Greek Government Favours Drachma - Won't Bow to Blackmail

Currencies / Eurozone Debt Crisis Jun 02, 2015 - 04:31 PM GMTBy: GoldCore

- Merkel, Hollande, Juncker, Lagarde and Draghi in “emergency” meeting re Greece

- Merkel, Hollande, Juncker, Lagarde and Draghi in “emergency” meeting re Greece

- Bankrupt Greece must find €1.6 billion to pay IMF in June

- First instalment of €300 million due on Friday

- Leaders of EU, IMF and ECB hold emergency summit in Brussels

- 58% of Syriza membership in favour of returning to Drachma

- Unforeseeable consequences and risks of ‘Grexit’

An emergency meeting was held in Berlin last night between Angela Merkel, Francois Hollande, EU Commission President Junker, Christine Lagarde of the IMF and ECB president Mario Draghi. The meeting was reported to have continued past midnight.

The discussions were apparently aimed at formulating a “take it or leave it” offer that would be acceptable to the Syriza government that would allow the remaining €7 billion of the existing bailout package to be unlocked so that cash can be handed back to Greece’s creditors and avoid a default.

Greece, a country whose own finance minister has described it as “bankrupt” is due to pay the IMF €1.6 billion over the course of June. The first instalment of four – totalling €300 million is due this Friday.

There were fears that the country would not be able to pay its public sector wages in May demonstrating the very fragile state of its finances. It would appear that the European leadership and that of the IMF and ECB also fear the state of Greece’s finances and its ability to make its payments to the IMF this month.

A recent poll suggests that 58% of Syriza supporters would rather return to the Drachma than to remain in the single currency while severe austerity measures are imposed. Syriza have a 26 point lead over the next most popular party, New Democracy.

From this point of view it is, therefore, not entirely politically untenable for Syriza to choose the default and exit option should the “institutions” fail to respect Prime Minister Tsipras’s “red line” on VAT hikes, pension cuts and labour market reforms.

Greek 10-year bond yields have been creeping higher – currently at 11.49% – indicating that the markets view the risk of a default as being quite high.

The “institutions”, however, are likely to want to keep Greece in the fold at any cost. In a softening of tone Junker told German newspaper Süddeutsche Zeitung yesterday:

“Anyone who doesn’t see there is a humanitarian crisis in Greece is deaf and blind to what is happening there.”

The unforeseeable risks posed by a default and “Grexit” to the Euro project are too great for the powers that be to wilfully allow it to happen. It could trigger credit default swaps and a derivatives crisis in the banking system.

It might also lead to a geopolitical crisis should erstwhile NATO member Greece turn to Russia for financial assistance in the form of funding, trade, economic and other cooperation agreements.

The consequences of making an acceptable offer to Greece may also be unforeseeable. In the short term it may buy time but in the longer term it is hard to see how Greece can come off life-support without a large scale write-off of some of its debts.

It may also embolden anti-austerity groups across Europe, particularly those in heavily indebted Italy and Spain.

The threats posed by the Greek situation to the euro – and indeed the threat posed by the entire European economic situation to the euro – make holding gold outside the banking system a vital form of financial insurance.

History and recent academic studies show that gold protects wealth from financial and economic risks.

Must Read Guide:

Gold is a safe haven asset

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,188.75, EUR 1,083.17 and GBP 779.91 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,187.30, EUR 1,088.29 and GBP 780.40 per ounce.

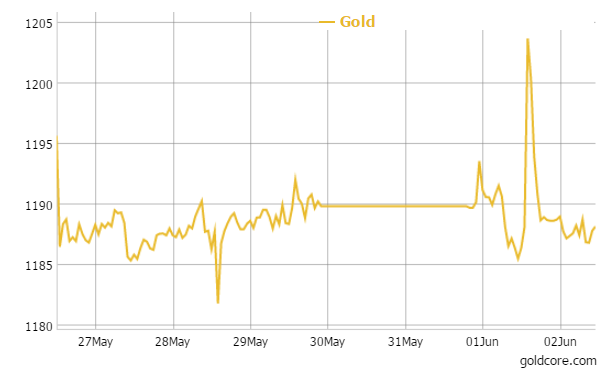

Gold fell $0.40 or 0.03 percent yesterday to $1,189.30 an ounce. Silver rose $0.01 or 0.06 percent to $16.74 an ounce.

Gold in US Dollars – 1 Week

Gold in Singapore for immediate delivery was marginally lower at $1,189.30 an ounce while gold in Switzerland was also in lockdown and continued tethered to the $1,190 level.

Gold remains capped under the psychological $1,200 an ounce level. Gold saw a sharp rally yesterday to over $1,203.50 per ounce from $1,185 per ounce. Gold was up nearly $20 or 1.5% and on track for its biggest daily rise in more than a fortnight prior to determined selling which saw prices back to exactly where they had started – down 40 cents for the day.

Gold saw even greater gains in euro terms as the euro weakened due to concerns about Greece but the euro has strengthened today which has capped gold’s gains.

Some attributed gold’s sharp rally to U.S. Federal Reserve Vice Chairman Stanley Fischer’s dovish comments that it would be a mistake to assume that financial crises are at an end. However, if this was the case it is hard to fathom why gold suddenly reversed the move higher and then gave up the gains nearly as quickly as they had been gained.

Mixed economic data is not giving a clear picture of the U.S. economy. This week’s jobs figures on Friday will be watched closely for any clues on the interest rate hike long mooted by the Fed.

The largest gold backed ETF, SPDR Gold Trust holdings dipped yesterday by 0.25 percent to 714.07 tonnes its, the lowest since mid January.

Meetings continue between the IMF, ECB, German Chancellor Angela Merkel, French President Francois Hollande and Jean-Claude Juncker European Commission President to discuss a “final proposal” ahead of Greece’s deadline on Friday for its first €300 million payment due to the IMF.

In late European trading gold bullion is down 0.10 percent at $1,187.87 an ounce. Silver is off 0.43 percent at $16.67 an ounce. Platinum is up 0.21 percent at $1,106.10 an ounce while palladium is marginally lower at $776.10 per ounce.

Platinum is trading near an 11 week low, and is at a discount of $90 an ounce to gold, which is its cheapest to the yellow metal since January 2013.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.