European Banks Vulnerable Today As 2008 Financial Crisis

Stock-Markets / Credit Crisis 2015 May 18, 2015 - 12:55 PM GMTBy: GoldCore

- Euro banks no more stable now than in run-up to 2008 crash

- Euro banks no more stable now than in run-up to 2008 crash

- Banks in France, Spain and Italy are “highly vulnerable to failure”

- Low quality bank equity not sufficient to withstand shock

- Risk to system “enormously underestimated”

- Investor deposits at risk of “bail-ins”

New research shows that European banks are as likely to fail today as they were preceding the global economic crash seven years ago.

Leading economists say that the European banking system is still highly vulnerable to financial and economic shocks despite the various policies which have been put in place to protect against such events since the collapse in 2008.

According to research by the University of Portsmouth Business School which was published in the Journal of Banking and Finance European banks are as vulnerable today as they were in the run up to the crisis of 2008.

The research suggests that southern European banks – particularly those of France, Italy and Spain – are “highly vulnerable to failure.”

The economists modelled a range of interconnected, dynamic economic shocks on 170 Eurozone banks in 16 countries, and the spread of that effect to other countries from 2005-2013.

The research focussed on threats emerging from three independent sources of risk – the interbank loan market, the sovereign credit risk market and the asset-backed loan market.

The models sought to determine the resilience of various systemically important European banks and “to track how shocks spread between domestic and international banks.”

Researchers found that “the European banking system remains highly vulnerable and conducive to financial contagion” and that speed of contagion and bank failures in southern Europe were “markedly more prominent”.

France, Spain and Italy appear to be dramatically more exposed to failing compared to their neighbours in one of the models. This showed France losing 73 billion euro compared to Belgium’s 6 billion euro after the same economic shock from the same source.

Dr Nikos Paltalidis, who led the research, is skeptical of the conclusions of stress tests which claim that banks could withstand a 10% drop in the value of their equity or that the banking system in the euro area is solvent.

He believes that the quality of the assets held by some key banks is of poor quality and in the event of a shock to the system they would cause the value of bank capital to below the required regulatory minimum.

“In theory, the new capital rules adopted by ‘systemically important’ banks should be able to endure a 10 per cent fall in the value of their assets before placing panicky calls to the central bank. Also, the euro area banking system seems to be fundamentally solvent, according to several stress tests.”

“However, our study provides ample evidence that this hypothesis does not hold in practice, indicating that similar to the pre-2009 period systemic risk is enormously underestimated once again.”

Dr. Paltalidis states the following:

“Our findings indicate that despite all the efforts to improve the resilience of banking, some banks are as vulnerable today as they were before the last banking crisis, they are just as likely to fail.”

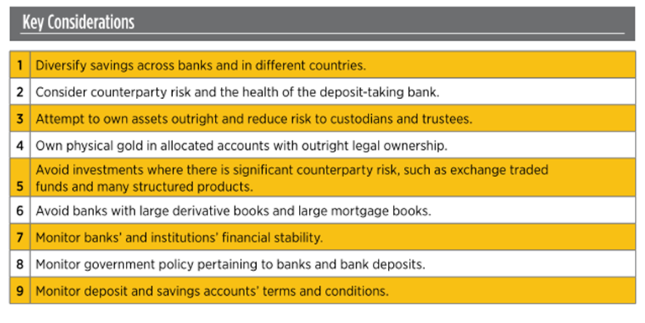

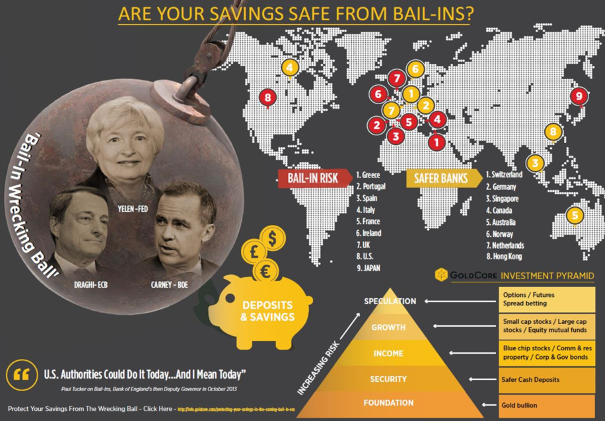

Frequent readers of our blog will be well aware of the risks posed to bank deposits by a bank failure.

While governments have sought to assure the public that their savings are safe due to bank deposit guarantee schemes they have been working behind the scenes to extricate themselves from that responsibility.

We reported last month on how the Austrian government was pushing through an EU law earlier than scheduled which removes all responsibility of the government for the bank deposits of its citizens. This legislation is due to be rolled out across Europe this year.

Long time readers will be aware that Irish Finance Minister Michael Noonan is on record as saying “bail-ins” are now the rule.

Bank deposits are increasingly vulnerable given the risks to the banking system and the likelihood of government reneging of deposit guarantees and of bank bail-ins in the event of a crisis.

Allocated and segregated gold bullion coins and bars held out-side of the banking system in stable jurisdictions like Switzerland, Hong Kong and Singapore will again protect in the likely event of another financial or economic crisis.

