Global Bond Market Rout - Draghi Says 'Get Used to Higher Volatility'

Interest-Rates / International Bond Market Jun 04, 2015 - 09:56 AM GMTBy: Mike_Shedlock

Bond Rout in Pictures

Bond Rout in Pictures

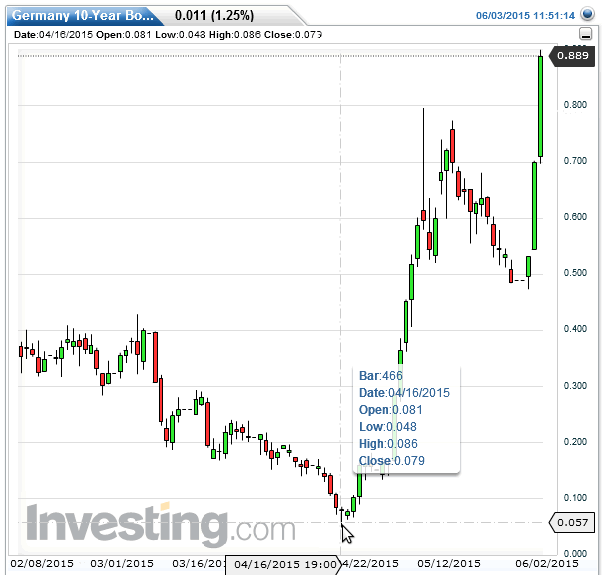

German 10-year bonds hit a yield low of .048% on April 16. Since then it's been a pretty steep uphill climb in yield (down in price).

Germany 10-Year Bond Yield

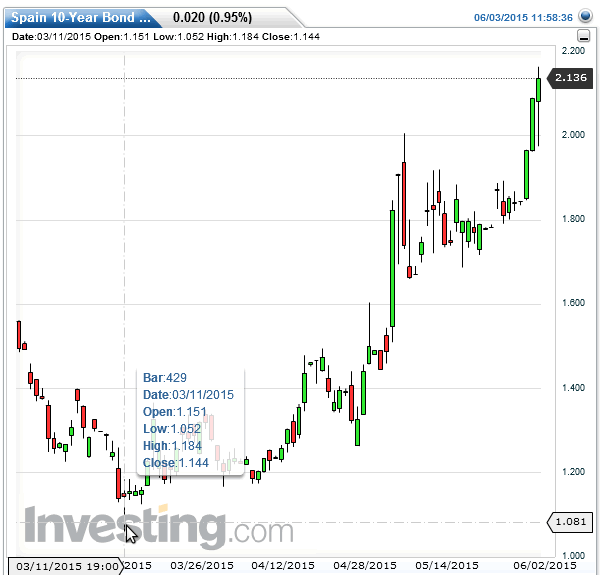

Spain 10-Year Bond Yield

Yield on the Spanish 10-year bond hit a preposterously low yield of 1.052% on March 11. It now sits at 2.136%, a rise of 108 basis points.

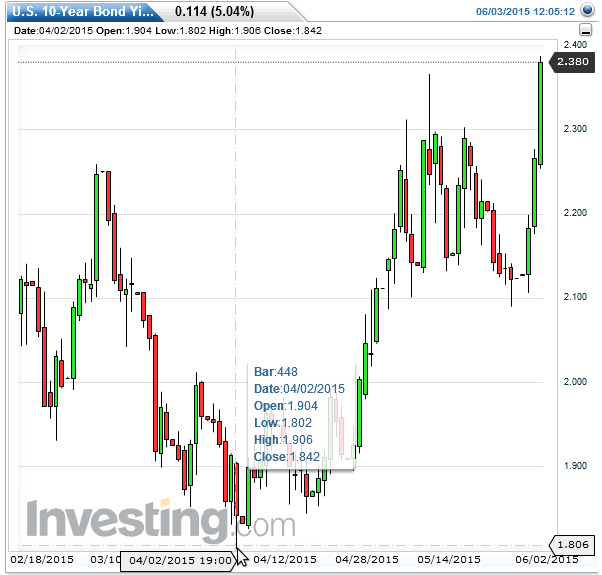

US 10-Year Bond Yield

Get Used to Higher Volatility

Bloomberg reports Draghi Says Volatility Here to Stay as Global Bond Rout Deepens.

With an insouciant turn of phrase, Mario Draghi whipped up a frenzy of selling in government bonds that left German securities on track for their worst two-day slump in the history of the euro era.

After the ECB President said markets must get used to periods of higher volatility, Germany's 10-year borrowing costs jumped to a seven-month high, Treasuries tumbled and Spanish bonds pared gains. Government bonds in the euro region extended a drop from Tuesday, when a report showed euro-area inflation rose more than economists forecast. The declines left investors sitting on a year-to-date loss for the first time in 2015.

"We should get used to periods of higher volatility," Draghi said at a press briefing in Frankfurt on Wednesday. "At very low levels of interest rates, asset prices tend to show higher volatility. The Governing Council was unanimous in its assessment that we should look through these developments and maintain a steady monetary policy stance."

US Yield Curve

Curve Watchers Anonymous puts the bond rout in proper perspective with this chart.

Comments

- Yield on the US 2-year bond (purple) and 3-year bond (green) have been steadily rising since early 2013.

- Yield on the 30-year bond (red) and 10-year bond (orange) hit recent highs in late 2013 before declining for the entire year in 2014, bottoming in January of 2015.

- Yield on the 5-year bond (blue) rose sharply in early 2013 and had meandered near 1.6% ever since.

These actions are in line with what one would expect on the short end, presuming the Fed is going to hike. Yet, if the economy was really ready to lift off as the Fed thinks, yield on the long end would be rising faster than it has.

Will the Fed hike this year?

It's still data dependent. The Fed certainly has a rosier forecast for the economy than I do.

The wild card is the Fed may very well decide to hike anyway, having yapped about doing that for years.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.