Economic Expansion Ahead? World Stock Markets Analysis

Stock-Markets / Stock Markets 2015 May 15, 2015 - 11:10 AM GMTBy: Puru_Saxena

BIG PICTURE - The global economy softened during the first quarter of this year; however, reflationary efforts by the central banks should bring about a pick-up in business activity. At this stage, it is difficult to tell precisely when the economy will accelerate, but we suspect that various data points will show a marked improvement during the back half of this year.

BIG PICTURE - The global economy softened during the first quarter of this year; however, reflationary efforts by the central banks should bring about a pick-up in business activity. At this stage, it is difficult to tell precisely when the economy will accelerate, but we suspect that various data points will show a marked improvement during the back half of this year.

You will recall that the world's economy slowed down significantly at the beginning of 2015 and this coincided with a surge in the US Dollar and extreme strength in government bonds. In response to the deflationary pressures, the European Central Bank (ECB) unleashed its QE program and unsurprisingly, this policy initiative immediately sparked a rally in European stocks. A few weeks later, the US Dollar Index put in an intermediate-term top, government bonds peaked, crude oil bottomed and the major foreign currencies ended their relentless downtrend.

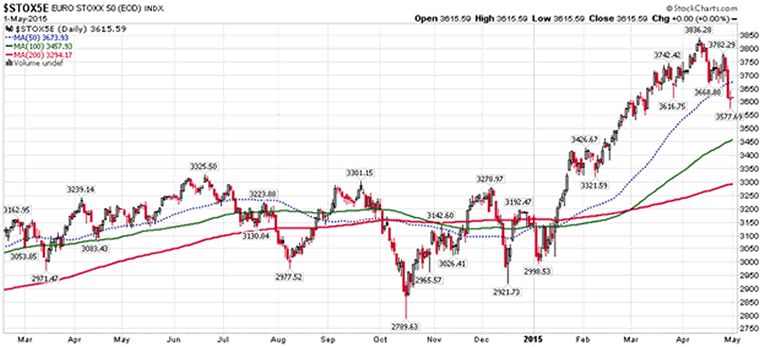

Given the above developments, it appears as though the ECB's QE program has momentarily succeeded in shifting investor sentiment and the markets are now positioned for economic expansion later this year. Whether you like it or not, the ECB's QE initiative has unleashed a strong rally in European stocks (Figure 1) and it appears as though bond purchases will revive business activity in the 'Old World'.

Figure 1: Euro STOXX 50 (daily chart)

Source: www.stockcharts.com

You will recall that QE in Japan and the US created a huge tailwind for the stock markets of those nations, so it is only reasonable to assume that it will have a similar effect in Europe. At present, the ECB has committed to bond purchases until September 2016; however, if business activity does not pick up sufficiently, it is probable that policymakers will extend the QE program.

From our perspective, the European QE initiative has prolonged the duration of the ongoing primary bull-market in common stocks and as long as the Bank of Japan (BOJ) and the ECB are purchasing assets, a bear-market will not occur.

It is notable that all the bear-markets throughout Wall Street's history (with the exception of the 1987-crash) occurred late into the monetary tightening cycle; so it is highly unlikely that the grizzly will growl at a time when two of the major central banks are trying to stimulate the economy!

Look. If interest rates normalise in the near future, then today's stock market will come across as very expensive. However, if interest rates remain low for an extended period of time, then today's stock market will look very cheap!

When it comes to investing, the risk free rate of return determines the value of every asset and in the context of today's record-low interest rates; Wall Street does not look particularly expensive. However, if business activity picks up abruptly and inflation rears its ugly head, then the Federal Reserve will be forced to raise its Fed Funds Rate aggressively and that will probably trigger a plunge in common stocks. So, if you own common stocks, perversely, you really do not want the economy to boom anytime soon!

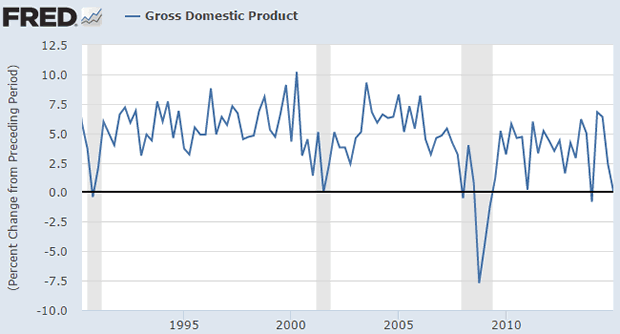

If you review Figure 2, you will observe that during Q1 2015, the US economy barely grew and under this scenario, it is improbable that the Federal Reserve will raise its benchmark short-term interest rate anytime soon.

