late with your payment, $4 on every ATM transaction, and the myriad of other fees and surcharges designed to bilk you and keep you from saving. The saving rate will continue to climb as people have no choice to make up for years of living beyond their means.

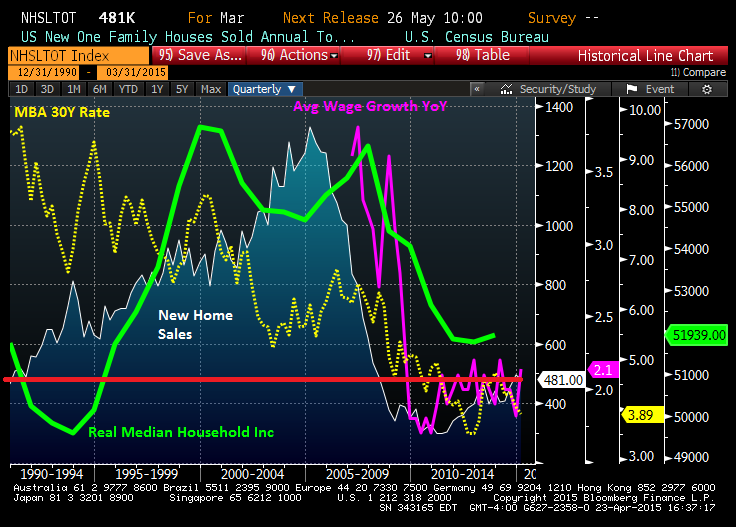

- Hilsenrath is willfully ignorant as he pretends to not understand why the American people will not or cannot accelerate their spending. It is really quite simple. Even a PhD should be able to understand. Real median household income was $52,300 in 1989. Real median household income today is $51,939. The median household has made no economic advancement in the last quarter of a century. And this is using the manipulated lower CPI figure. Using a true inflation rate would show a dramatic decline over the last 25 years. There has been virtually no wage growth during this supposed six year recovery. The industrial base of the country has been gutted, except for the production of arms to blow up brown people in the Middle East. Young people have $1.3 trillion of student loan debt weighing them like an anchor, and those Ruby Tuesday waitress jobs and Home Depot cashier jobs aren’t going to cut it.

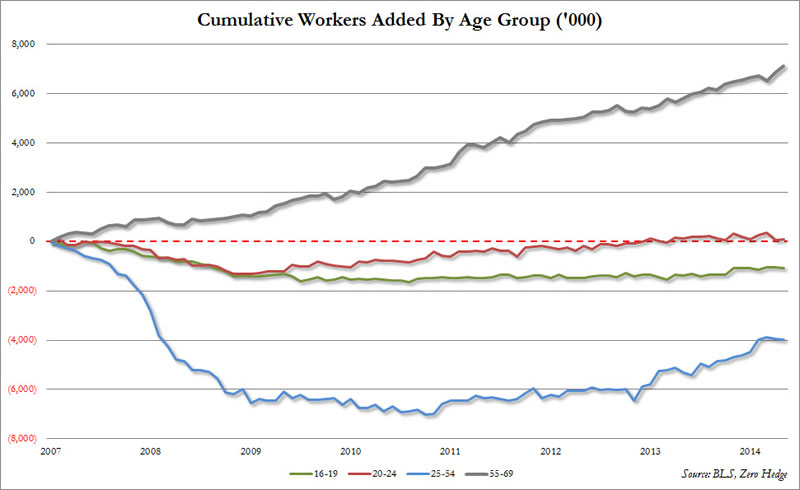

- So we have the demographic dilemma of aging, under-saved, over-indebted Boomers who are being forced to spend less. We have an over-indebted, under-employed youth who don’t have anything to spend. And lastly we have the 25 to 54 year old age bracket who should be in their prime earning and spending years who are still 4 million jobs short of where they were in 2007 before the Fed induced financial collapse. The only age bracket to gain jobs since the crisis has been 55 to 69, as they have been forced to work to make up for their lost interest income. The only people making job gains are those least likely to spend.

