Euro-zone Bail-Ins Coming - EU Gives Countries Two Months To Adopt Rules

Commodities / Credit Crisis 2015 Jun 03, 2015 - 02:13 PM GMTBy: GoldCore

- 11 countries face legal action if bail-in rules are not enacted within two months

- 11 countries face legal action if bail-in rules are not enacted within two months

- Bail-in legislation aims at removing state responsibility when banks collapse

- Rules place burden on creditors – among whom depositors are counted

- Austria abolished bank deposit guarantee in April

- “Bail-in regimes” coming globally

The European Commission has ordered 11 EU countries to enact the Bank Recovery and Resolution Directive (BRRD) within two months or be hauled before the EU Court of Justice, according to a report from Reuters on Friday.

The news was not covered in other media despite the important risks and ramifications for depositors and savers throughout the EU and indeed internationally.

The article “EU regulators tell 11 countries to adopt bank bail-in rules” reported how 11 countries are under pressure from the EC and had yet “to fall in line”. The countries were Bulgaria, the Czech Republic, Lithuania, Malta, Poland, Romania, Sweden, Luxembourg, the Netherlands, France and Italy.

France and Italy are two countries who are regarded as having particularly fragile banking systems.

The rules, known as the Bank Recovery and Resolution Directive (BRRD) ostensibly aim to shield taxpayers from the fall out of another banking crisis. Should such a crisis erupt governments will not be obliged to prop up the banks. At any rate most countries are far too deeply indebted to play such a role.

Instead, the burden is being placed on the creditors. As Reuters put it

The rules seek to shield taxpayers from having to bail out troubled lenders, forcing creditors and shareholders to contribute to the rescue in a process known as “bail-in”.

However, if recent events in Austria are anything to go by, creditors now also include depositors of banks. In April, Austria enacted legislation which removed government liability for all bank deposits.

Until then, the state would protect deposits of ordinary people and companies up to a value of €100,000. In its place a bank deposit insurance fund is being set up. This fund appears inadequate to protect savers’ deposits in the event of any kind of bank failure. We covered the story in more detail here.

Each country will enact its own version of the BRRD. How vulnerable savers are in specific countries is difficult to tell at this time. The drive towards a cashless economy which has accelerated in recent months makes deposit holders and savers ever more vulnerable.

This bail-in legislation which is being driven by the BIS through the Bank of England, ECB, Federal Reserve and Federal Deposit Insurance Corporation (FDIC) appears designed to protect banks by allowing them to confiscate deposits to prop them up rather than the noble stated objective – “to shield taxpayers”.

Those who hold deposits in our banks are also taxpayers and have already paid tax in order to earn the money that is on deposit.

Allowing for the confiscation of deposits is a retrograde step and may be the last straw for an already enfeebled western banking system. It will also be very deflationary as a primary source of capital and demand – from companies and consumers – is confiscated.

Cyprus was devastated by bail-ins and has shown little sign of recovery.

Central banks claim to be attempting to avert deflation with QE and negative interest rates and not simply bailing out and aiding overly indebted banks.

However, the bail-in of deposits would again place the interests of banks over those of taxpayers and depositors. It would be very deflationary and could be the tipping point which pushes economies into a recession and depression.

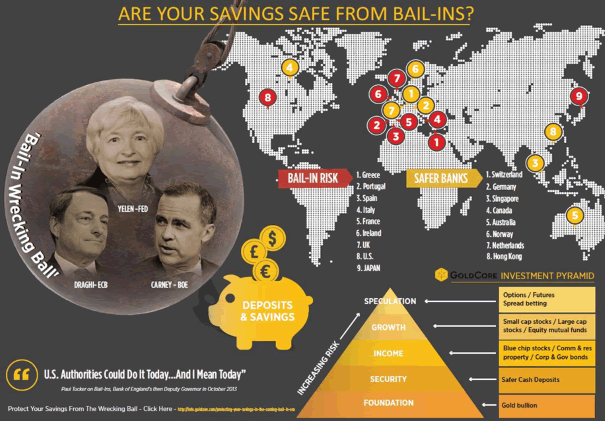

However, the key insight from Cyprus and the coming move from bail-out regimes to bail-in regimes, is that a precedent has now been created in terms of deposit confiscation. Therefore, simply having deposits in a bank is no longer the safest way to save, protect capital and conservatively grow wealth.

Conservative wealth management, asset diversification and wealth preservation will again become important and gold will again have an important role to play in order to protect, preserve and grow wealth in the coming bail-in era.

Must-read Guides:

Protecting Your Savings In The Coming Bail-In Era

From Bail-Outs To Bail-Ins: Risks and Ramifications – Includes 60 Safest Banks In the World

MARKET UPDATE

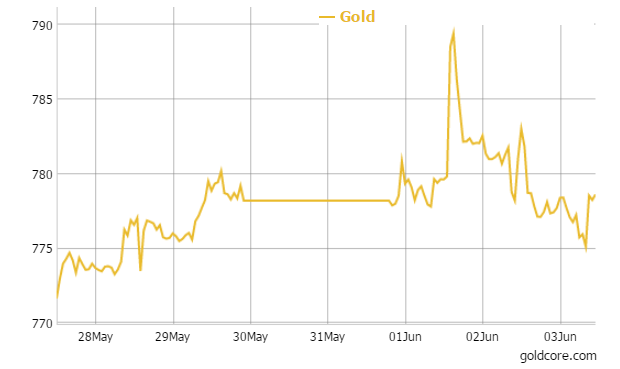

Today’s AM LBMA Gold Price was USD 1,186.60, EUR 1,067.23 and GBP 777.60 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,188.75, EUR 1,083.17 and GBP 779.91 per ounce.

Gold climbed $4.10 or 0.34 percent yesterday to $1,193.40 an ounce. Silver rose $0.06 or 0.36 percent to $16.80 an ounce.

Gold in GBP – 1 Week

Gold in Singapore for immediate delivery edged down 0.2 percent to $1,191.40 an ounce near the end of the day, while gold in Switzerland ticked marginally higher.

Gold rallied a bit yesterday on the news of weak U.S. factory orders and a feeble U.S. dollar and falling stock markets, while the market looked for closure in the Greek debt negotiations.

News that Greece outlined an agreement to deliver to the Athens government strengthened the euro and saw the dollar come under pressure.

Top gold ETF holdings were seen at a five year low yesterday. SPDR Gold Trust, the world’s largest gold exchange-traded fund, said its holdings fell 0.59 percent to 709.89 tonnes on Tuesday, the lowest since January.

Holdings of all gold ETFs are close to their lowest in nearly six years showing the very poor sentiment towards gold.

The current holding pattern on the gold price continues. The non farm payrolls number on Friday will be keenly watched for signs about how bad the slowdown in the U.S. is.

In late morning trading gold bullion is down 0.43 percent at $1,188.43 an ounce. Silver is off 0.76 percent at $16.64 an ounce and platinum is down 0.12 percent at $1,111.67 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.