Figure 2: US Gross Domestic Product (% change from preceding period, quarterly)

Source: St. Louis Fed

Currently, many market participants are expecting rate hikes during the second half of the year. However, if the Federal Reserve stays on hold until the end of the year, then it is conceivable that global stock markets will appreciate significantly from these levels.

Turning to Asia, it is interesting to observe that a number of the prominent stock indices have recently broken out of multi-year trading ranges and this is a bullish development. Once again, this renewed strength in the region's stock markets suggests that the easy monetary conditions in the developed world are spilling over to the peripheral economies.

It is noteworthy that over the past month, Hong Kong's Hang Seng Index, Singapore's Straits Times Index, South Korea's Seoul Composite and Taiwan's Weighted Index have all broken out of formidable trading ranges and the stage is now set for impressive gains!

Elsewhere in Asia, as per our expectation, the Shanghai Composite Index is charging ahead. Although China's stock market is currently over-extended and due for a consolidation (Figure 3), the primary uptrend should continue for several months.

Figure 3: Shanghai Composite Index (weekly chart)

Source: www.stockcharts.com

Past performance is no guarantee of future returns, but it is noteworthy that during the previous bull-market (October 2005-October 2007), the Shanghai Composite appreciated by over 500% and that primary uptrend was only punctuated by three consolidation phases which were both brief and shallow (Figure 3).

During the current bull-market, so far the Shanghai Composite has undergone just one consolidation phase (early 2015) and it appears as though we are now approaching the second routine pullback. Technically, China's stock market is very overbought so a reaction to around the 4,000 level cannot be ruled out. Thus, if you are looking to deploy additional capital to China's A-shares, it may be worthwhile to invest after a near-term pullback.

At this stage of the cycle, nobody knows when China's bull-market will end, but given that the preceding bear-market lasted for 7 years, the ongoing uptrend could easily continue for another year or two.

Although we do not possess a crystal ball, we are of the view that before the end of this bull-market, the Shanghai Composite will surpass its all-time high recorded in October 2007.

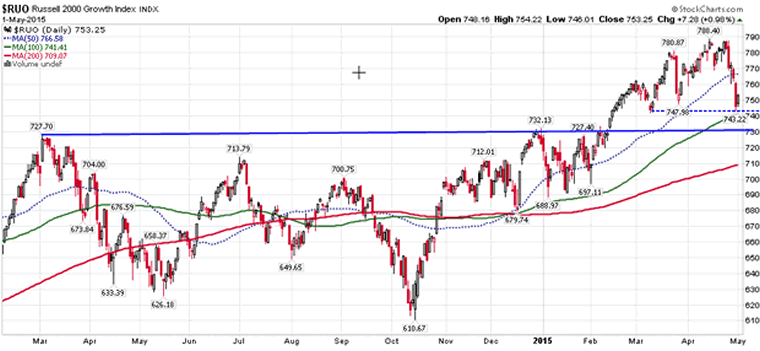

Over on Wall Street, it is encouraging to observe that the tech-heavy NASDAQ Composite and the Russell 2000 Growth Index are showing strength and faring better than the broad market.

If you review Figure 4, you will note that in February, the Russell 2000 Growth Index broke out of a multi-month trading range and during this stock market pullback, it has found support above its March-low (blue dotted line on the chart). Given the fact that this index is comprised of growth stocks, its relative strength bodes well for the broad market.

Figure 4: Russell 2000 Growth Index (daily chart)

Source: www.stockcharts.com

Turning to the technical picture, it is encouraging to note that during the recent stock market pullback, the number of 52-week NYSE lows did not spike and the NYSE Advance/Decline Line (measure of market breadth) is sitting just beneath its record high. Elsewhere, after a large consolidation phase, the KBW Bank Index is coming back to life and approximately 62% of the NYSE stocks are currently trading above the 200-day moving average.

Bearing in mind the above, we are of the view that the next bear-market is at least several months away and after some additional consolidation, the stock market should continue its north-bound journey.

As far as sector analysis is concerned, it is notable that airlines, asset managers, auto dealers, auto parts manufacturers, banks, biotechnology, footwear, housing materials, industrials, railways and restaurant stocks are performing well.

In terms of geographical exposure, in addition to the developed world (Europe, Japan and the US), many stock markets in Asia (China, Hong Kong, India, Philippines, Singapore, South Korea and Taiwan) are now showing signs of strength.

Bearing in mind the above, we have allocated our equity and fund portfolios to the strongest areas and are confident that these strategies will deliver robust returns over the following months.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2014 Puru Saxena Limited. All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.