Stock Market Downtrend Continues

Stock-Markets / Stock Markets 2015 Jun 07, 2015 - 12:01 PM GMTBy: Brad_Gudgeon

Last weekend, I was looking for a low on Monday, a rally into Wednesday and then down into June 8, followed by a rally into June 10 and then down hard into June 12. The low came on Tuesday, and we did rally into a Wednesday top, but the amplitude of the waves forecast was wrong. One never knows exactly how the waves will play out until one is right on top of the occurrence (later as it unfolds it becomes a little clearer).

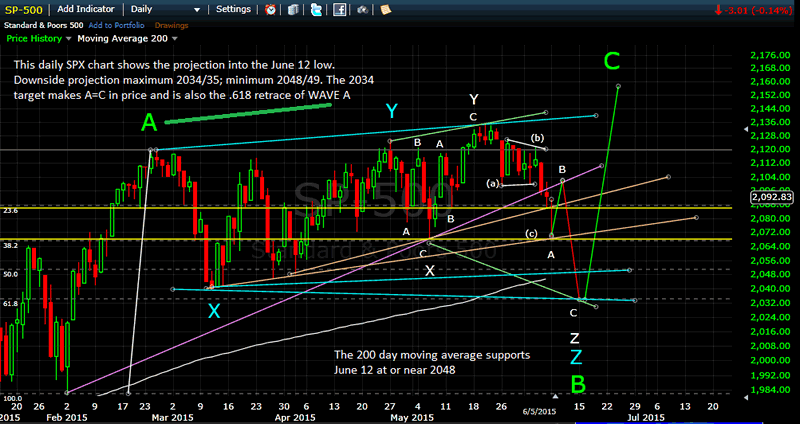

Right now it looks as though the SPX is due to go to the next pivot/support near 2067/68 on Monday. A bounce back to the bottom of the rising wedge near 2100/01 (Friday's top) would be the next expectation into Wednesday next week and then down hard into Friday. Friday's expected bottom target is anywhere between 2034/35 on the low side and 2047/48 on the high side.

The chart below explains the e-wave denotations with pivot/supports:

S&P500 Chart

Either way, SPX 2034 or 2048 we should rally strongly (+6%?) into the 24th of June (Jupiter trine Neptune June 22 indicates a topping area). I prefer the 2034 target as A=C in price and 2034 is the .618 retrace of GREEN WAVE A, but with the 200 day moving average near 2048 next Friday and the fact that 5 weeks ago, the SPX fell about 52/53 point in the same cycle position, I have included it as an alternate. I would give it a 60/40 ratio odds: the preferred over the alternate, so it could be flip of the coin. In the past 3 years, we have made a top about every 35 weeks and then fallen for 3-5 weeks at least 100 SPX points. Also, a lower wave Z of B would provide more strength for a powerful C WAVE rally. We'll see!

Astro-wise, we have Mercury going direct Thursday and Neptune going retrograde on Friday. This is a huge astro nesting for a reversal. It is also the next 4/13 TD low.

Silver and gold have been plummeting (as I had forecast a couple of weeks ago), but these, too, should reverse and go markedly higher (with the stock market) after June 12 into the week after OPEX/Futures Expiry.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.