How To Spot A Bubble

Stock-Markets / Liquidity Bubble Jun 03, 2015 - 02:34 PM GMTBy: Raul_I_Meijer

We’ve been entertaining ourselves to no end the past couple days with a ‘vast array’ of articles that purport to provide us with ‘expert’ opinion on the question of whether we are witnessing a bubble or not. Got the views of Goldman’s David Kostin, Robert Shiller, Jeremy Grantham, Jeremy Siegel, Howard Marks.

We’ve been entertaining ourselves to no end the past couple days with a ‘vast array’ of articles that purport to provide us with ‘expert’ opinion on the question of whether we are witnessing a bubble or not. Got the views of Goldman’s David Kostin, Robert Shiller, Jeremy Grantham, Jeremy Siegel, Howard Marks.

But although these things can be quite amusing because while they’re at it, of course, the ‘experts’ say the darndest things (check Bloomberg ‘Intelligence’s Carl Riccadonna: “You had equity markets benefit from QE, but eventually QE also jump-started the broader recovery.. Ultimately everyone’s benefiting.”), we can’t get rid of this one other nagging question: who needs an expert to tell them that today’s markets are riddled with bubbles, given that they are the size of obese gigantosauruses about to pump out quadruplets?

Moreover, when inviting the opinions of these ‘authorities’, you inevitably also invite denial and contradiction (re: Siegel). And before you know what hit you, it turns into something like the climate change ‘debate’: just because a handful of ‘experts’ deny what’s right in front of their faces as tens of thousands of scientists do not, doesn’t mean there’s a valid discussion there. It’s just noise with an agenda.

And though the global climate system is infinitely more complex than the very vast majority of people acknowledge, fact remains that a plethora of machine-driven and assisted human activities emit greenhouse gases, greenhouse gases trap heat and higher concentrations of greenhouse gases trap more heat. In very similar ways, central banks’ stimuli (love that word) play havoc, and blow bubbles, with and within the economic system. Ain’t no denying the obvious child.

But even more than the climate ‘debate’, the bubble expert articles made us think of a Jerry Seinfeld episode called The Opera, which ends with Jerry doing a stand-up shtick that goes like this:

I had some friends drag me to an opera recently, you know how they’ve got those little opera glasses, you know, do you really need binoculars, I mean how big do these people have to get before you can spot ‘em?

These opera kids they’re going two-fifty, two-eighty, three-twenty-five, they’re wearing big white woolly vests, the women have like the breastplates, the bullet hats with the horn coming out.

If you can’t pick these people out, forget opera, think about optometry, maybe that’s more you’re thing.

As far as we can figure out, all you need to know today about bubbles is displayed right there in front of you if you’re able to simply imagine what asset prices would be like without the $40 trillion or so in global stimulus measures the central banks have gifted upon the banks and forced upon the rest of us.

Does anyone honestly think that prices for stocks and bonds and houses and commodities would be anywhere near where they are now without all that zombie money?

How can you even pretend that anything at all has a fair valuation these days? Central banks buy bonds up the wazoo, and there’s no way that does not drive up prices like they’re being chased by the caucasian Baltimore police force department.

Home prices have stabilized for one reason only: the beneficiaries of QE money have done one of two things: either buy up homes wholesale themselves, or sign some poor greater sucker into a loan to procure a leaking and peeling American dream at inflated ‘value’.

As for stocks, they’re supposed to reflect the state of the economy, and their record setting highs obviously do nothing of the kind, because economic performance is just as obviously many lightyears away from any record high.

In fact, the only thing that’s ‘positive’ about the economy is home and share prices. And that is because corporations engage in M&A and in buybacks the size of which people just 10 years ago would have not deemed possible, or even legal, and because that drives up share prices to levels where the many millions of greater fools get tempted to participate. Just watch China.

The flipside of this, as they will find out soon enough, is that QE and ZIRP and that entire alphabet soup completely destroy price discovery. And that means that nobody knows what anything is really worth, everyone’s just guessing, there is no correlation left to the work that has gone into producing anything, let alone to the practical value of what’s being produced.

These companies that buy their own shares can do so with credit borrowed at very low rates, so low their actual activities don’t even have to generate anywhere near an economically viable profit. They can simply borrow it.

Where and when then will these grossly bloated monstrosities burst? The clue would seem to be closely related to what Martin Armstrong had to say:

Velocity of Money Below Great Depression Levels

Ever since the repeal of Glass-Steagall by Bill Clinton in 1999, this “new” way of making money by transforming banking from Relationship to Transactional Banking has destroyed the economy in ways we are soon to discover. The VELOCITY of money has fallen to BELOW Great Depression levels. This is the destruction of Capitalism, and I fear the response against the banks on the next downturn will lead to authoritarianism.

