Gold Cheap on Oil Ratio Basis

Commodities / Gold & Silver Jun 17, 2008 - 09:01 AM GMTBy: Mark_OByrne

Gold closed at $883.20 in New York yesterday and was up $13.30 and silver closed at $1 7.24 up 67 cents. Gold traded in a range between $880 and $890 in Asia n and in European trading this morning prior to selling off at the open on the NYMEX .

Gold closed at $883.20 in New York yesterday and was up $13.30 and silver closed at $1 7.24 up 67 cents. Gold traded in a range between $880 and $890 in Asia n and in European trading this morning prior to selling off at the open on the NYMEX .

With oil selling off and the dollar stronger versus the euro today, gold has come under pressure. But the inflation genie is well and truly out of the bottle and central banks internationally are in an extremely difficult situation. Unfortunately, present macroeconomic conditions look set to worsen (possibly considerably) in the coming months before they get better. Stagflation is increasing by the day and this will result in gold outperforming other asset classes in the coming months as it did in the 1970's.

Bank of England Warns Inflation Here to Stay and to Accelerate

Britain's inflation rate rose more than expected in May (+3.3%) to its highest since the Labour government came to power in 1997 and the Bank of England will now have to explain in a letter how it will bring prices back under control. Bank of England Governor, Mervyn King warned that inflation was here to stay and will accelerate and exceed 4% in the coming months.

Investors are losing faith in the central bank's, including the Bank of England, ability to keep inflation low. Thus, despite a dire need for lower interest rates due to a risk of a property crash and serious recession, central banks seem to be talking tough on inflation while actually adopting a 'wait and see' approach.

At 5 percent, Britain's interest rate is the highest in the Group of Seven industrialized nations. U.K. inflation is also lower, at 3 percent in April, compared with 3.9 percent in the U.S. and 3.6 percent in May for the euro region. Britain, unlike the U.S., does not have negative real interest rates and thus has more room for manoeuvre than the beleaguered Ben Bernanke.

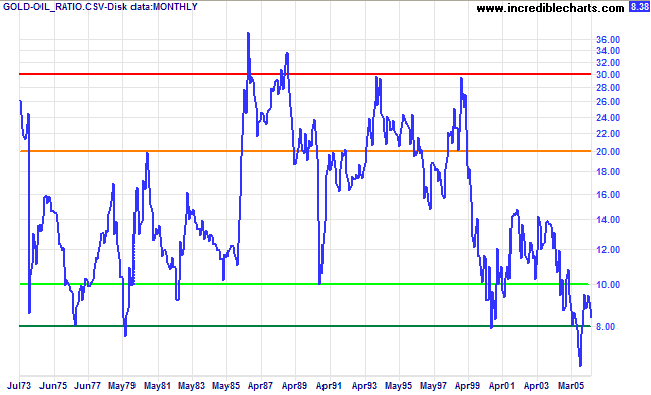

The Gold to Oil Ratio

The gold to oil ratio remains near all time multi decade lows and clearly shows gold is undervalued vis a vis the lifeblood of the global economy - black gold or oil. With gold at $880 per ounce and oil at $135 per barrel, the gold/ oil ratio is now at 6.5. The average in the last 40 years is 15. Oil has well surpassed it's inflation adjusted 1980 high of $104 a barrel ( the nominal high in 1980 was $39.50 a barrel which equals $103.76 in today's money).

Gold continues to play laggard as it often does but will outperform oil in the later stages of the bull market as recession and demand destruction leads to a fall in oil prices but leads to safe haven buying of gold. Gold's inflation adjusted high of $2,200 per ounce remains a very likely price target in the next 3 to 5 years.

Today's Data and Influences

I nvestors await economic figures on inflation at the wholesale level and the housing market. Wall Street is also expecting a report on industrial production. An hour before the opening bell investors will be looking for figures to show that the producer price index, which measures wholesale and raw material prices, rose in May. The Labour Department's index will likely draw particular attention this month because investors are looking for signs of whether increased costs for a range of commodities, including oil, will force companies to pass along higher costs to customers.

Silver

Silver is trading at $1 6.90 /1 7.00 per ounce (1 3 30 GMT).

PGMs

Platinum is trading at $20 3 5 /20 4 5 per ounce (1 3 30GMT).

Palladium is trading at $4 56 /4 60 per ounce (1 4 30 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.