Has Bitcoin Price Down Move Begun?

Currencies / Bitcoin Jun 02, 2015 - 04:47 PM GMTBy: Mike_McAra

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

More banks are looking into the possibility to use Bitcoin's underlying technology, the blockchain, to develop their own solutions without necessary relying on Bitcoin itself, we read on the American Banker website:

Ask a U.S. banker about the prospects for Bitcoin, a digital currency with no trusted central authority or mechanism to reverse transactions, and you're likely to get a lukewarm answer.

But financial institutions are increasingly taking an interest in Bitcoin's recordkeeping system, known as the blockchain, a so-called distributed ledger that can be used to track much more than stateless electronic tokens.

Bank of New York Mellon, for example, has created its own digital currency, BK Coins, and built an employee recognition application that rewards IT staff with the tokens, which can be redeemed for gift cards and vouchers. CBW Bank, an innovative community bank in Weir, Kansas, is building a risk management system incorporating cryptocurrency technology. USAA has a team of researchers looking into the potential of the blockchain.

These institutions see possibilities for efficiency and security improvements in areas like payments and securities handling through the use of the blockchain.

The banks are not so much interested in Bitcoin as they are in the digital ledger, the blockchain, that underlies the system. By using such a ledger separate from the Bitcoin systems, banks will try to adapt the system to their needs. A ledger system might offer advantages in the form of reduced transaction costs, speedier transfers of funds, confirmation of data, and other things the banks might have even not thought about yet.

We still are of the opinion that startups will provide much of the needed development. Banks are not traditionally initiative organizations. They might look at the Bitcoin technology but it still seems that new innovative companies will provide the necessary solutions, which might then be used by the banks.

For now, let's take a look at the charts.

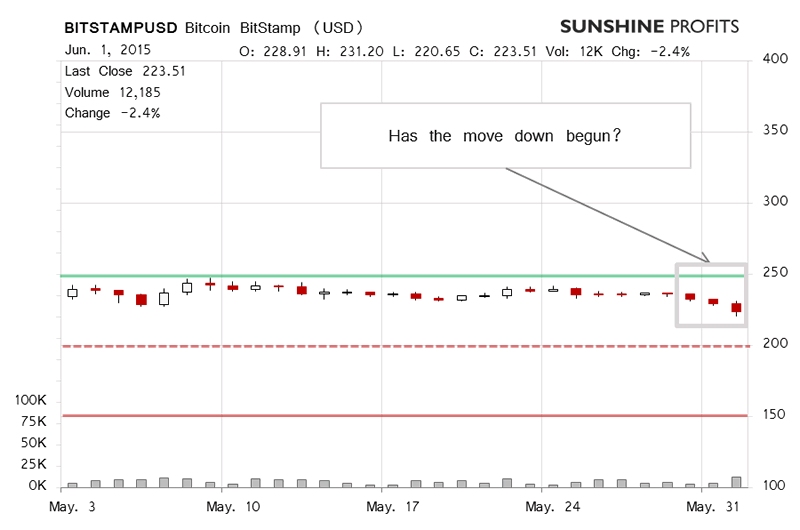

On BitStamp, we see a move down, and the situation now looks more bearish than it did yesterday. Recall our comments from yesterday:

(...) we see a move down, yesterday and on the day before, which looks stronger than what we had seen in the preceding days. This was not confirmed by volume, however, as the trading didn't really pick up. The question now is whether a move down has already started.

Today (...), there has been an uptick in volume, not a huge one, but a visible one nonetheless. (...)

So, there has been a move down in line with our remarks but is it the beginning of a more significant move? It might be, but we wouldn't be overly optimistic about such a move. There has been no strong confirmation so far. The short-term outlook has deteriorated but most of the move might still be ahead of us.

We saw a confirmation in volume as it went up decisively yesterday as the move down deepened. The volume was the highest since April 30, 2015. Today, the move has been to the upside (this is written around 9:00 a.m. ET) but not really strongly so. Does this mean that the move down is over? We wouldn't bet on it. It seems that we might see a breather but our take is that the move down might still continue.

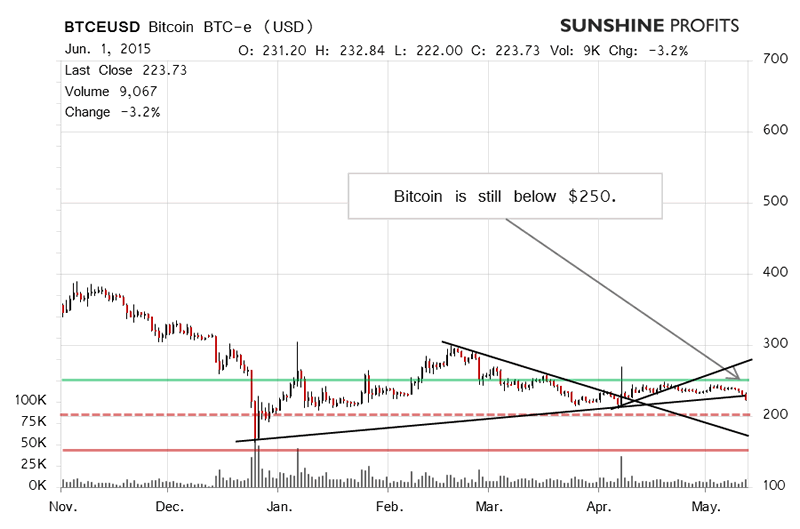

On the long-term BTC-e chart, we see Bitcoin below $250 (green line) and now also below a possible rising trend line based on the January and April local bottoms. There has been only one daily close below this line, mind, so the implications don't seem too bearish at this time but may as well get a lot more bearish in the next couple of days.

In other words, we might have seen a beginning of a more significant move down, which could bring Bitcoin down perhaps to $200 (dashed red line) but, in our opinion, the move hasn't ended yet. If we see another day or two of Bitcoin trading at the levels we're seeing today, the already bearish outlook will become even stronger. Along the same lines, our hypothetical short positions might become even more profitable.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.