Debt and the Tinderbox

Stock-Markets / Quantitative Easing Jun 05, 2015 - 04:18 PM GMTBy: DeviantInvestor

We know that the Federal Reserve cranked up their digital printing presses and created over $16 Trillion in new currency, swaps, loans, bailouts, gifts, etc. in response to the 2008 financial crisis. Example: Bernie Sanders says that Bank of America received over $1.3 Trillion in bailouts.

We know that the Federal Reserve cranked up their digital printing presses and created over $16 Trillion in new currency, swaps, loans, bailouts, gifts, etc. in response to the 2008 financial crisis. Example: Bernie Sanders says that Bank of America received over $1.3 Trillion in bailouts.

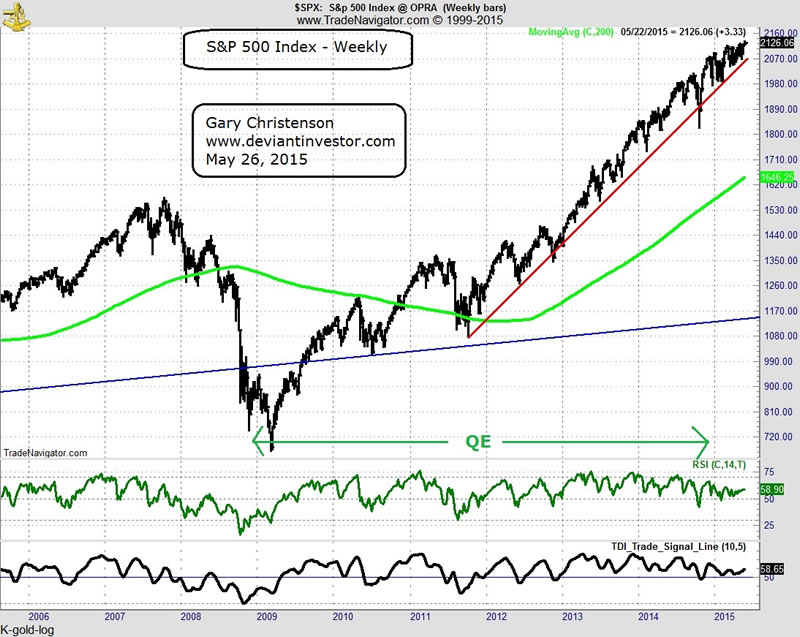

If you invested in stocks and bonds, the various QE – “money printing” programs were probably successful for you. Examine the following chart and note the impact of QE on the S&P 500 Index.

The S&P has blasted higher since March 2009 and particularly since October 2011. The Fed “printed” $Trillions, added over $3 Trillion to their balance sheet, and the stock and bond markets exploded higher.

Where is the consumer price inflation? Yes, hamburger and college tuition and hundreds of other items cost more than in 2008 (see the chapwood index) but most of the inflation has been in paper assets. Much of that created currency has NOT found its way into the real economy, as it sits on the Fed balance sheet as excess bank reserves.

Given what QE did for the S&P (see above) and bond markets (see below), a relevant question is: “What will happen to consumer price inflation, commodities, and hard assets when those $Trillions of new dollars are released into the economy. Alan Greenspan supposedly called those “excess reserves” a tinderbox of explosive inflation looking for a spark. The Fed has stated many times that they seek higher inflation and that deflation is unwelcome in their world. If those “excess reserves” were pushed into the real economy inflation would return quickly.

Perhaps the Fed is worried about unexpected consequences. Perhaps the Fed is waiting for the right moment to release more currency into circulation to boost inflation to meet a political objective, possibly an election in 2016.

Regardless of the hidden agendas, we can be reasonably certain that:

- “Printing currencies,” monetizing bonds, Quantitative Easing, and “stimulus” cannot continue forever. Such monetary madness self-destructs.

- Those excess currencies printed by central banks eventually find their way into the economy and lead to higher consumer prices. This time will not be different.

- Global debt has been reported at about $200 Trillion and is rapidly increasing. The global economy cannot afford the interest payments on $200 Trillion at historically average rates. Hence the debt must be defaulted, or interest rates much be kept low by central banks and government efforts. But low interest rates encourage more debt, which requires more interest payments. The circle is unbroken, for now.

- So we choose between low interest rates for the foreseeable future or massive defaults. But low interest rates destroy the yields for pension funds, insurance companies, and retiree savings. Defaults destroy the values for pension funds, insurance companies, and retiree savings. Hmmmmmm………

- The official US national debt exceeds $18 Trillion. The annual increase in debt runs about a $Trillion, even when interest rates are at multi-generational lows. Clearly the US government (and most other governments) can’t pay their bills, so they choose to borrow more each year, and run massive deficits even when interest rates are tiny, or in some cases, negative. What happens when interest rates rise? Deficits increase and governments borrow even more, and the cycle continues.

- Financial “lifeboats” are required unless you are a member of the political and financial elite. From Stephen King of HSBC, the world’s 3rd largest bank:

“… we can categorically state that, in the event we hit an iceberg, there aren’t enough lifeboats to go round.”

“The world economy is like an ocean liner without lifeboats.”

THOUGHTS:

- If it can’t continue forever, it will stop. We can’t fix an excessive debt problem with more debt, even though central banks are making the effort. Quantitative easing and such nonsense will have unexpected consequences and collateral damage – mostly negative for the real economy, your expenses, your savings, and pension plans.

- Lifeboats are needed.

- IQ Test: Would you rather have a million dollars in dodgy debt issued by an insolvent government paying 2% (or less) per year for 10 years, or 800 ounces of gold safely stored outside the banking system?

- It is better to board a lifeboat 3 months early than miss it by 30 minutes.

- I rest my case.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.