No Money, No Growth

Economics / US Economy May 16, 2015 - 05:48 PM GMTBy: John_Rubino

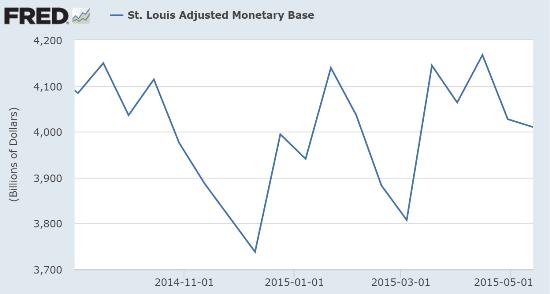

Last August, the US Fed stopped creating new currency out of thin air and dumping it into the banking system. Which is another way of saying the US money supply stopped growing. Here’s the adjusted monetary base — a proxy for the amount of new currency the Fed is creating — over the past eight months:

Last August, the US Fed stopped creating new currency out of thin air and dumping it into the banking system. Which is another way of saying the US money supply stopped growing. Here’s the adjusted monetary base — a proxy for the amount of new currency the Fed is creating — over the past eight months:

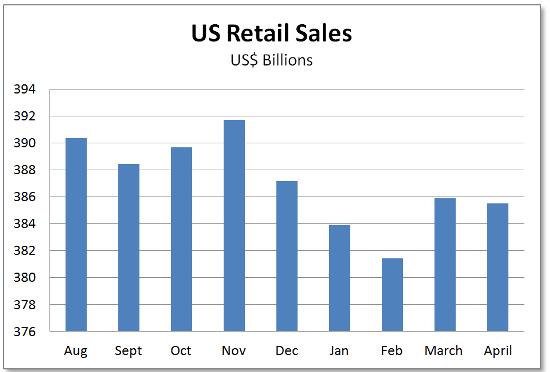

Then a whole bunch of other things started happening. First, the dollar soared, becoming by far the world’s strongest currency. And Americans started buying less stuff:

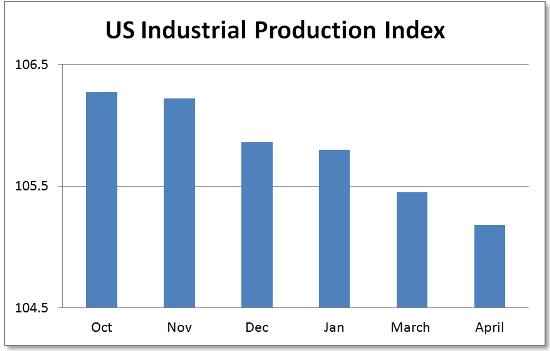

And then US factories started making less stuff:

The latest batch of economic reports now implies zero growth for the entire first half of 2015. What conclusions should we draw from this?

1) Beyond a certain point, an over-indebted society can’t function without continued infusions of new cash. Turn off the spigot and you grind to a halt. The world, in other words, is one big Ponzi scheme.

2) With a US presidential election in full swing, everyone from Fed governors who hope to be reappointed (or hired by thriving Wall Street banks) to congressmen in uncertain districts to Treasury officials who like their jobs are concluding that austerity of any kind is a very bad idea. The June interest rate increase is now being walked back to September. And with nothing on the horizon to reverse today’s negative growth trends, the September increase will shortly be walked back to December and then replaced by hints of renewed QE in 2016.

3) Generally, central banks like to raise interest rates during a recovery to create ammo (in the form of high interest rates that can be lowered) for the next go-round. But the coming easing will begin with rates at record low, in some cases negative, levels. So rates will have to go not just lower but seriously negative in order to make a difference. And the war on cash will officially begin.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.