Dangerous Debt Trend And What It Could Do to Your Wealth

Interest-Rates / Global Financial System Jun 01, 2015 - 05:50 AM GMTBy: Investment_U

Andrew Snyder writes: It is a fascinating trend - something every investor must be aware of. It’s yet another reason interest rates are likely to stay lower for far longer than most folks ever expected.

Andrew Snyder writes: It is a fascinating trend - something every investor must be aware of. It’s yet another reason interest rates are likely to stay lower for far longer than most folks ever expected.

If rates rise, after all, countless governments are in big trouble.

Everywhere we look, return-desperate investors are turning to the debt market and its virtually free money. It’s one thing when companies use borrowed money to buy their own shares. It’s a victimless crime.

But when governments use a similar trick to artificially lower their pension burden, we’re all at great risk.

If you pay attention to the political news, you may have heard of pension obligation bonds (POBs). They’re a dangerously popular tool governments have turned to as the half-cocked answer to their problems.

They borrow money from the debt market and turn around and put it in the stock market. Think of it as an arbitrage play. The spread between the debt and the return from the stock market (if things work out) is profit.

On paper, it can temporarily erase a city’s or state’s pension deficit. In reality, it’s incredibly dangerous. If this sort of arbitrage actually worked, the whole world would be rich.

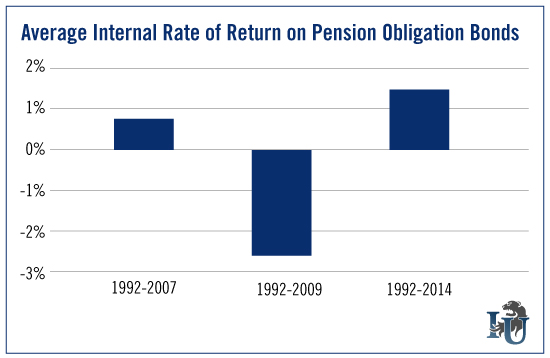

Proving the point, a recent study looked at nearly 300 pension obligation bonds and found that, like ordinary investors, most governments were borrowing and investing when the market was at its peak... virtually guaranteeing losses, making their fiscal problems worse.

That was certainly the case in Detroit, where the government borrowed billions in the high-flying years leading up to the 2008 meltdown. The scheme is what ultimately helped push the city into bankruptcy, after a $1.44 billion POB deal ended up becoming a $2.8 billion liability as its credit rating sank.

Further south, Puerto Rico is facing its own fiscal mess. Earlier this month, billions of dollars’ worth of its POBs traded for a mere $0.37 on the dollar. Most of those bonds, sadly, are owned by the citizens of the American territory.

If their government can’t make good on its debt... they lose.

It blows our mind, but despite Detroit’s and Puerto Rico’s horrible experience with pension obligation bonds, states are lining up to take advantage of low rates by launching a Ponzi scheme of their own.

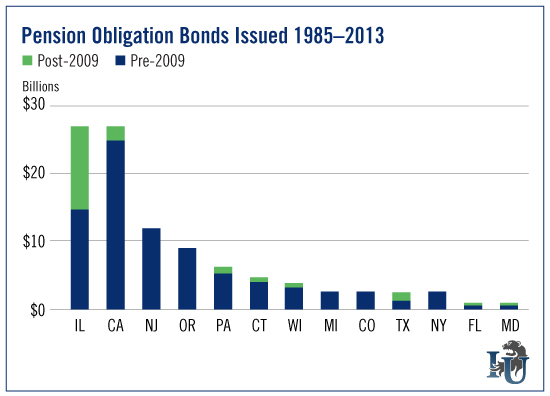

Pennsylvania - my home state - made news this week when its rookie governor unveiled his idea to issue $3 billion worth of debt. Kansas just approved a billion bucks worth of POB debt. Connecticut borrowed $125 million and the Atlanta school district has plans to borrow $400 million to cover pensions for bus drivers and cafeteria workers.

Again, on paper, the idea can work... as long as money stays cheap and stocks keep rising.

But let’s not forget Yellen is busy talking herself into a corner. She’s virtually forced the Fed to raise its key rate over the next nine months. If she pushes rates higher, though, by any material amount, the free-money stock market bonanza will be over. The ticker-tape confetti will stop falling from the sky.

When it does, countless cities, states and school districts will suddenly see their schemes fall apart.

Frankly, it’s an unaffordable risk. Yellen and her monetary maestros at the Fed know it.

They know they created an addiction. They know they are now in control of far more than just inflation and employment levels.

Right now, they control the fate of our economy.

What’s most frightening, though, is they aren’t alone. Central banks across the planet are in the same situation. Case in point... the situation in Greece. Cheap money is the country’s only saving grace. If the European Central Bank reverses course, Greece sinks even faster.

It’s the same story in China, Japan and England.

As an investor, you absolutely need to be aware of this trend. We often talk about the idea of financial education. But don’t be mistaken. We’re talking about far more than the ability to read a balance sheet or understanding the key metrics.

That’s vital knowledge... but you can learn it anywhere. Instead, we urge you to learn how to connect the dots, how to uncover the unspoken trends and see the truth behind the headlines.

What’s happening across the globe is not good. Debt is a dangerous tool. But if you’re informed about what’s going on and what it means, you can avoid the fallout.

Understand our leaders are addicted to debt. Know what’s happening... and what it means for your wealth.

I am flat-out convinced this trend - the planet’s addiction to cheap money - will keep interest rates in artificially low territory for far longer than most folks think.

As we’ve seen over the last five years, that’s good news for stocks.

Good investing,

Andrew

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.