Must-read guide and research on bail-ins here:

Protecting Your Savings In The Coming Bail-In Era

MARKET UPDATE

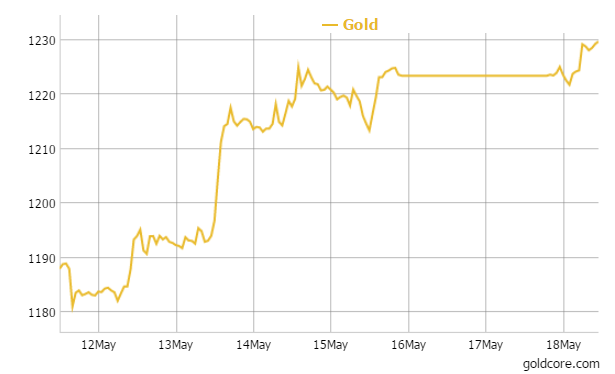

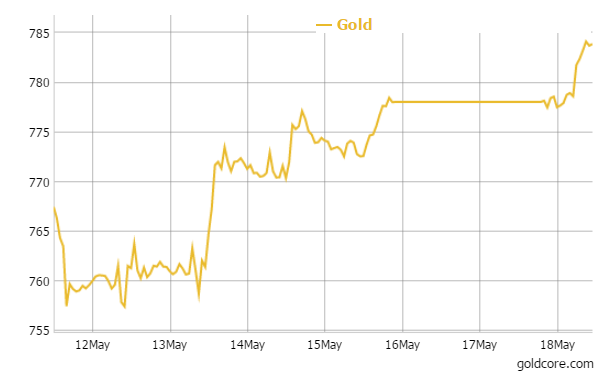

Today’s AM LBMA Gold Price was USD 1,228.15, EUR 1,079.41 and GBP 784.12 per ounce.

Friday’s AM LBMA Gold Price was USD 1,216.30, EUR 1,071.23 and GBP 772.95 per ounce.

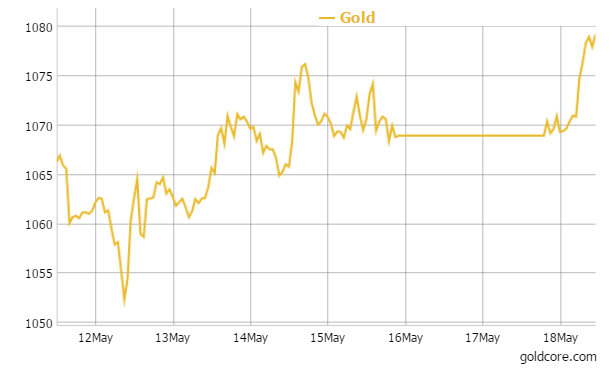

Gold in USD – 1 Week

Gold climbed $3.10 or 0.25 percent to $1,224.90 an ounce on Friday, and silver rose $0.10 or 0.57 percent to $17.53 an ounce.

Gold and silver both performed strongly for the week – gold gained 3 percent and silver outperformed once again and surged 6.4 percent.

Gold in Singapore rose to $1,232.20 an ounce near the end of day trading – its highest price since February. In London, gold climbed for its fifth consecutive session making it the longest winning streak since March.

Gold in GBP – 1 Week

Silver was up 1.3 percent at $17.80 an ounce, while platinum was up 0.4 percent at $1,174.50 an ounce and palladium was flat at $795 an ounce.

Asian shares were mixed as are European shares today on Grexit and bond market jitters. These risks do not appear likely to recede anytime soon and this should keep gold supported. The weaker dollar and expectations that the U.S. Fed will not raise interest rates in June is also supporting the precious metals.

Gold in EUR – 1 Week

Recent poor economic data is leading to concerns about the health of the U.S. economy as U.S. share prices look “toppy” and remain near historic all time record highs.

The U.S. FOMC April meeting minutes are released on Wednesday and may provide further clues on the possible timing of the Fed’s first interest rate hike in ten years.

Norilsk Nickel and other investors aim to complete a purchase of palladium bullion from Russia’s central bank by the end of 2015, deputy chief executive Pavel Fedorov said today. It outlined the deal last year and is still working to get it done.

London Platinum Week kicks off today after a few preliminary events over the weekend.

At the opening of the annual industry gathering, the World Platinum Investment Council said in a report it expected the platinum market deficit to shrink this year and platinum stockpiles to reach the lowest level in at least 10 years.

Above-ground stocks will fall to a very small 2.6 million oz in 2015, according to the WPIC. That compares with a peak of 4.5m in 2010, 2011, Director of Research Trevor Raymond told Bloomberg on the phone.

The WPIC do not believe that platinum stocks will be completely depleted and reach zero because the amount includes long term holdings by private investors, sovereign wealth funds and hedge funds. It said that stocks typically held in vaults, excludes ETFs.

Overall demand is set to to grow 3% to 8.2million ounces. The market will see a deficit of 190,000 in 2015, down from earlier prediction of 235,000, report showed. Total supply should increase 10% to 8 million ounces. Mine supply is seen up 12% and autocatalyst recycling may rise 10%.

Reuters reports that producers, refiners, recyclers, traders, bullion brokers and analysts are gathering in the UK capital to make contacts, strike deals, and discuss the state of a market that has been weighed down by falling prices for much of the last year.

GoldCore are in attendance in London this week and available for meetings and interviews.

In late morning London trading gold is at $1,229.45 an ounce or up 0.48 percent. Silver is at $17.67 an ounce or has surged 1.14 percent and platinum is up 0.58 percent at $1,169.54 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.