What You Really Need to Know to Play Rising Rates and Win

Interest-Rates / US Interest Rates Jun 13, 2015 - 03:25 PM GMTBy: ...

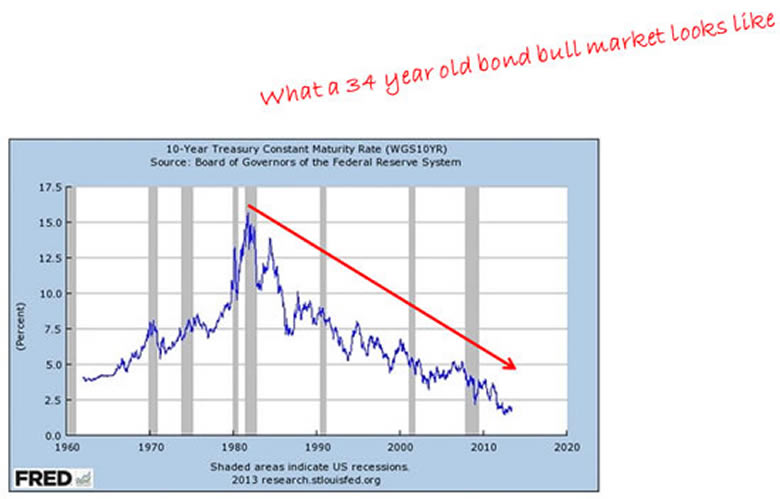

MoneyMorning.com  Keith Fitz-Gerald writes: Millions of investors are understandably flummoxed by the prospect of rising rates, and with good reason – it’s something that they’ve never had to contend with because interest rates have been on a one way trip down since 1981 when they peaked above 15%.

Keith Fitz-Gerald writes: Millions of investors are understandably flummoxed by the prospect of rising rates, and with good reason – it’s something that they’ve never had to contend with because interest rates have been on a one way trip down since 1981 when they peaked above 15%.

Naturally, Wall Street’s hype machine is in full gear and the headlines are terrifying. For every one telling you this isn’t a big deal there are 10 telling you it’s the end of the financial universe as you know it.

Worse, they’ll have you believe that you’re some kind of moron to own bonds at the moment.

Neither one of these things is true. In fact, bonds are more relevant than ever.

Today we’re going to talk about why and what you need to know to successfully profit when Team Yellen finally makes its move. And, as usual, I’m going to give you three actionable steps you can take immediately as well as two specific recommendations that can help protect your money and profit even as others are left crying in their coupons.

Here’s why bonds matter more than ever.

Wall Street has done an exceptional job of fear-mongering when it comes to rising interest rates. Judging from the headlines, they’re the worst thing in the world to own right now:

“Bond Fund Investors Feel the Pain of Rising Rates” – USA Today

“Bond Investors Beware, History Is Not On Your Side” – Seeking Alpha

“Bonds Overvalued According to Three-Quarters of Investment Professionals” – Hedgeweek.com

If you’re shaking in your boots, I don’t blame you one iota. The current bond bull market is 34 years old and it’s been a one way trip as yields have fallen.

If you’re wondering why we’re talking about a bull market and I’m showing you a chart that’s headed lower, there’s a good reason. Yields and bond prices move in opposite directions. This means that prices rise as yields fall. Conversely, when yields (rates rise) bond prices fall.

On the surface, there’s a lot to be afraid of especially when the media is playing up comments from guys like “Bond King” Bill Gross, formerly of PIMCO now of Janus.

He appeared moments before I did on CNBC this past Wednesday noting that the Fed doesn’t “know the way home.” It was a thinly veiled innuendo meaning that the Fed hasn’t got a clue how to unwind the massive stimulus-related mess they’ve created not to mention hundreds of billions in toxic debt sludge they now own.

I couldn’t agree more strongly. But here’s the thing…rising rates are not a “one and done” situation and not every bond is not toxic.

In fact, bonds have played and will continue to play a very important role in your portfolio.

Let me show you why.

