Bitcoin Price Short Trade

Currencies / Bitcoin May 23, 2015 - 10:08 AM GMTBy: Mike_McAra

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

Bitfinex, one of the leading Bitcoin exchanges, may have been compromised. On the exchange's website, we read:

Urgent action required

Dear Customer although we keep over 99.5% of users' BTC deposits in secure multisig wallets, the small remaining amount in coins in our hot wallet are theoretically vulnerable to attack. We believe that our hot wallet keys might have been compromised and ask that all of our customer cease depositing cryptocurrency to old deposits addresses. We are in the process of creating a new hot wallet and will advise within the next few hours. Although this incident is unfortunate, its scale is small and will be fully absorbed by the company. Thanks a lot for your patience and comprehension. Bitfinex Team

This is bad news for Bitfinex customers, for the exchange but also for Bitcoin as such. We haven't had a major incident like this in months but it turns out now that Bitcoin exchanges might still be vulnerable to attacks. If you read the announcement by Bitfinex, it seems that the extent of the vulnerability might be limited. On the other hand, any security issues like these are likely to undermine the trust of the customers and investors.

This suggests that more improvements have to be done as far as the security of Bitcoin exchanges is concerned. We'll see how new regulated exchanges cope with that challenge.

For now, let's focus on the charts.

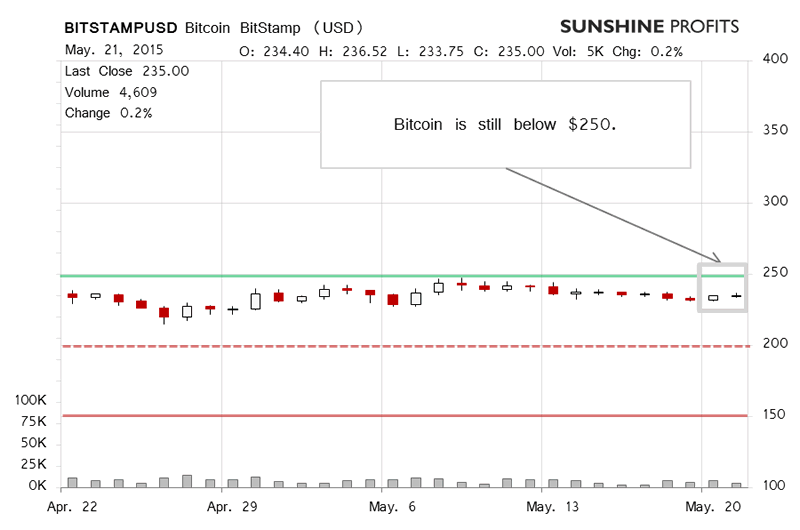

On Bitstamp, we didn't see much action yesterday. Bitcoin moved up slightly but the volume was down than on the day before, and quite visibly. This doesn't seem like strong appreciation. Yesterday, we wrote:

(...) Bitcoin hasn't moved much, it has appreciated a bit but the volume hasn't been strong (...). The situation as it currently is seems to be one where Bitcoin is running out of steam, what little steam it had yesterday. Of course, nothing in the market is certain, but again this reminds us of weakness, not strength. Bitcoin might still move up but it seems that the upside might be limited by the $250 level (green line in the chart), while the downside might be more promising with the next psychological level at $200 (dashed red line).

This is still up to date. Bitcoin hasn't moved much (this is written around 11:00 a.m. ET). The volume has been up, but not accompanied by a move to the upside this doesn't look like a move up. Consequently, the situation remains unchanged and our best bet here would be on a move down.

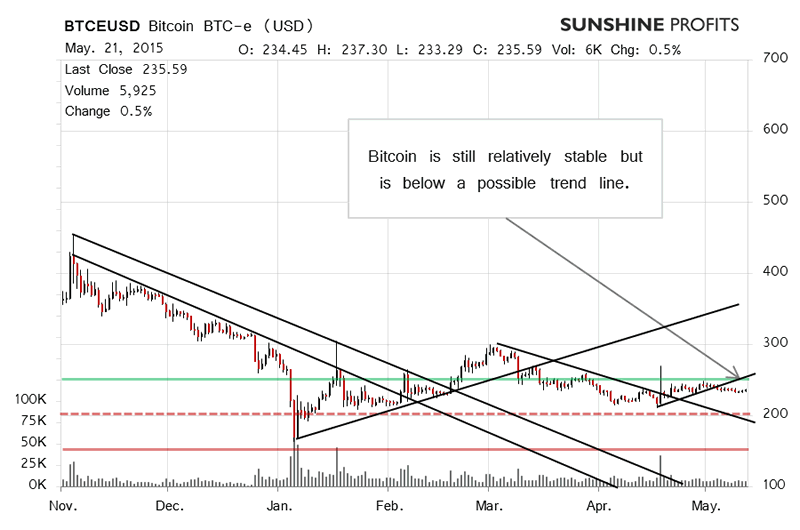

On the long-term BTC-e chart, we still see Bitcoin below the $250 level. Yesterday, we wrote:

Our take now is that the current environment favors a move down. Bitcoin is below $250, below a possible trend line, it's been moving down recently, the downside might be more significant than the upside. All of this points to the possibility that the move down might accelerate in the next couple of weeks.

Not much changed yesterday after our alert was posted and we haven't seen major moves today either, so the situation is still similar to what it was yesterday. In our opinion, Bitcoin might move down in the next couple of weeks.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.