SPX Making a Double Zigzag

Stock-Markets / Stock Markets 2015 Jun 03, 2015 - 05:15 PM GMT SPX has completed a double zigzag. This does not fit a Wave (c) ending, but tells us there is a high likelihood for yet another zigzag to complete an Ending Diagonal formation. The target appears to be 2126.22, which will make it an Expanded Flat Wave [ii]. It may also delay the decline until Monday.

SPX has completed a double zigzag. This does not fit a Wave (c) ending, but tells us there is a high likelihood for yet another zigzag to complete an Ending Diagonal formation. The target appears to be 2126.22, which will make it an Expanded Flat Wave [ii]. It may also delay the decline until Monday.

However, ths analysis is void should the SPX decline beneath 2109.48. The confirmed sell trigger is still the 50-day Moving Average at 2100.73.

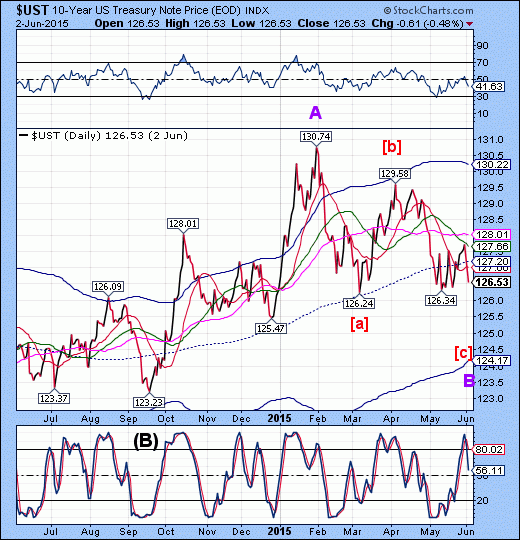

UST futures appear to have hit bottom today at 125.59. This qualifies as a Master Cycle low (259 days) for both UST and USB. I’ll attempt to get the Mid-Week report out tonight with commentary on USB.

Martin Armstrong writes, “The Fed will be forced to raise rates, and both Congress and the media will blame them for not raising rates sooner and for creating an asset bubble. They will have no choice because that is their job, as expected from the public at large. Even in Australia and Canada where there are real estate booms going on in Sydney and Toronto, criticism is rising attributing the booms to low interest rates when in fact it is foreign capital inflows that have some calling Canada the new Switzerland. The problem is always blinders on with analysts who only see everything domestically and are ignorant of international capital flows.”

Read the article in its entirety. Some of you may remember that I had done a study of the Fed Fund rates VS the 90-day T-bill rates from 1949 to 2007. Not once did the Feds raise or lower the Fed Funds rate before the 90-day T-bill rate made its move. In fact, may times they were 90-120 days behind, giving the Primary Dealers the ability to profit from the spread.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.