Taking interest rates NEGATIVE will not reverse this trend – it will accelerate the trend. This is all part of Big Bang. We seriously need to understand the nature of the problem or we will lose all rights and freedom because of what the bankers have set in motion. Transactional Banking only benefits the banks and fails to create a foundation for economic growth. This is not about Fractional Banking, this is all about the destruction of Relationship Banking which creates small businesses and employment.

The collapse in the VELOCITY of money illustrates the collapse in liquidity in the markets, which will erupt in higher volatility we have not seen before. The VELOCITY of money declines as HOARDING rises. This is how empires, nations, and city-states decline and fall.

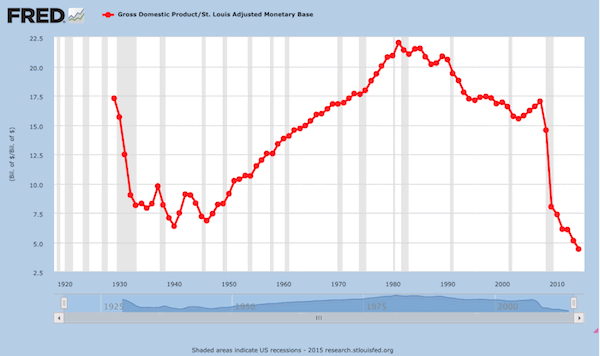

Armstrong uses the following graph to make his point, which is a series that depicts (not seasonally adjusted) GDP/St. Louis Adjusted Monetary Base.

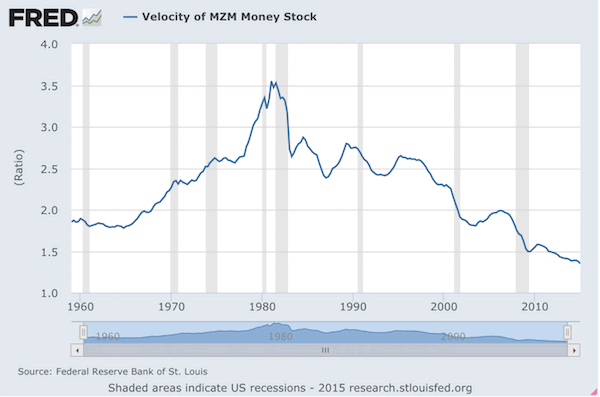

I’ll add the MZM graph (Money Zero Maturity = all money in M2 less the time deposits, plus all money market funds). It’s not as dramatic, but more commonly used (do note that the timescale is different):

It’s obvious that what ails the US economy, and all western economies, is that people are not spending. That’s what brings velocity of money down. And that’s also what causes deflation, and by that we don’t mean falling prices only.

Ergo: when Armstrong states that “The VELOCITY of money declines as HOARDING rises”, he’s half right, but only half. I’ve explained before that this is also where Bernanke’s preposterous claims about an Asian savings glut a few years ago failed in dramatic fashion.

In that same sense, I wrote recently that the ‘savings rate’ in the US is calculated to include debt payments. If you pay off your mortgage or your payday loan, that is jotted down as you saving, even hoarding your money. Just one in a long range of mind-numbing accountancy tricks the US utilizes to hide the real state of its economy. Makes one wonder what the double seasonally adjusted savings rate might be.

This issue shirks uncomfortably close to the contribution of each dollar of added debt to a country’s GDP, which in the west by now must shirk just as uncomfortably close to zero. And once it is zero, the game’s up.

That puts into perspective Jon Hilsenrath’s quasi-funny letter yesterday in the Wall Street Journal, which Tyler Durden presented with: “..to our best knowledge, this is not the WSJ transforming into the Onion.”

Dear American Consumer,

This is The Wall Street Journal. We’re writing to ask if something is bothering you. The sun shined in April and you didn’t spend much money. The Commerce Department here in Washington says your spending didn’t increase at all adjusted for inflation last month compared to March. You appear to have mostly stayed home and watched television in December, January and February as well. We thought you would be out of your winter doldrums by now, but we don’t see much evidence that this is the case. You have been saving more too. You socked away 5.6% of your income in April after taxes, even more than in March. This saving is not like you. What’s up?

The most glaring problem with this letter is -though granted, there’s quite a few- that Americans are not actually saving. Of course some of them are, but that’s not what drives the savings rate. Americans are paying off debt. They have no choice. They’re maxed out. They don’t want to lose their homes, or not feed their kids. The only jobs created have been low-paid ones. While home prices have been QE’d into a suspended state of Wile E. style false stability.

This is how you gut a society. It’s 101. Central banks’ largesse has indulged the rich with more than they can spend, while the rest get less than they need to spend to survive. Home prices are so high they keep people from spending, says Bloomberg.

That’s where the rubber hits the road. That’s where the asset bubbles hit the real economy. And they haven’t even started to burst yet, for real. When they do, the brunt of that will be borne by the real economy as well.

What will bring down our western economies is that people simply no longer have money to spend. While consumer spending in the US is still close to 70% of GDP. That won’t be solved by handing money to banks, or by keeping asset prices from reverting to their market values. Quite the contrary.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2015 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.