How To Profit From A Bursting Bond Bubble

Commodities / Resources Investing Jun 02, 2015 - 04:36 PM GMTBy: SecularInvestor

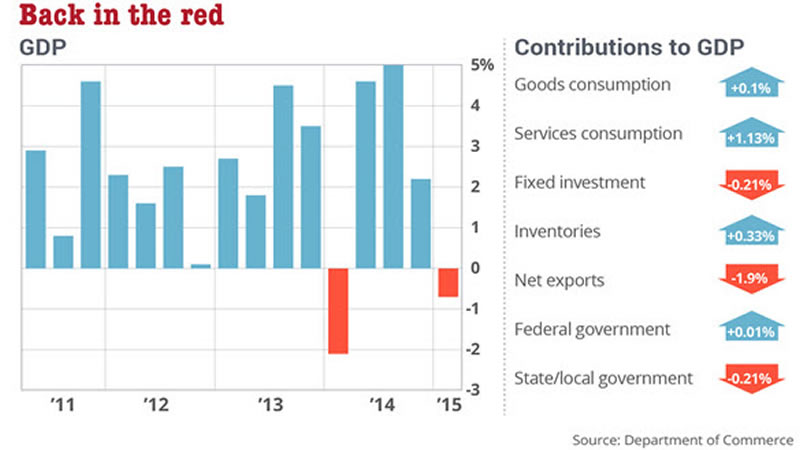

Recent economic data do not show much strength, at least not in the U.S. The Q1 Gross National Product in the U.S. pointed to an economic contraction of -0,7%. It was the second consecutive year in which the economic activity declined quarter-on-quarter. That has not happened since the credit crisis of 2008. Chart courtesy: Marketwatch.

Recent economic data do not show much strength, at least not in the U.S. The Q1 Gross National Product in the U.S. pointed to an economic contraction of -0,7%. It was the second consecutive year in which the economic activity declined quarter-on-quarter. That has not happened since the credit crisis of 2008. Chart courtesy: Marketwatch.

The American economy clearly has been impacted by the strengthening dollar. But we also believe that real growth is fading. Additionally, we know an interest rate hike will occur sooner or later, which will undoubtedly have economic repercussions. Considering those elements the peformance of the broad averages should not come as a surprise.

It seems that the American economy, as well as its monetary policy, are arriving at some sort of “end point.” What is the reason for continual stimulation of an economy, which after 5 years of extreme stimulus, is not growing?

This will be a tough challenge for financial markets in the years to come.

However, every problem contains an opportunity. Likewise, every crisis creates new heroes. John Paulson became famous because of his ‘Big Short’ in 2008. He traded the other side of those financial products which were so hot in the real estate market before the financial crisis hit (ABC’s, CDS, CDO’s, MBS, etc). John Paulson became a multi-billionaire.

Today, we see another rich investor who has turned his attention to the next ‘Big Short.’ His name is Paul Singer. Do not forget his name. He is calling his trade ‘the Bigger Short’!

Singer is telling his subscribers today the same thing we have been telling our subscribers for years. The monetary interventions of central banks are unprecedented and have never been implemented on such a large scale. Therefore, even the monetary masters (i.e. central bankers) find it impossible to predict the effects.

Singer is convinced these policies will have dramatic effects on the bond market, sooner or later. Consequently, his “Bigger Short” is focused on government bonds … from all over the globe!

“Bond holders still believe it is safe to own 30-year German government bonds with a yield of 0,6%, or 20-year Japanese bonds with a 1% yield, or American 30-year Treasuries with a 2% rate. That is an unrealistic belief.”

Obviously, Paul Singer is correct. However, he does not want to be the first one to short bonds. Many have tried to short bonds but were hurt by the ongoing outrageous bond bull market. Still, Singer believes that the current bond market justifies a short trade from a risk/reward perspective.

Only time will tell whether Singer will become the “next Paulson.” We definitely support Singer’s vision in theory, but from a practical point of view we prefer to execute differently. The rationale behind our vision is that a collapse in the bond market will lead to a gigantic exodus of capital which will seek new investment opportunities.

Instead of shorting bonds we believe it is better to invest in the assets that will benefit from the capital that will come out of bonds. We believe an exodus from bonds will be inflationary, hence we are looking into inflation sensitive assets: commodities, precious metals, and stocks. We believe they will be the next secular trend, and recommend secular investors focus on those segments.

We do not see a bust coming, similar to the collapses of 2000 and 2008. The exit of capital out of the bond markets will be a slow process which will take years. An appropriate analogy would be a tanker leaving port. It will initially move extremely slowly, but once it has picked up speed, there is no way to stop it!

We believe that commodities will benefit not only from the inflationary effect, but even more importantly, supplies are shrinking. The inexpensive minerals in the earth are being exhausted and are less available each year.

