Kill the Export-Import Bank and Cut Corporate Taxes

Politics / US Economy Jun 05, 2015 - 10:00 AM GMTBy: Steve_H_Hanke

Former Texas Governor Rick Perry announced his candidacy for the 2016 GOP presidential nomination earlier today. Many recall his 2012 bid, which came to a rather spectacular end when Gov. Perry, on live television, forgot the name of the third federal agency he promised to eliminate if elected president. However, in a recent Wall Street Journal op-ed, Gov. Perry redeemed himself by offering a real candidate for elimination: the Export-Import Bank.

Former Texas Governor Rick Perry announced his candidacy for the 2016 GOP presidential nomination earlier today. Many recall his 2012 bid, which came to a rather spectacular end when Gov. Perry, on live television, forgot the name of the third federal agency he promised to eliminate if elected president. However, in a recent Wall Street Journal op-ed, Gov. Perry redeemed himself by offering a real candidate for elimination: the Export-Import Bank.

The Export-Import Bank (Ex-Im) provides financing and loan guarantees at below-market rates to foreign purchasers looking to buy products from American exporters. For example, if Emirates Air wants to buy planes from Boeing, Ex-Im can provide a loan guarantee, reducing the interest rate Emirates will pay and thus incentivizing Emirates to buy from Boeing rather than Airbus.

Ex-Im's supporters claim that these subsidies create jobs and finance domestic economic growth. But they fail to consider the ensuing downstream effects, which Bastiat termed "ce qu'on ne voit pas" -- that which is unseen. As the Cato scholar Daniel Ikenson makes clear, every dollar Ex-Im provides to subsidize foreign purchasers of U.S.-produced products discriminates against U.S. consumers of the same products. For example, when Emirates receives a subsidy for planes because it is a foreign company, Emirates gets a leg up on Delta.

An edifying account of how this system works was presented many years ago by the late Professor Yale Brozen in his foreword to Professor Leland Yeager's classic Proposals for Government Credit Allocation (1977):

Whom you know and with whom you have influence becomes more important in obtaining capital than how productively you can use it. Capital is diverted from more productive uses to politically determined applications.... The national income pie shrinks as an increasing proportion of our capital is allocated by the political process -- not only because of its diversion from more productive uses but also because more and more of our resources are devoted to winning political influence, as that becomes the road to access to available capital and subsidies.

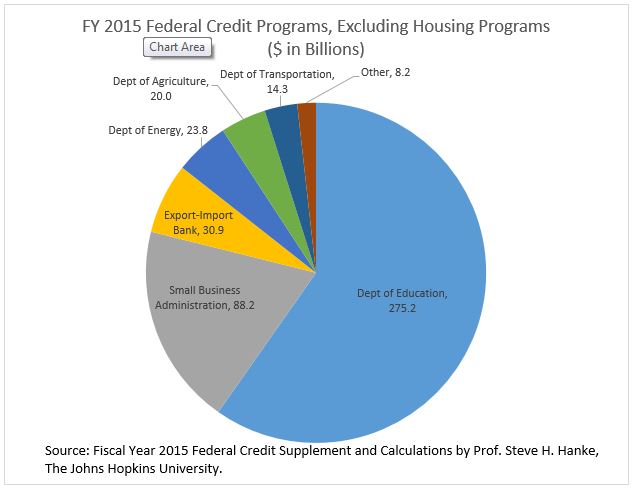

For the record, Ex-Im isn't small potatoes. In Fiscal Year 2015, Ex-Im's loans and loan guarantees will total $30.9 billion, or 6.7 percent of all non-housing federal credit programs. (See the accompanying chart.) The Ex-Im's total cumulative loans and guarantees outstanding (read: credit exposure) currently sits at $112 billion. Because the loans are granted at below-market rates, the Ex-Im does not receive fair compensation for the $112 billion of risk it takes on.

Instead of adopting a policy that makes a few U.S. exporters winners at the expense of many losers, there is a way to make all U.S. firms more competitive: Just lower the grueling corporate tax rate. Rick Perry also embraces this idea in his op-ed, mirroring what I have been advocating for years.

The message is clear: Taxes on corporations increase costs, decrease margins, and often lead to price increases. The top U.S. corporate tax rate (excluding state taxes) currently stands at 35 percent.

When our sky-high corporate tax rates are the highest of any of the 34 member countries of the Organization for Economic Co-operation and Development, something is wrong. There is clearly a better way to unburden U.S. corporations than to sponsor a "bank" in which politicians and bureaucrats, not capital markets, choose winners and losers. Rick Perry is right: It is time to move away from a mercantilist view of trade towards one that puts the market back in control. Kill the Export-Import Bank and cut corporate taxes, please.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2015 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.