REITs Are One of the Best Income Investment Opportunities Today

Companies / Investing 2015 May 24, 2015 - 08:59 PM GMTBy: DailyWealth

Dr. David Eifrig writes: No matter what type of income investor you are, worries about the broad economy dominate today's markets.

Dr. David Eifrig writes: No matter what type of income investor you are, worries about the broad economy dominate today's markets.

The specter of rising interest rates hangs over every income-producing asset. And it's true... the more yield investors can get from bonds, the less they'll be interested in riskier sources of income, such as dividend-paying stocks.

But we think these fears are overdone today... and it gives us an excellent opportunity to pick up safe and stable income from a certain class of income-producing assets – no matter what happens in the broad economy.

I'm talking about real estate investment trusts, or REITs...

Regular readers know that a REIT is a special way to structure real estate holdings. A management company serves tenants, maintains buildings, and gets big tax breaks in exchange for agreeing to pass on the vast majority of its annual income to shareholders. (This allows it to pay fat dividends.)

This makes REITs a great way to invest in real estate assets without having to deal with the headache of personally managing them. And because REITs trade as shares in the stock market, you can sell your investment at any time... a normally difficult and time-consuming process as a personal property owner.

Today, some analysts suggest staying away from REITs because interest rates are bound to rise eventually.

The thinking goes as such... The economy is improving. As the economy improves, the Fed will raise rates. When the Fed raises rates, all interest rates will rise. That will make the yield on REITs look less attractive in comparison and raise borrowing costs for REIT operators. In turn, the share price of REITs may fall when interest rates rise.

Of course, those same analysts have been making these same claims since 2013. They've underperformed as a result. Nearly every step in that "logic" is hogwash.

First of all, market pundits have predicted that the Fed would raise rates for years now. It hasn't happened yet. It'll happen eventually, for certain. But slowing economic growth and the complete lack of any inflation will delay a Fed move even longer. The futures market expects an increase in rates of 0.2% by the end of the year. That's not a big move.

Remember, the Fed only controls one single short-term interest rate called the Federal Funds rate. Raising this rate has some wider effects, but it's the supply and demand of safe assets that truly determines interest rates. With so much wealth and so few low-risk assets in the world today, we think rates on medium- to long-term securities will stay low.

More important... REITs perform just fine in times of rising interest rates.

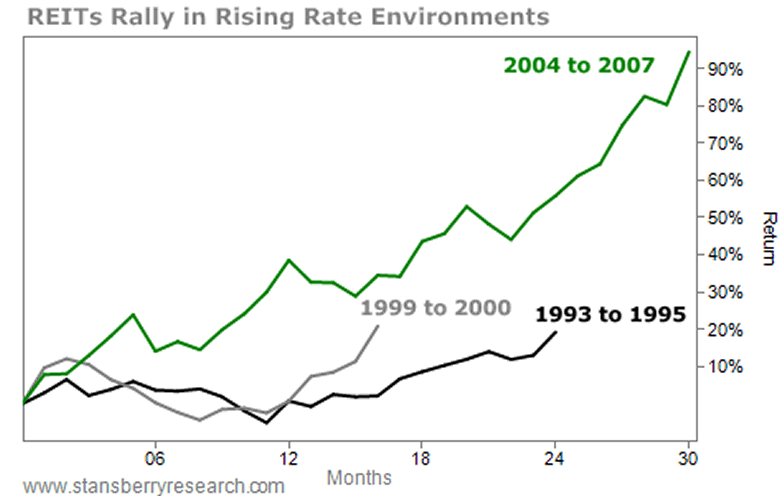

While many investors accept the "conventional wisdom" on interest rates and REITs, history doesn't back it up.

From 1970 to the early 1990s, there were four periods of rising interest rates. REITs split the difference... rising in two of those periods and falling during two. Of course, take that with a grain of salt, because most modern REITs didn't really take shape until 1993. But it's clear there's no strong historical relation between interest rates and REITs.

Looking from 1993 on, there have been three times rates have risen... The first, 1993 to 1995, saw REITs rise 21%. The second, from 1999 to 2000, saw REITs rise 17%. The third, from 2004 to 2007, saw REITs rise 99%. (All numbers include dividends.)

Anyone who says rising interest rates mean death for REITs simply hasn't looked at the facts. And that's exactly what we do in my Income Intelligence newsletter.

You'll often see headlines these days like, "REITs Fall on Fed Statements." REITs move with interest rates in the very short term. Little hiccups happen here and there as investors get spooked. But extrapolating a short-term move to long-term investment returns is a recipe for major blunders.

The trick is that REITs are real businesses with real fundamentals. Interest rates rise when the economy is hot and everything is running at full blast. During those times, it is true a treasury bond may look a little more attractive than a REIT on a yield basis, but with the economy growing, REITs see higher tenancy rates, higher rents, and bigger profits. Those factors trump the effect of higher interest rates.

Also recall that interest rates rise during periods of high inflation. When inflation becomes a concern, the Fed tries raising rates to choke it off. Not much hedges inflation better than real estate.

That's why we're happy to own REITs no matter where rates go over the long term.

We're going to see short-term volatility from interest rates, but that's a small price to pay. REITs are exactly the sort of counter-cyclical asset an income investor needs in his or her portfolio.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

P.S. I recently told my Income Intelligence subscribers about one of my favorite REITs to buy today. It features a safe yield of more than 4% today and operates in an industry that can grow 10 times or more in the next decade. It's truly in the sweet spot of safety and growth. You can learn all the details with a risk-free trial subscription to Income Intelligence. Sign up right here. (This does not link to a long video).

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.