Oil, copper, zinc, … it is increasingly difficult and expensive to mine those assets. Not coincidentally, China is very focused on most of those commodity segments. Why? On the one hand, the Chinese are bargain hunters. But also, that country has a culture with a focus on long term value, so they must be recognizing that there is enormous value at current prices. Hence, it is very likely that it is China’s “Big Short” trade, in line with ours.

Mark Bristow, chief executive officer at South African-based Randgold Resources Ltd., recently explained that gold companies are mining “a shrinking reserve base,” adding to it there is no way they can continue to mine a declining reserve grade at current prices. The price has to go up, or production has to come sharply down.

New gold discoveries are at their lowest level in decades. Gold production is expected to peak in 2015. That is because the typical development cycle between discovery and production lasts 20 years, and peak discovery took place in 1995 (source: Eugene King, Goldman Sachs).

China answer in the precious metals market is one of increasing control. It is empowering its Shanghai Gold Exchange to experiment with a gold price fix denominated in yuan. That should give more weight to be a price setter on the global market, as currently the COMEX futures market and the London fix are in a dominant position. Meantime, China is steadily increasing its gold reserves, month-on-month, year-on-year.

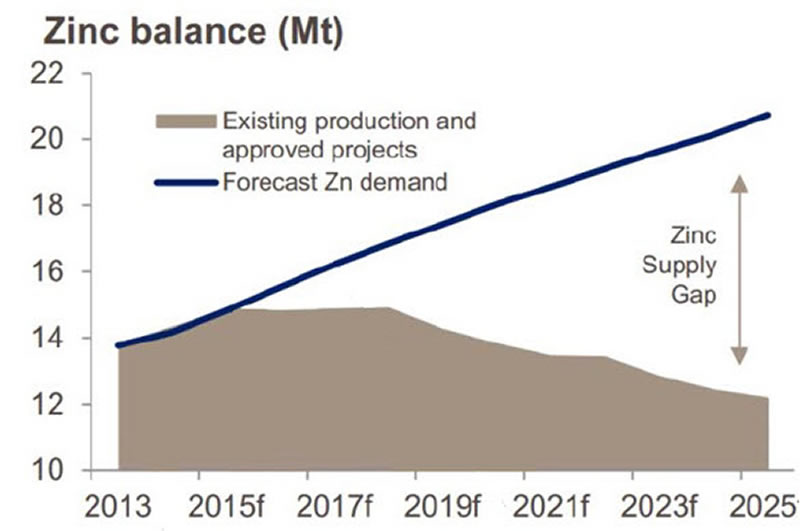

Another example with different market dynamics is zinc. In 10 years we might be looking at a yearly shortage of 10 million tons of zinc on the global market if we continue down the current path of supply and demand. At this point it is unclear where all the extra zinc will come from to satisfy the growing global demand, especially from Asia. Chart courtesy: Glencore, CRU Metals, via Foran Mining Corporation.

About 48% of the total demand for zinc comes from China and this number is expected to go up, since China is still in full expansion-mode and the demand for zinc is expected to rise by 6% per year on average until 2020.

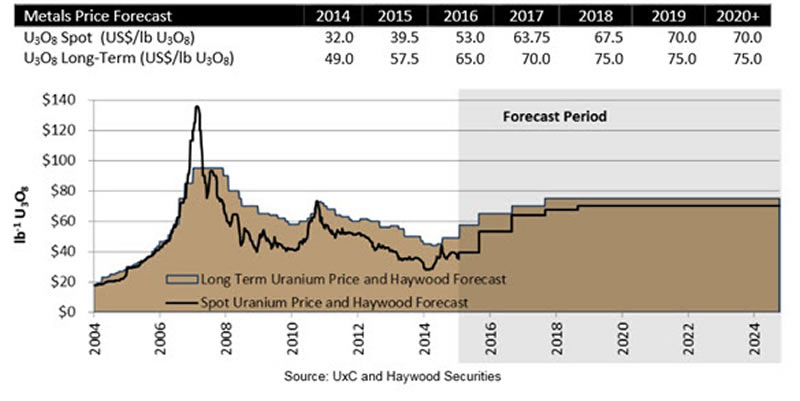

What to think about uranium? Its small size does not reflect the true demand. Additionally, it is a critical asset for the economy since the richest countries in the world use nuclear energy.

Every uranium contract offered on the market has been bought by China for several years. As the world has recently stopped offering contracts to them, because of the extremely low uranium spot price, China reacted by buying uranium deposits globally. That is what Mr. Wang Ying said, chief executive of the CNNC (China National Nuclear Corp), during a recent interview. The Chinese Republic has committed to make the acquisitions in 5 years. The aim of the Chinese authorities is to increase their nuclear capacity from 17 Gigawatts today to 58 Gigawatts in 2020.

Our vision is that hard assets will continue to play a key role, both economically as for investors. In that respect, we believe that China is setting the scene: the country is making use of the current cheap valuation of most commodities. Secular investors should follow that example, in our view.

Our Commodity Report is created for secular investors. Read the newest edition.

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.

Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

© 2015 Copyright Secular Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.