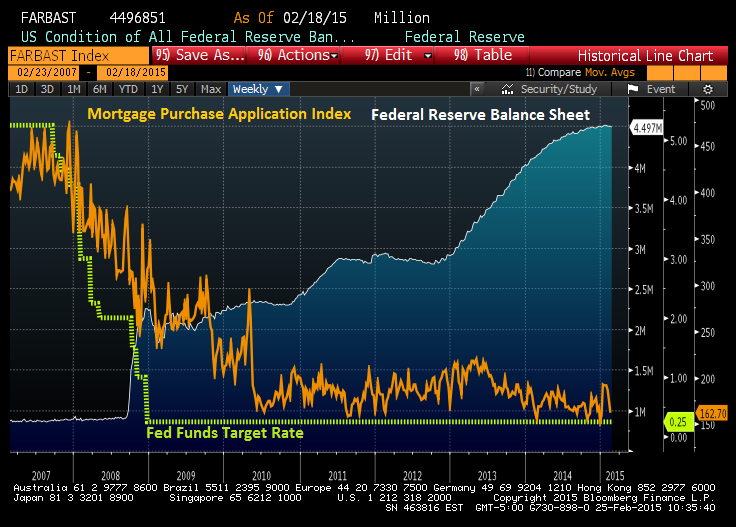

- The spending crescendo in 2004 through 2007 was fueled by the Greenspan housing bubble and the $3 trillion of mortgage equity withdrawal used to buy BMWs, in-ground Olympic size pools, Jacuzzis, vacations to Tahiti, home theaters, granite countertops, stainless steel appliances, and boob jobs, by delusional, apparently brain dead Americans who fell for the Bernaysian propaganda spewed by the Wall Street criminal class, hook line and sinker. The majority of shell shocked underwater home owners have been unable to sell since the housing crash. A 35% price decline will do that. The Fed has created $3.5 trillion out of thin air, more than quadrupled their balance sheet with toxic mortgages from Wall Street, artificially suppressed interest rates to bring mortgage rates to record lows, and was a co-conspirator along with Fannie, Freddie, FHA, and Wall Street hedge funds (Blackrock) to delay foreclosure sales and pump home prices with their buy and rent scheme. The result has been unaffordably high prices, mortgage applications at 1997 levels (60% below 2005 levels), first time buyers at a record low, and a non-existent housing recovery – despite the MSM propaganda saying otherwise.

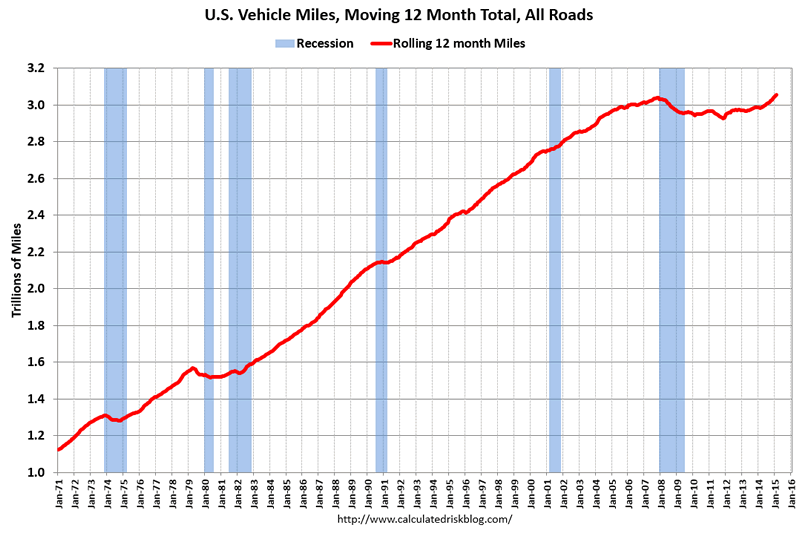

- The last data point which might help the math challenged Hilsenrath understand why you aren’t spending is total U.S. vehicle miles driven. The chart below shows a relentless climb from 1982 through to the 2008 collapse. It coincides with the debt fueled consumption orgy over this same time frame. The unrelenting expansion of retail outlets and importing of cheap Chinese crap required a lot of trucks to haul the crap. It required a lot of trips to the mall in the minivans and SUVs by soccer moms living in our suburban sprawl paradise. In case you hadn’t noticed, the fastest growing retailer in the U.S. since 2008 has been Space Available. The well run retailers like Home Depot and Wal-Mart saw the writing on the wall and stopped expanding. The badly run retailers like Sears and JC Penney have been closing hundreds of stores. And the really badly run retailers like Radio Shack have gone bankrupt. Vehicle miles have essentially flat-lined for the last six years as retailers are closing more stores than they are opening, job growth has been non-existent and commerce within the U.S. is stagnant. If we were experiencing a real economic recovery, vehicle miles would be surging.

So this concludes my little tutorial for the Ivy League educated central bankers at the Fed and the Wall Street Journal Fed mouthpiece – Jon “I don’t understand” Hilsenrath. I know it is difficult for people to understand something when their paycheck depends upon them not understanding it, but this is pretty simple stuff. Pompous, arrogant, egocentric assholes who write for the Wall Street Journal, run JP Morgan, or control monetary policy for the world, know exactly what they have done, what they are doing, and who is benefiting. We all know the benefits of ZIRP and QE have gone only to the .1% who run the show. We know income inequality is at all-time highs. We know TPP will be passed, because the corporate fascists control the purse strings of our political class. We know the status quo will be maintained at all costs by the Deep State.

We know mega-corporations continue to ship jobs overseas and replace us with cheap foreign labor. We know the current administration actively encourages illegals to pour over our borders, swamp our social safety net, increase crime, and take jobs from Americans. We know the government has us under mass surveillance and will not hesitate to use all of that military equipment in the hands of local police against us. The will of the people is nothing but an irritant to those in power. They might not have us figured out, but a growing number of critical thinking, increasingly pissed off people, have them figured out. The debt expansion days are numbered. A deflationary depression is in the offing. The coming civil strife, financial panic, war, and overthrow of the existing social order will rival the three previous tumultuous upheavals in U.S. history – American Revolution, Civil War, Great Depression/World War II. Fourth Turnings are a *****.

Hopefully I’ve explained the situation to the satisfaction of Jon and Janet. The mood in this country is darkening by the day. There is no going back to the good old days of yesteryear. They are long gone. No amount of debt issuance and propaganda is going to work. The system is overloaded. The people are angry. The politicians are captured. The banking elite are ransacking the nation for every last dime they can get their grubby little hands on. The military industrial complex is itching for war with Russia and China. The world hates us. If you can’t see it coming, you are either blind, dumb, or an Ivy League educated economist. So go out and spend to make your slave owners happy.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.