Stock Market CAC40 Trend Forecast

Stock-Markets / France May 17, 2015 - 07:45 AM GMTBy: Austin_Galt

The French stock index, the CAC40, looks to have the final top to its bull market already in place. Let's analyse the technicals using the weekly, monthly and yearly charts.

The French stock index, the CAC40, looks to have the final top to its bull market already in place. Let's analyse the technicals using the weekly, monthly and yearly charts.

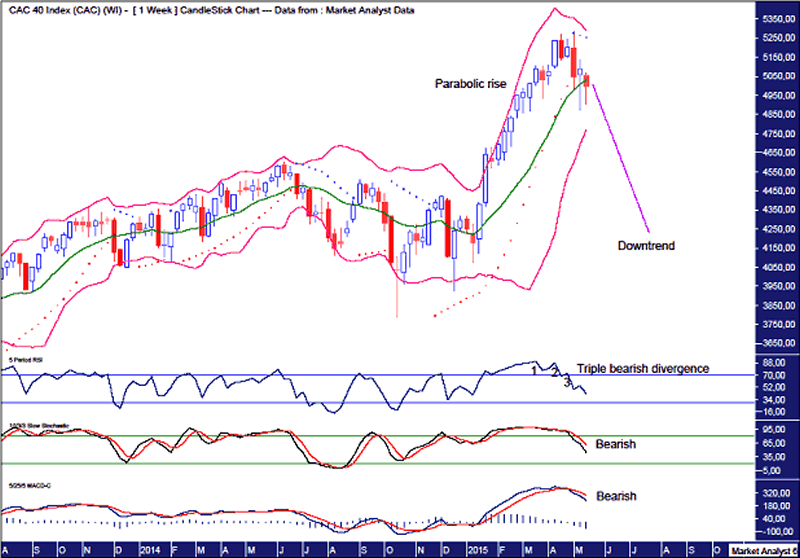

CAC40 Weekly Chart

We can see the parabolic rise by price this year. This behaviour is often found at the end of bull markets and I think this bull market is now done also.

The PSAR indicator has a bearish bias for the first time this year. The dots are now above price and represent resistance.

The Bollinger Bands show price has already left the upper band and is now milling around the middle band. I expect the next move by price will be to the lower band.

The recent price high was accompanied by a triple bearish divergence which often leads to a significant decline and while that has already happened I think the move down is about to become even more significant.

The Stochastic and MACD indicators have both made recent bearish crossovers and are now trending down looking very bearish.

I expect a big downtrend is already in its early stages.

Let's move on to the monthly chart.

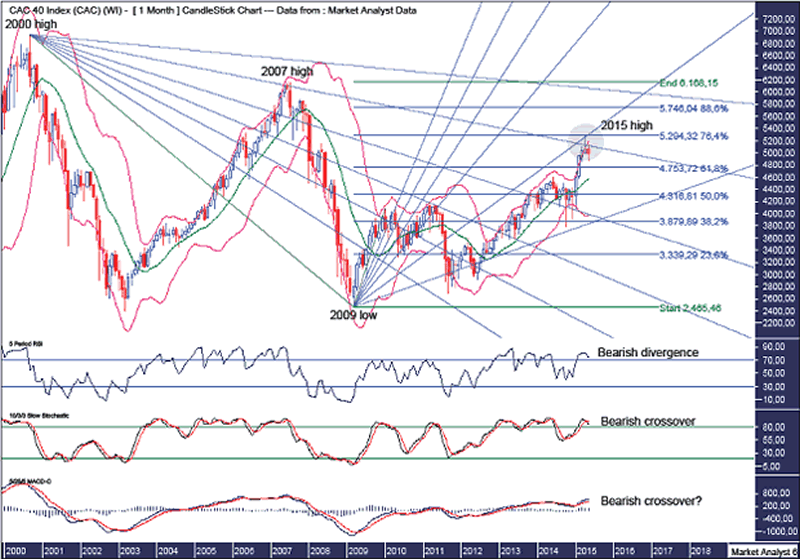

CAC40 Monthly Chart

We can see the 2015 high in the green highlighted circle. There are several indications that this is a solid high and therefore likely the end of the bull market.