Bonds Are Ultimate Proof that Slow and Steady Secures Your Financial Future

From 1970 to 2014, bonds produced a compound annual return of 6.3% according to MarketWatch data. Equities turned in an average annual compound return of 11.8%. The inference, of course, is that bonds were an inferior investment. The implication from Wall Street is that they still are, especially when it’s a foregone conclusion that rates are going to rise.

Not so fast.

The typical bond portfolio over that time frame had a deviation of only 4.1% while stocks came in at 14.8%. What this means is that stocks subjected you and your money to a ride that was more than three times as volatile. Very few investors have the stomach for that.

The key takeaway here is that you want to use bonds in conjunction with your stocks and other investments.

The other whopper making the rounds right now is that “everybody is going to dump bonds” when the time comes.

That’s simply not true.

An estimated 75% of all U.S. government bonds owned are never sold. That’s because they’re purchased by institutional investors, hedge funds, insurance companies, foreign governments and sovereign wealth funds. Those are all entities that cannot sell without mortally wounding themselves because they have to meet underlying income requirements. And U.S. government bonds allow them a measure of security in doing that.

If you’re one of millions thinking that “things could be different this time” I don’t blame you. But, here too, think again.

Where are they going to put all that money if they do sell? Europe? Nope. China? Hardly. Japan? I don’t think so. There’s simply not enough liquidity anywhere to absorb a massive bond dumping bonanza.

And, finally, the Fed has been telegraphing that it’s going to raise rates at a “measured” pace which says to me that it’s going to be the slowest normalization in recorded history.

We’re probably talking about a few basis points at a time…at most. A basis point is bond speak for 1/100th of 1% so 25 basis points is 0.25%, for example.

I realize that’s hard to understand if you’re not used to dealing with bonds, so let me flip that logic around.

Imagine you have a bond portfolio that’s got a fairly typical duration of 5.6 years right now. Bonds, ETFs, funds… it really doesn’t matter what the composition is.

To have a 20% loss on your money, you’d have to see rates rise by 4% instantly. A loss of 10% would translate into a 2% hike overnight. There’s a snowball’s chance in hell that Yellen has that kind of moxy.

My point is that the nightmare scenario being advanced at the moment is very unlikely. Instead, it’s the product of some overly active imaginations and too much Internet access. No doubt there will be some volatility, but that’s hardly unexpected.

Two Investments to Slash Your Risk from Rising Rates

Now that we have that out of the way, let’s talk about what this means for your money and how to position yourself to win as rates rise.

First, take a look at every bond investment you have. In particular, you want to look for something called “duration.” That’s the number showing how long, in years, it will take for the price of a bond to be repaid by the cash flow it creates.

The shorter your duration, the less risk you have to an interest rate hike and the less volatile your bond portfolio will be.

Various studies suggest that having a duration of five years or less may remove 70% of the volatility from your portfolio yet still allow you to capture 90% of total bond returns over longer periods of time.

Second, if you’ve got munis or muni funds, make sure you think locally, not nationally. You want a good mix here because munis represent about 10% of the U.S. bond market.

Where most investors get into trouble is that they either inadvertently or deliberately wind up using them for around 90% of their bond portfolio. So they take on risk that will bite them in the financial behind when they least expect it. Anything more than about 30% is too much (but check with your financial advisor to be sure).

And, third, rethink owing individual bonds. Funds are better for most individual investors because they can be diversified, shed risk, and continually move up the coupon ladder as rates rise. Individual bonds have to be bought and sold which can be time consuming and risky, especially when you have to duke it out with bond professionals worried about the same thing.

If you don’t yet own bonds or want to begin rotating out of longer term bonds funds (with longer durations), now’s a great time to make your move.

Here are two choices to get you started:

- The Vanguard Short-Term Bond Index Admiral Shares (VBIRX), which has an effective duration of 2.7 years and a long history of solid performance.

- The Janus Short Term Bond (JSHNX), which also offers a potentially much smoother ride that longer term bond funds in its peer group. It, too, has low expenses and a long history of solid performance.

Like anything we talk about, the key is moderation. As rates rise, you will want to gradually increase your duration… and we’ll talk the best way to do that another time.

Until then,

Keith

Source :http://totalwealthresearch.com/2015/06/what-you-really-need-to-know-to-play-rising-rates-and-win/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.