The Solution to Ultra-Low Interest Rates

Companies / Investing 2015 May 24, 2015 - 09:04 PM GMTBy: Investment_U

Andrew Snyder writes: The addiction continues...

Andrew Snyder writes: The addiction continues...

The latest word from the Fed tells us there’s no rate hike in sight. Welcome to a world without interest rates.

The Fed’s inability to wean us off its stimulus has me pondering an even bigger idea... Why is something as dangerous as debt such a coveted and vital tool within our economy?

I mean, why is it Uncle Sam finds it wise to let us deduct our interest expense, but then taxes our dividends twice?

We’re rewarded for borrowing what we don’t have... and penalized for finding success. It doesn’t make sense... (Unless, of course, you’re trying to manipulate a force as powerful as the free markets.)

Don’t worry, though. I’ve got a solution.

We often talk about liberty through wealth. But what about liberating wealth? I’ll explain...

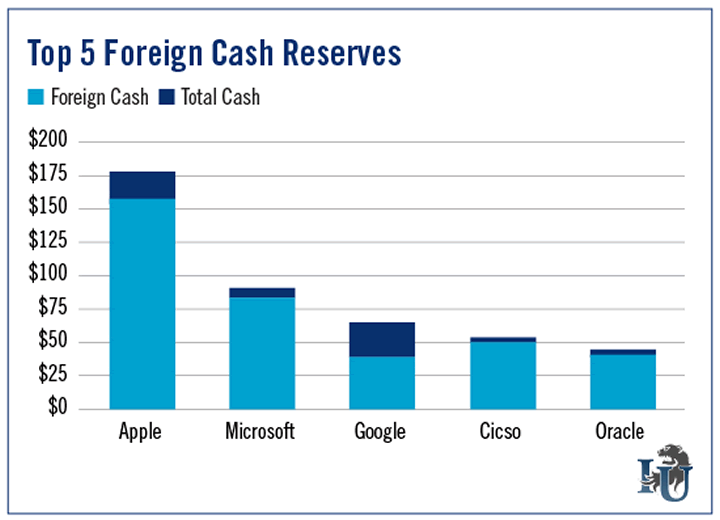

You may not have heard the news (after all, it’s not something our leaders are particularly eager to boast about), but the amount of cash held overseas by American firms is now estimated at an incredible $2.1 trillion.

That means 64 cents out of every dollar in corporate cash... is stashed somewhere outside our borders.

I’m absolutely convinced that if we liberate that wealth - that is, bring it home to the States - it would be far more beneficial to our economy’s long-term health than keeping interest rates artificially and dangerously low.

The problem is all that money is not going to be brought home anytime soon. After all, Uncle Sam wants nothing more than to pull his “fair” share from the stockpile.

He wants to tax all those profits... at a rate of 35%.

For proof of just how deadly that ultra-high tax rate is, all we need to do is turn to tech giant Cisco (Nasdaq: CSCO). It’s sitting on some $50 billion worth of foreign cash reserves. But instead of bringing it home and handing over a third of it to Washington, it’s using the cash to expand in India, France and Israel... flat-out admitting it would be hiring in the States if it weren’t for America’s high corporate taxes.

“I’d prefer to have the vast majority of my employees here,” the company’s CEO John Chambers said when pressed on the idea. “And our tax policy is causing me to make decisions that I don’t think is in the interest of our country, or even in our shareholders, long term.”

Just about the only industry interested in repatriating its offshore reserves is the cash-starved energy sector. And it’s paying the price.

Duke Energy (NYSE: DUK) recently tapped part of its $2.7 billion worth of foreign profits. But before it did, it had to cut a check worth $373 million to Uncle Sam.

Again, with a 35% tax rate waiting to pillage foreign profits, there’s no incentive to bring money home and boost the American economy in a real and sustainable way.

In fact, it’s just the opposite. Instead of tapping their reserves, cash-fat companies like Apple (Nasdaq: AAPL) are borrowing money. As we mentioned last week, the company has tapped the bond market for tens of billions of dollars over the last two years. It’s all thanks to artificially low interest rates.

The bottom line here is quite clear.

If we want to boost the American economy and do it in a way that doesn’t get us addicted to dangerous, half-cocked monetary policy, we must let that foreign cash come home.

Slashing the corporate tax burden is the answer. It’s the smart solution.

Instead of hoping and praying low interest rates (and therefore... more debt) will keep our economy alive, Washington must cut the rate that really matters - our foreign tax rate.

We’d instantly liberate 2 trillion bucks of real money... that was earned, not printed and loaned to the lowest bidder.

Then again, that makes too much sense.

Good investing,

Andrew

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.