US Economy – Semi b2b Amps Up its Trend

Economics / US Economy May 28, 2015 - 06:00 PM GMTBy: Gary_Tanashian

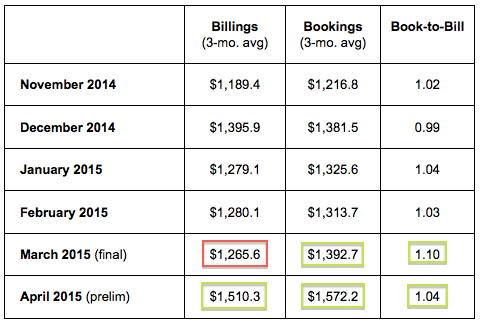

A quick review for newer subscribers: In Q1 2013 we noted that the Semiconductor Equipment industry was in “ramp up” mode per a personal source in the industry. After that pivotal period, we have relied on the Semi Equipment ‘book-to-bill’ ratio as a monthly checkup on what is often an important economic leading indicator. The Canary chirped in 2013 and it is still singing a sweet song today.

A quick review for newer subscribers: In Q1 2013 we noted that the Semiconductor Equipment industry was in “ramp up” mode per a personal source in the industry. After that pivotal period, we have relied on the Semi Equipment ‘book-to-bill’ ratio as a monthly checkup on what is often an important economic leading indicator. The Canary chirped in 2013 and it is still singing a sweet song today.

For forward looking purposes we note that it is the bookings, not billings that matter.

The graphic is, as usual, from SEMI.org (w/ my mark ups) as is this quote…

“Both bookings and billings trends have improved, with the ratio remaining above parity over the past four months,” said Denny McGuirk, president and CEO of SEMI. “Orders are higher than last year’s numbers, and current spending is on target with 2015 capex plans.”

NFTRH 343’s opening segment reviewed the US economy, including the following…

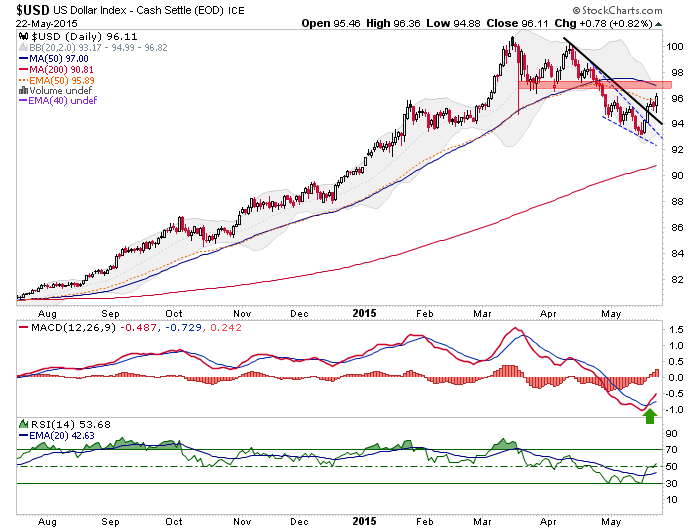

- But again, the USD has taken a correction and as the macro ripples along, might we expect an ephemeral improvement in economic data due to USD weakness?

- We may play Whack-a-Mole with short-term data popping up and down but it still looks like cyclical changes are coming on a 1 () year horizon.

I’d say that yes, we might expect a ripple of economic improvement, notably in coming ISM manufacturing reports. That is in keeping with the original thesis that Semi would lead manufacturing, which would lead the economy and ‘Jobs’.

The US dollar plays a central role here as well, as its strength out of last summer pressured manufacturing and exports and even helped depress the Semi Equipment makers to a degree. April is the month that USD cracked and began to correct hard.

So the strong b2b implies that we may see one of those ripples in the economic data. We should try to stay ahead of these shorter-term trends (for survival and moderate capital appreciation) while at the same time staying focused on the big picture as well (for future investment and exceptional capital appreciation potential).

The early-April to mid-May drop in USD may well pump future economic data to some degree. It is just something we should be aware of as a factor in the game of economic Whack-a-Mole we noted last week.

A lot will depend on what USD does at 97 area resistance. Elliott Wave people might be able to tell you whether the USD has conclusively ended its correction or not. But I, using simpler TA, am not. I am from the ‘keep it simple’ KISS school after all. What I am able to tell you is that certain sensitive economic data have already bounced and other data are likely to bounce (at least to a minor ‘bump’ degree) due to USD weakness.

If the USD resumes its bull market that data improvement would likely prove very temporary. If USD takes a harder correction, it would probably be a tail wind for the stock market and the capital equipment/exports segments of the economy. I am very interested to see what the Machine Tool sales data were for April and will update that as soon as it is released. [edit] We updated this on May 26.

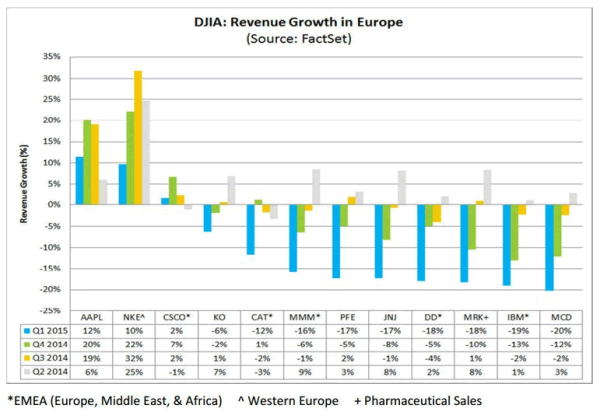

From FactSet.com we get an update of the Dow 30 components and their still weak European sales. Understand that this data was compiled while the USD was still relatively strong and had been on a relentlessly strong trend for about 8 months.

From FactSet: “The stronger dollar was clearly a key factor in the weaker revenue performance in Europe. Of the 12 companies in the DJIA that provided revenue growth numbers for Europe, 11 cited a negative impact on revenues or EPS (or both) for Q1 due to unfavorable foreign exchange during their earnings conference calls. Seven of these 11 companies specifically discussed the weakness of the euro relative to the dollar during these same earnings calls.”

The nature of the current stock market is to look for things to be positive about in order to ‘buy buy BUY!’ stocks. As the Fed fades to the background for a couple of months (the market is apparently taking June off its radar for a rate hike) might not a bump in economic data be just the tonic for this groaning, wheezing, sideways going market?

Just one scenario among several could be a ‘sell in May’ downturn in May or June (to small or larger degree), followed by a data (and sentiment) driven recovery (the ole’ summer rally) as Q2 earnings season kicks off in July.

That is just one guess. We will need to update the process weekly and simply stay in tune with it. Gold would be in trouble short-term in this scenario (more troubling short-term aspects for this sector to follow) “as the macro ripples along”.

So without further delay, let’s move on to update the usual markets… which is what NFTRH 344 proceeded to do, in depth. Consider joining NFTRH for well rounded analysis at a very affordable rate compared to services offering only a fraction of our coverage area.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.