The recent high showed a bearish divergence on the RSI and Stochastic indicator while the latter has also just made a bearish crossover. The MACD indicator looks to be threatening a bearish crossover after its averages diverged recently.

I have added Fibonacci retracement levels of the move down from the 2007 high to 2009 low and the recent high was right at resistance from the 76.4% level. Nice.

I have drawn tow Fibonacci Fans. The fan drawn from the 2009 low shows the recent high right at resistance from the 76.4% angle. The fan drawn from the 2000 high shows the high at resistance from its 76.4% angle. Nice.

Let's wrap it up with the big picture outlook using the yearly chart.

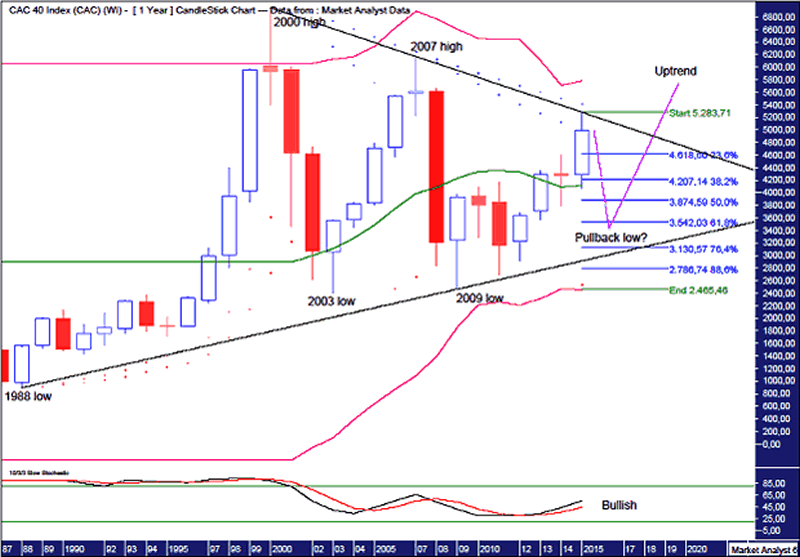

CAC40 Yearly Chart

I have added two PSAR indicator settings - one tight and one loose. Price has just busted the tight setting resistance and is now just below the loose setting resistance. I often find after price busts the tight setting resistance it then corrects before going on to bust the loose setting resistance at a later stage. This is my expectation here. The dots of the loose setting indicator currently stand at 5415.

I have drawn a downtrend line across the 2000 and 2007 highs and price is now right at resistance from this trend line. I expect price to retreat now before coming back up in a few years to bust this resistance on its fourth attempt which is generally successful.

This pattern is actually very interesting in that it is essentially a downward-sloping triple top. Triple tops generally don't end trends and so once the correction is over the probability is for price to head back up and over this downtrend line. Also, the reaction down from triple tops is generally not nearly as deep as reactions down from double tops. Mega-bears may want to have a good hard think about this.

I have drawn an uptrend line along the 1988 and 2009 lows which represents support but I doubt price will trade down that low.

The Bollinger Bands show price between the middle and upper bands. I favour price doing a bit more work around the middle band before it makes its way to the upper band.

I have added Fibonacci retracement levels of the move up from 2009 low to recent high and I am targeting the 61.8% level at 3542 to bring in the final pullback low. The 61.8% level is a very popular technical level so I expect price to nudge below there in its own way to fake out the technical analysts that will be watching that support level.

Finally, the Stochastic indicator is very bullish and a big correction now should see the averages come back together again before price turns back up and this indicator continues on its merry way.

Summing up, the bull market top appears in place and a big correction looms. However, I expect this correction to last only a couple of years if that before the massive uptrend continues which sees price challenge the all time highs in the years to come.

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2015 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.