The Chinese and U.S. Economies Are Bubble-Thin

Stock-Markets / Liquidity Bubble May 24, 2015 - 09:07 PM GMTBy: ...

MoneyMorning.com  Michael E. Lewitt writes: The Shanghai Composite Index soared by 8% last week to its highest level since 2008 and is up about 130% over the last year.

Michael E. Lewitt writes: The Shanghai Composite Index soared by 8% last week to its highest level since 2008 and is up about 130% over the last year.

The Shenzhen Composite Index jumped by 12% last week and is up 166% over the same period and is now trading at 66x earnings according to Bloomberg, three times the level of the Shanghai Index.

How do you spell "bubble" in Chinese?

In China, the "Casino" Was Open Last Week

What caught investors' eyes last week was the plunge in Hong Kong listed Hanergy Thin Film Power Group's (OTCMKTS: HNGSF) stock, which collapsed by 47% and cost China's richest man $15 billion.

Hanergy is a maker of thin-film solar panels whose stock has soared by 600% over the last two years. The company is controlled by privately held Hanergy Group, which is headed by founder Li Hejun, who was listed by Forbes as China's richest person before last week's stock collapse. Most of Hanergy's sales are made to its parent company, which should raise questions if anybody was worried about the fundamentals of the company. But in China's stock market, fundamentals don't matter. The only thing that matters is momentum and whether the government is perceived to be supporting a stock. This isn't investing, it is gambling.

While the millions of uneducated Chinese who are opening trading accounts may not know better, American investors should know better. Yet U.S. investors got burned by Hanergy last week nonetheless. A U.S.-listed exchange traded fund (ETF), Guggenheim Solar ETF (NYSearca: TAN) held 12% of its $439 million of assets in HNGSF stock and lost 8.6% on the week. Investors need to understand their ETF holdings to avoid these kinds of blow-ups.

Stocks are Expensive and Fed Meddling Won't Help

Back in the U.S.A., markets were quiet. The Dow Jones Industrial Average lost 41 points or 0.2% to close at 18,232.02 after closing earlier in the week at a new record of 18,312.39. The S&P 500 rose 3 points or 0.2% to 2,126.06 after also hitting a record high of 2,130.82 a few days earlier. The Nasdaq Composite Index, powered forward by Apple, Inc. (Nasdaq: AAPL), added 41 points or 0.8% to 5089.39.

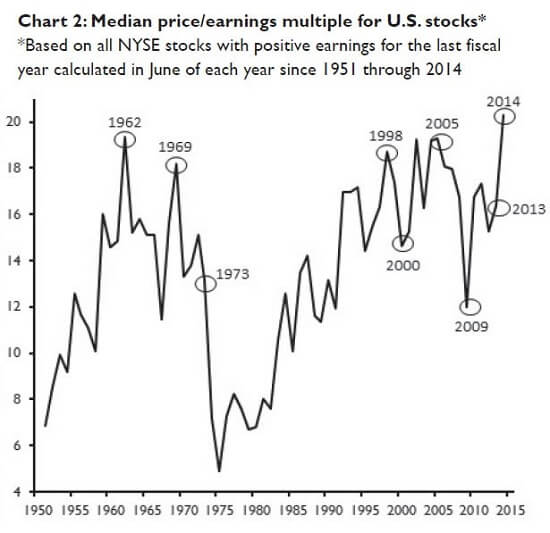

Stocks in the U.S. are extremely expensive. The following chart, borrowed from David Stockman's Contra Corner blog (May 21, 2015), shows just how expensive they are. The chart takes the median PE multiple for the thousands of stocks listed on the New York Stock Exchange rather than the weighted average and shows that the valuation of these stocks has never been higher than 1950 – including during the Internet Bubble! The chart stops in 2014 so the 21x P/E ratio is actually 23x today based on the 10% rise in the market since 2014.

This is consistent with other valuation methodologies such as the Shiller Cyclically Adjusted P/E Ratio, which measures the P/E ratio over a 10-year period and now stands at 27x versus a long-term average of 16.6x. Or the S&P 500 Market Capitalization/GDP Ratio, which now stands at nearly 140% compared to a long-term average of 75%. Anyway you stack it up, stock are very expensive while economic growth is just the opposite – very sluggish.

The big debate this week was over whether the economy was really as weak as the first quarter GDP numbers suggested. The current first quarter GDP number is +0.2% but it was expected to be revised lower. But the government has now determined that there are flaws in how it seasonally adjusts its data that likely led to too low a number (perhaps by as much as 1.5%) and said it expects to correct this by July.

The net result of this correction will not be to increase overall GDP growth but instead to alter the distribution of growth among the different quarters. In view of the fact that the Atlanta Fed is still tracking second quarter GDP growth as very weak (below 1%), this would seem to be a debate about nothing. The U.S. economy is still struggling to grow while the stock market continues to rise on the back of its faith in the Fed to keep its easy money policies in place indefinitely.

On that score, Fed Chair Janet Yellen gave a speech Friday afternoon in Providence where she said that the Fed expects to raise rates sometime later this year. Markets reacted by moving the dollar higher after her speech, with the U.S. Dollar Index closing up 0.74 to 96.14, a sharp rise from where it opened the week at close to the 93 level. The release of the most recent set of Federal Open Market Committee minutes strongly suggested that the Fed will wait until September to start raising rates.

But the Fed clearly is running out of reasons not to raise rates. The unemployment rate is down to 5.4% and the most recent inflation numbers were higher than expected. Rather than micromanaging the economy, the Fed would do better to allow rates to start normalizing and the market to operate more freely.

Source :http://moneymorning.com/2015/05/24/the-chinese-and-u-s-economies-are-bubble-thin/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.