The Stock Market is Topping!

Stock-Markets / Stock Markets 2015 May 17, 2015 - 07:47 AM GMTBy: Brad_Gudgeon

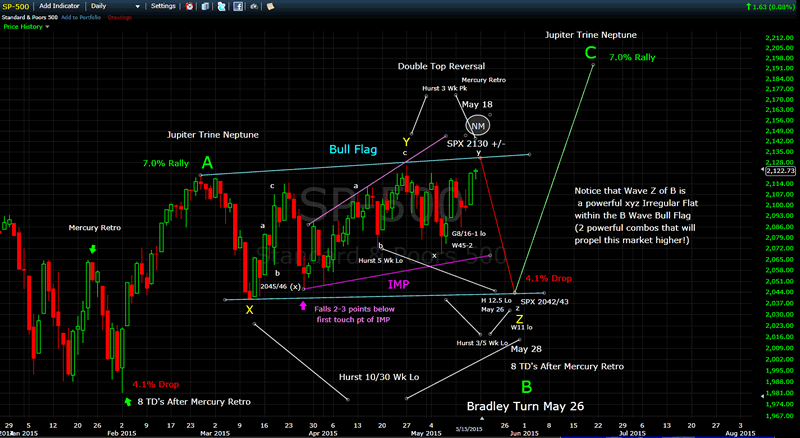

Last time I wrote, I expected to see new highs on the S&P 500. The week before, I submitted a cycle chart where an expected three week cycle top should occur on May 18th. We are within a hair's breadth of the 2130 target I had for last week and should tag that price on Monday. We also have a new moon, which should easily reverse the trend back to down in the coming days.

I had been expecting something more major than what I'm seeing for the down side in the near term, but I think that all we get is about a 4% drop over the coming days (enough to make money on!). Not huge by any means, but not commensurate with a normal market with this kind of lagging stock participation.

I believe the biggest problem is: where do you put your money? Interest rates are too low, and gold and silver are in a bear market. The value investor says: stocks are too rich and the economy is slowing down (you can see this by looking at the transportation average, a Dow Theory sell signal). This is true, but we still have the same problem going forward.

This being said, I believe after this sell-off, we will see a 7% rally into June and new highs! Has the average investor gone nuts! Perhaps, but I believe the time is near when the market will drop anywhere between 10-17% and that it will happen quite quickly (over the course of a month) and it will shake the buy and hold investor a bit (but not too much). They will say, "The market will always come back", and I think it will, but they will have missed out on the trading opportunities (moves 'both up and down') that this "schizoid" market will continue to present to us going forward.

I keep saying, "The days of buy and hold are over. The easy money has been made." Eventually, the time will come, when the bubble will burst and the market will fall by more than 80%. But for now, the majority will go on unaware that a major economic catastrophe is on our doorstep, that will, in my opinion, also likely lead to a major military conflict in the Middle East and Europe. We probably have a few more years of this insane topping action left before the crash begins. So what are you: a buy and hold investor or a trader?

Below is a chart of the S&P 500, with E-Wave denotation, cycles, astro, etc., projecting into the late May bottom and the expected June top.

S&P500 Chart

Silver broke out to the upside over the past few days. Either Monday or perhaps Tuesday, I believe silver will fall about 5% suddenly overnight into early trading. We are still in a bear market in silver.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.